Corporate Finance Institute (CFI) is the global leader in online finance education, trusted by millions of professionals and organizations worldwide. Our expert-led courses and industry-recognized certifications equip professionals with the practical skills and knowledge needed to succeed in their careers.

Delivering the Finance Skills and Tools to Succeed

Professionals Worldwide

On-Demand Lessons

Courses

Who We Are

Our History

-

2016CFI founded

-

2017Financial Modeling & Valuation Analyst (FMVA®) was launched

-

2019LSG acquired by CFI

-

2020

-

2020Over 1 million students joined CFI

-

2021Productivity software Macabacus joins the CFI family

-

2021Commercial Real Estate Finance Specialization was launched

-

2021Business Intelligence & Data Analyst (BIDA®) was launched

-

2022

-

2023Environmental Social & Governance Specialization was launched

-

2023FinTech Industry Professional (FTIP®) was launched

-

2023Cryptocurrencies and Digital Assets Specialization was launched

-

2023Business Intelligence Analyst Specialization was launched

-

2023Data Science Analyst Specialization was launched

-

2023Leadership Effectiveness Certificate Program was launched

-

2023Data Analysis in Excel Specialization was launched

-

2024Over 2 million students joined CFI

-

2024

-

2025

-

2025London Institute of Banking & Finance (LIBF) accredits FMVA, CBCA, CMSA, BIDA, FPWMP, FTIP Certification programs

What we do

We believe that anyone with the ambition to have a rewarding career in finance can achieve success when equipped with the right skills, knowledge, and support.

As the largest online finance & banking training platform for individuals, we empower millions of finance and banking professionals worldwide to achieve their highest professional potential by providing the resources they need to advance their careers.

We aspire to provide meaningful value to every finance professional at each stage in their career journey.

