The most recent improvements to your CFI Dashboard

Easier access to in-progress Certifications, Specializations, and Role-Based Learning Paths

Self-Study and Full-Immersion subscribers now have easier access to view the programs that they have enrolled in. Navigate to Certifications, Specializations, or Role-Based Learning Paths and the programs you’re enrolled in will be shown at the top of your screen.

New ability to bookmark additional types of content

In addition to Courses, you now have the ability to bookmark additional content: Templates, Skills Assessments, Case Study Challenges, Articles, Podcasts, Webinars, Certifications, Specializations, and Role-Based Learning Paths. This new feature will help you customize and organize your learning journey.

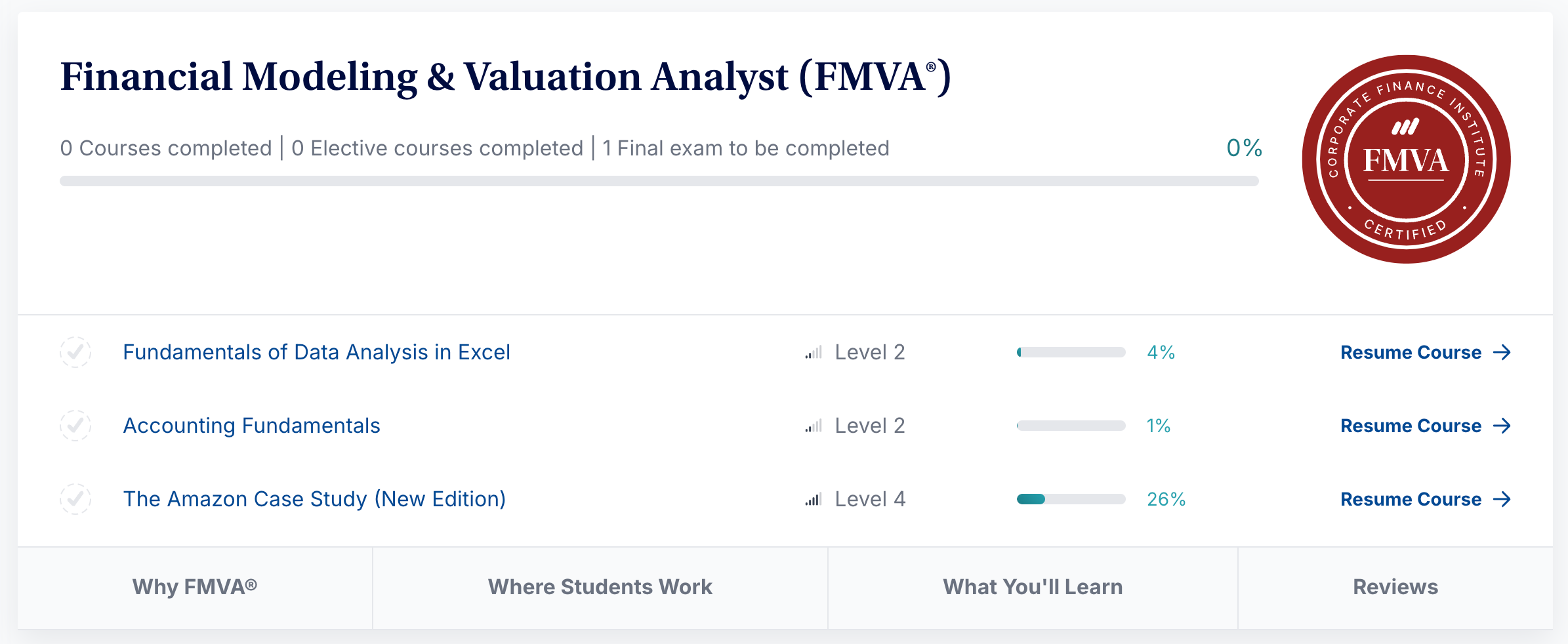

View in-progress courses for enrolled programs

For each program you are enrolled in, the courses you have in progress for that program are shown beneath your overall program progress. This makes it easy to jump back into learning!

Enroll in a Certification, Specialization, or Role-Based Learning Path to view your in-progress courses for that program.

Program enrollment is only available for Self-Study and Full-Immersion.

