Overview

Auditing and Balancing a 3-Statement Model Course Overview

The three-statement financial model forms the foundation on which many other models and analyses are built, and constructing a three-statement model is a critical skill for many roles in accounting and finance. In this course, we will cover the most common errors and issues that cause a three-statement model to be out of balance. We’ll show how to correctly find and fix these issues using error-checking best practices. We’ll also build some common error checks that can be used to quickly diagnose issues.

Auditing and Balancing a 3-Statement Model Learning Objectives

- Review Excel’s formula auditing and error checking tools.

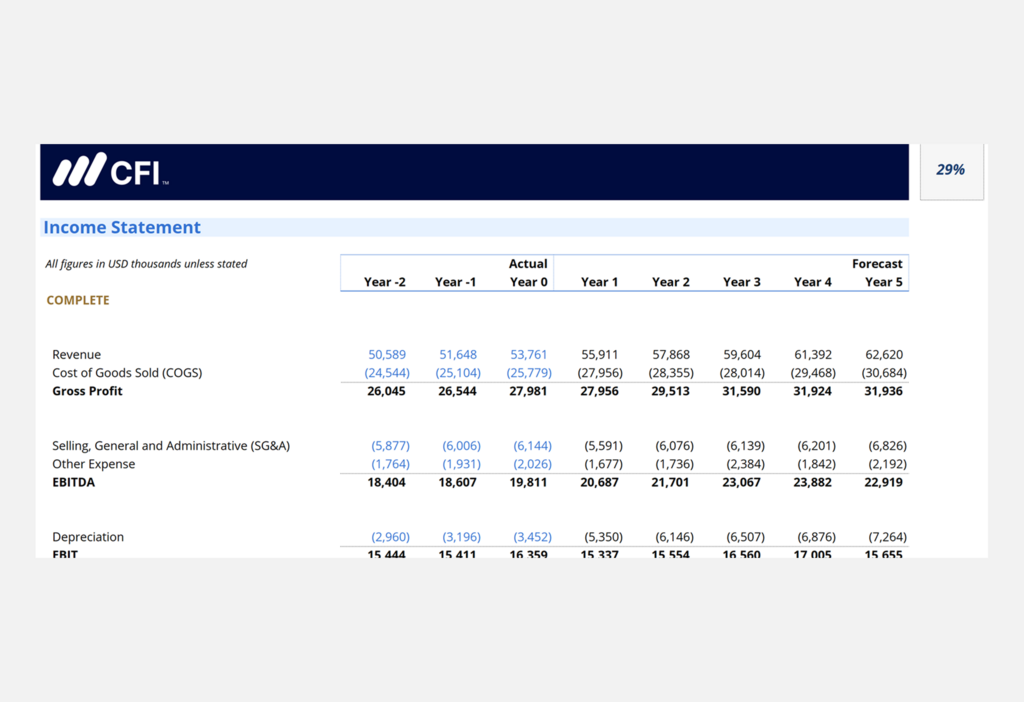

- Identify the most common errors and sources of imbalance in a 3-statement model.

- Apply techniques to ensure consistency and accuracy across financial models, including checking for column alignment, row differences, and proper referencing.