Trusted by finance professionals at

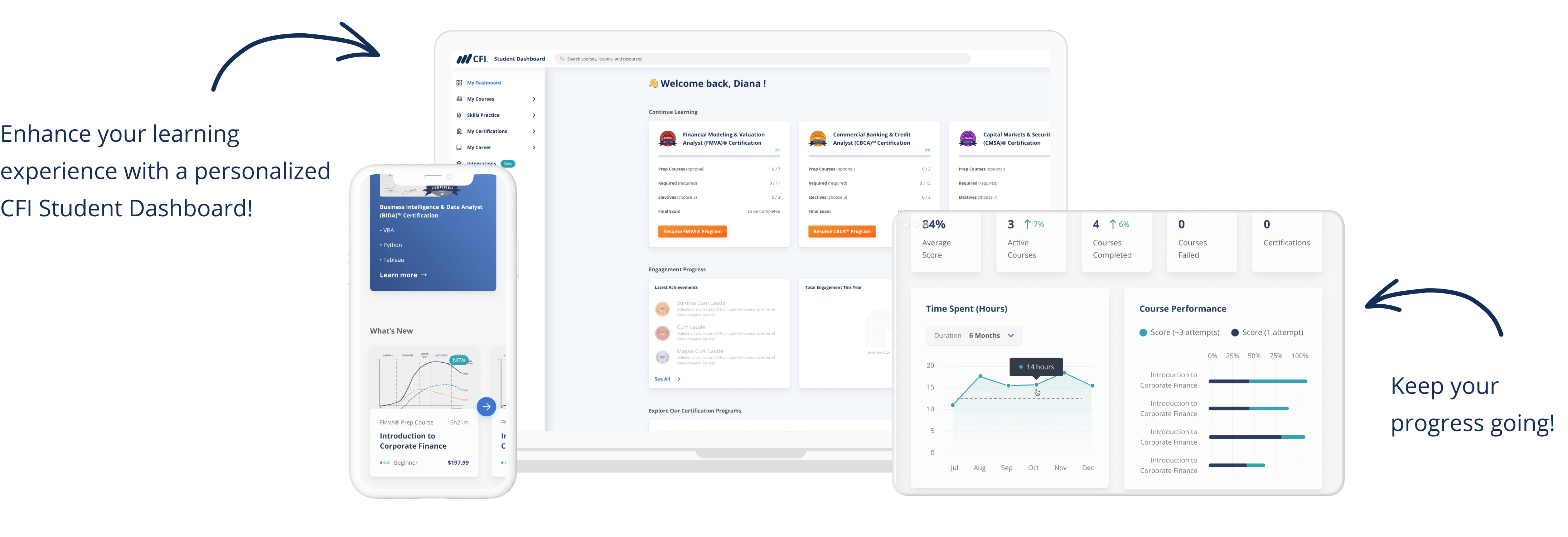

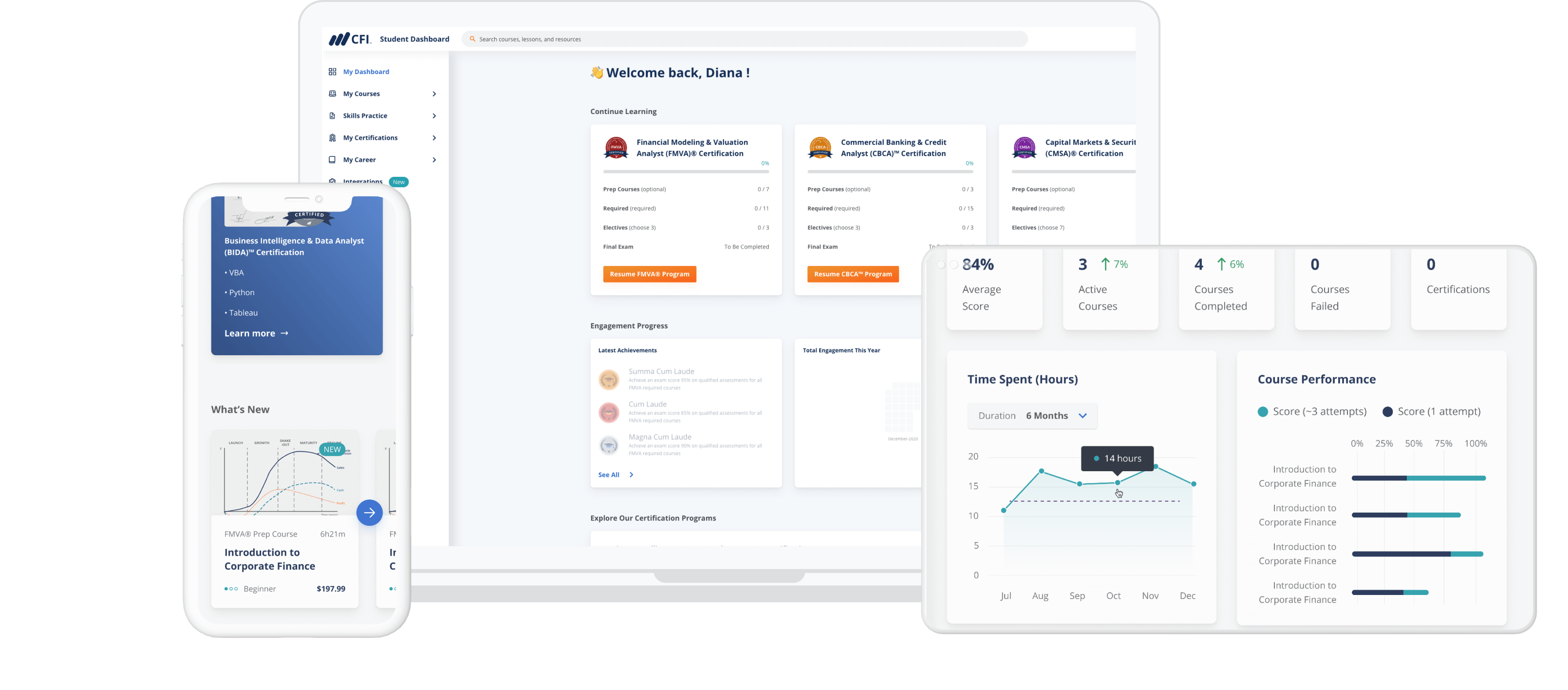

We provide practical, on-demand training for finance and banking professionals

CFI empowers professionals of any level with accredited certifications, hands-on lessons, tools, and resources created by experienced professionals who've worked and taught at leading finance and banking organizations across the world.

What CFI Students Have to Stay

In-Demand Certifications to Make Anyone a Go-To Expert

Trusted by 2 Million+ professionals worldwide.

"Abhishek Choudhry (CBCA)"

"World-class skills set"

"Ajiboye Afeez (FMVA)"

"Andrii (CBCA)"

"Anthony Santillanes (FMVA)"

"Daelan Subban (CBCA)"

"David Kamenya (FMVA)"