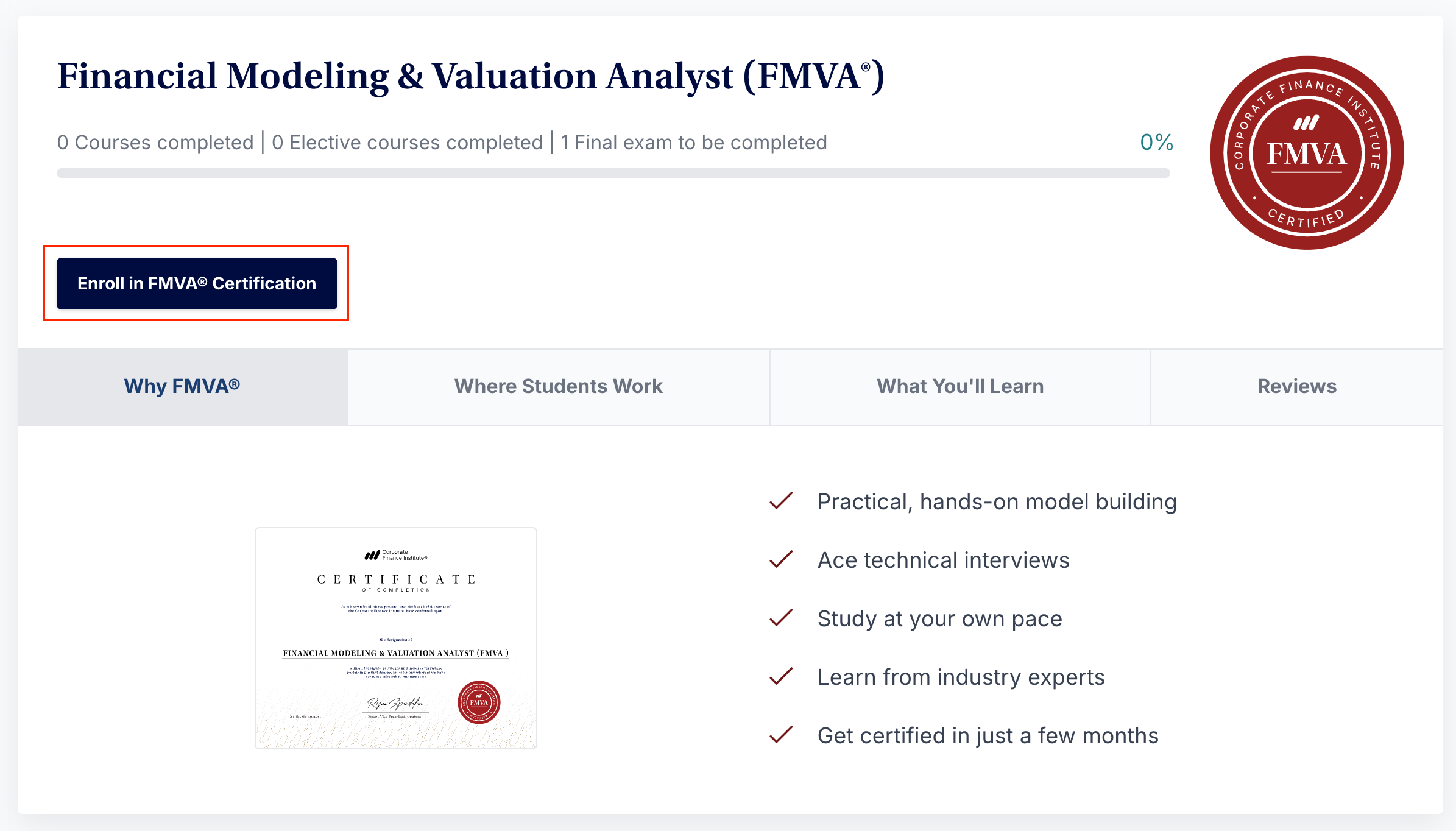

Enroll in Certifications, Specializations, and Role-Based Learning Paths

Self-Study and Full-Immersion subscribers now have the option to enroll in Certifications, Specializations, and Role-Based Learning Paths.