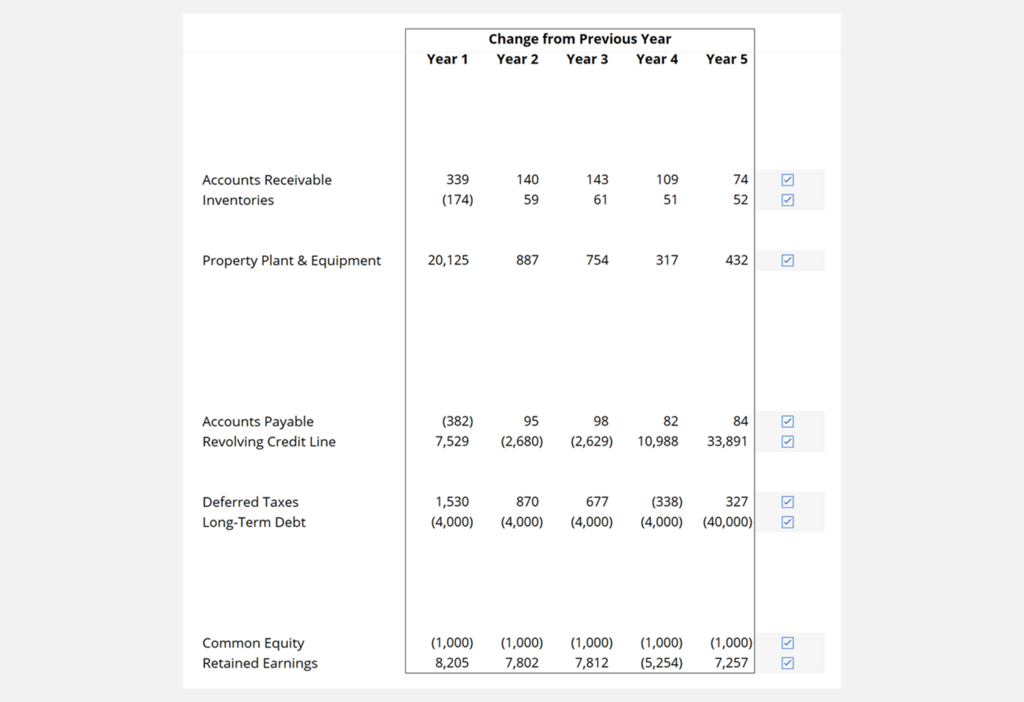

- Reconcile changes in balance sheet accounts with corresponding cash flow statement entries to identify and resolve discrepancies effectively.

Who Should Take This Course?

This course is most suitable for anyone working in investment banking, equity research, and private equity. The content may also be relevant for other financial modeling roles such as corporate development and financial planning and analysis (FP&A).

Auditing and Balancing a 3-Statement Model

Level 4

1h 45min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Referencing Columns and Rows

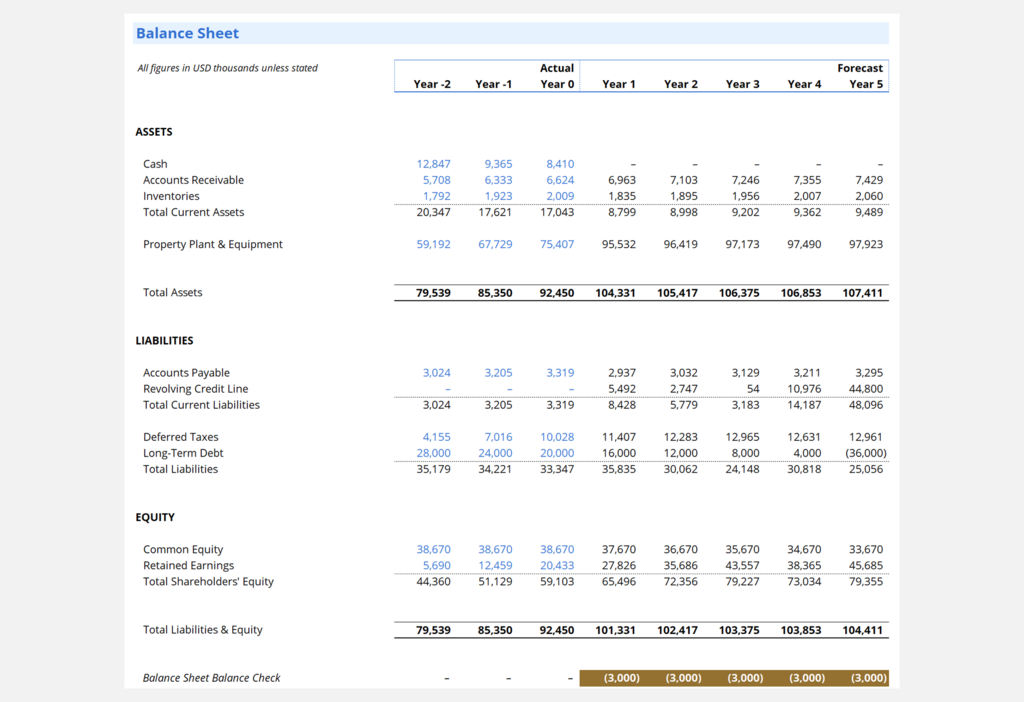

Balance Sheets are Cumulative

Balance Sheet and Cash Flow Statement Reconciliation

Find the Errors

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development