Overview

Workflow Best Practice for Analysts Course

Efficient workflow management is critical for saving time, ensuring accuracy, and improving team collaboration. Learn invaluable lessons from experienced analysts who have honed their skills over many years of work experience. This course distills essential best practices for naming conventions, versioning, formatting, and automation, helping you to avoid common pitfalls and shortcut your way to exceptional working practices. Master these techniques to boost your productivity and build a strong reputation as a top-tier analyst. Additionally, you’ll find plenty of inspiration and suggestions for how to further develop your skills, speed, and efficiency.

Workflow Best Practice for Analyst’s Learning Objectives

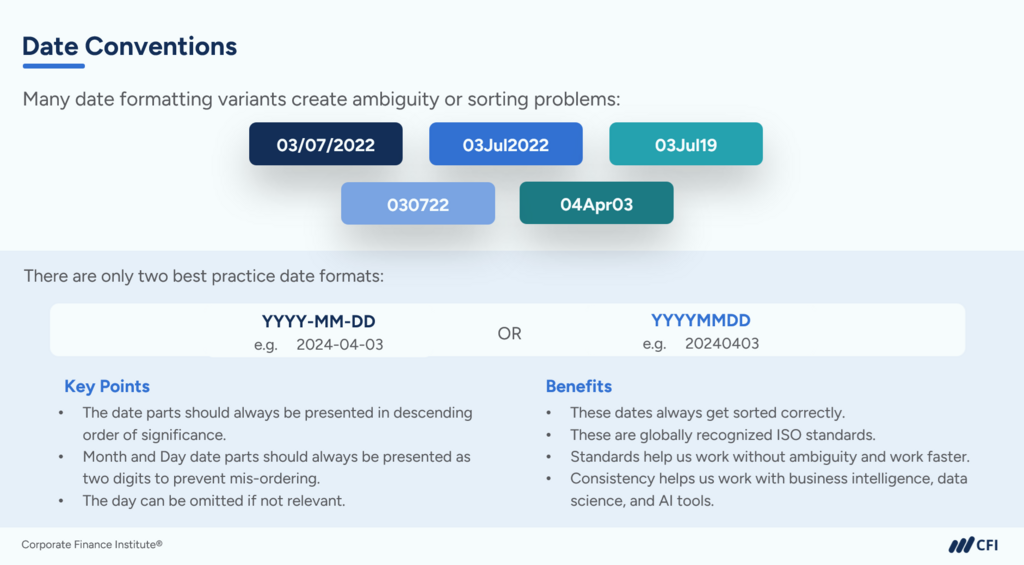

Upon completing this course, you will be able to:- Use best practice file date conventions to improve organization and collaboration.

- Produce best-in-class documentation and audit trails for your models and data links.

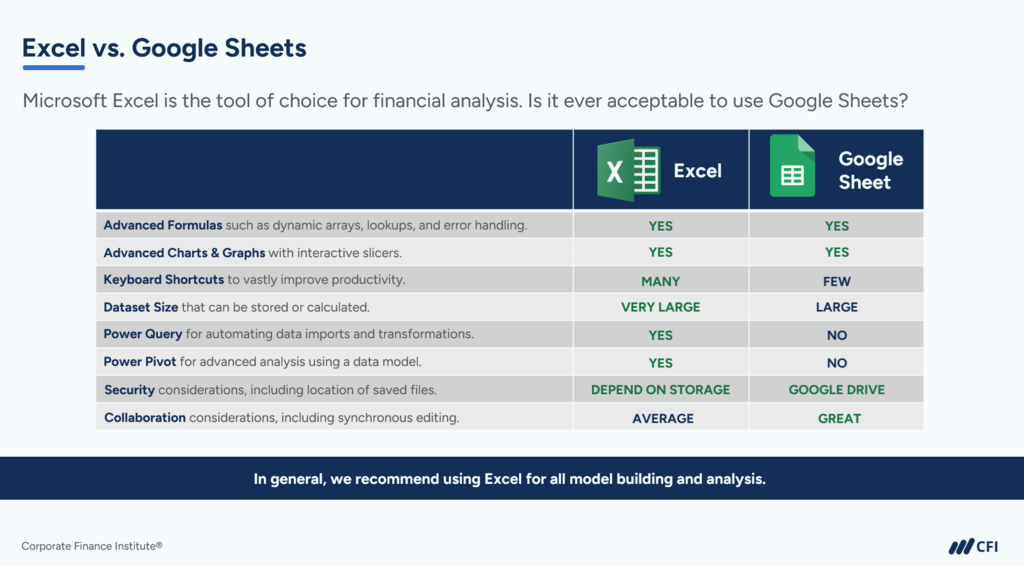

- Understand why Excel is superior to Google Sheets for financial modeling.

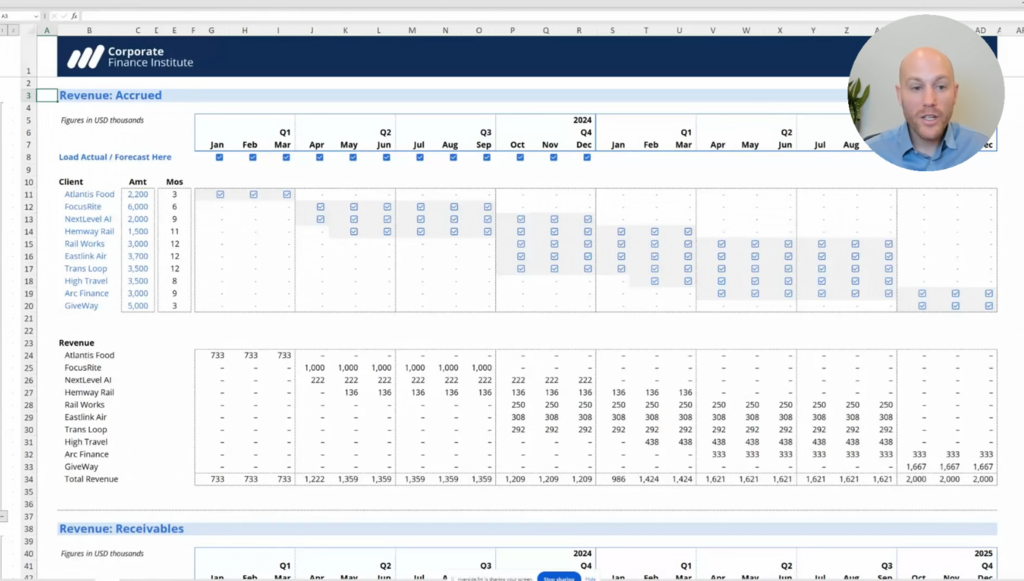

- Explore best-in-class model formatting with a financial modeling expert.

- Implement basic automation to effectively manage data and chart connections between Excel and PowerPoint.

- Identify tools to enhance efficiency and double your productivity.

Who Should Take This Course?

This course is ideal for analysts at any stage of their career who want to enhance their workflow efficiency and productivity. It is particularly beneficial for analysts who work with many stakeholders or deal with lots of files, data, and presentations.

Prerequisite Skills

Recommended skills to have before taking this course.

- Basic computer skills

Workflow Best Practice for Analysts

Level 2

1h 56min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Naming Conventions

Software & File Storage

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Financial Planning & Analysis (FP&A) Specialization

- Skills Learned Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, and more.

- Career Prep Financial Analyst, Project Evaluator, FP&A Manager and more