Enrolling in a program will make it easier to track your progress. You must be enrolled in a program to take the Final Exam (if applicable) and receive your program certificate.

You can un-enroll in a program from your Profile.

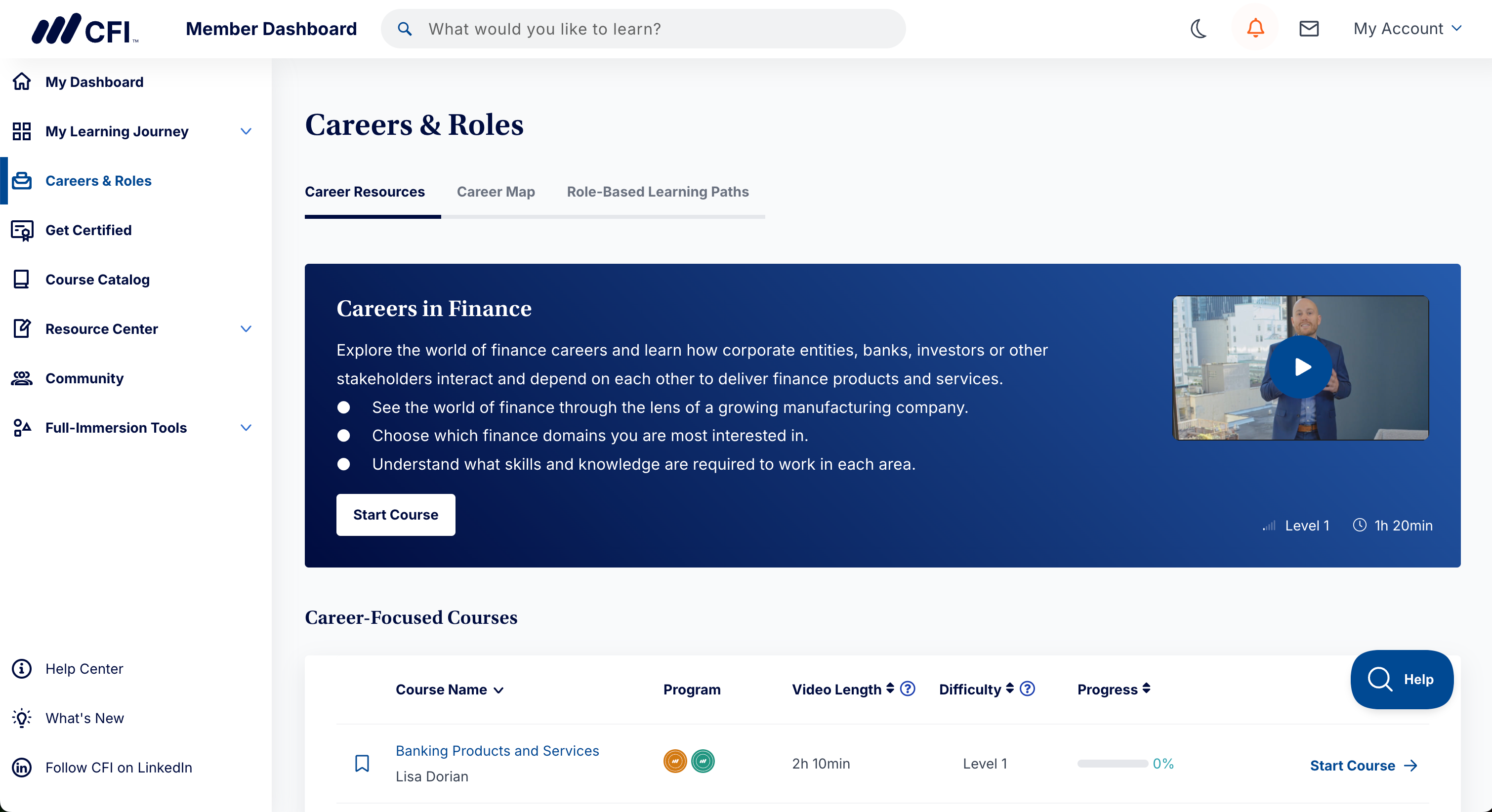

Career Resources are Now Available

Career Resources are now available on your CFI dashboard. Start a career-focused course, such as the new Careers in Finance course, and explore recommended resources to help you progress in your career.

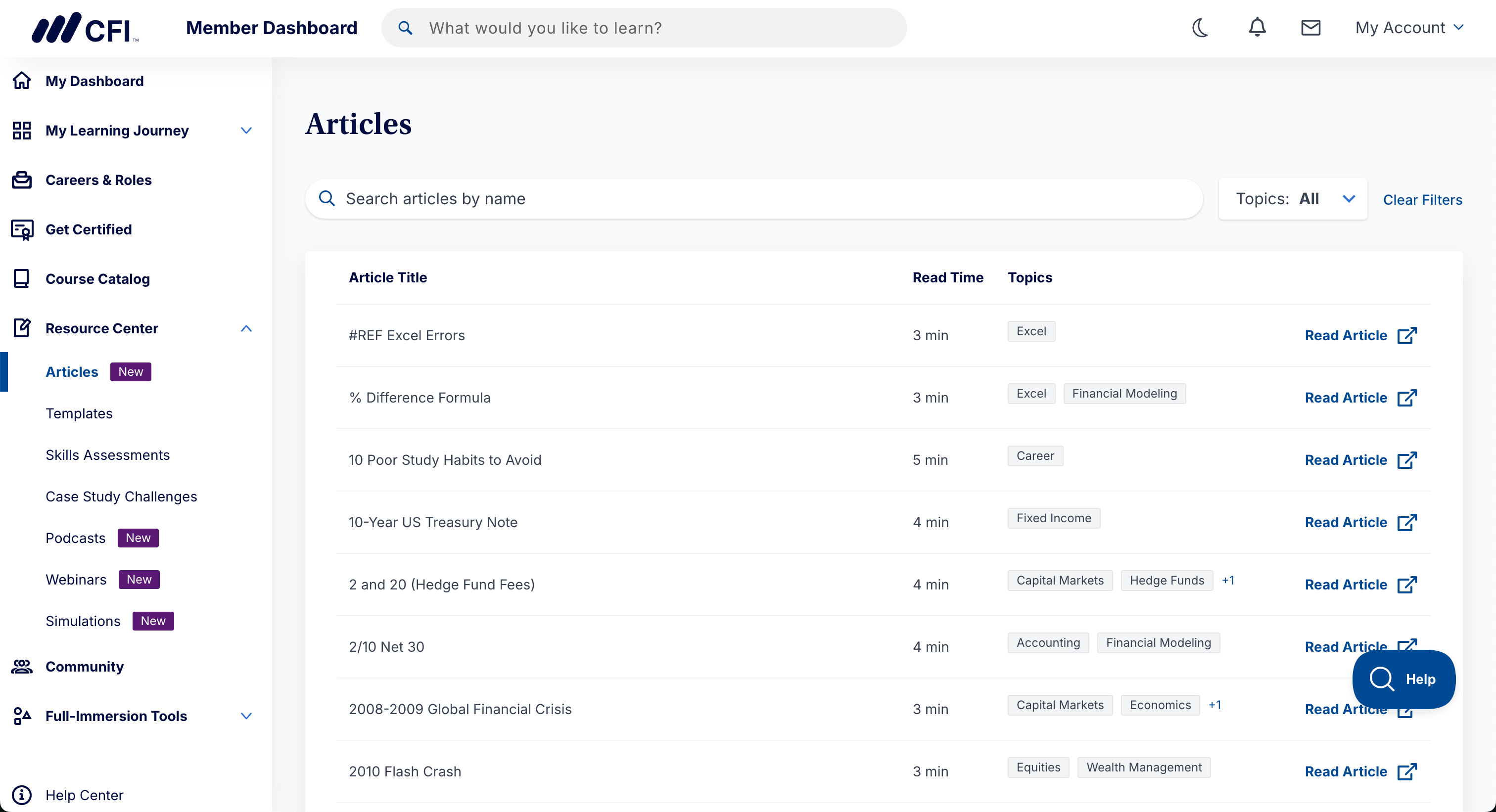

Access Articles, Podcasts, and Webinars within your CFI Dashboard

CFI’s massive library of Articles, Podcasts, and Webinars is now accessible within your CFI Dashboard.

This will make it even easier for you to find resources that support your learning goals.