Overview

Analyzing Growth Drivers & Business Risks Course Overview

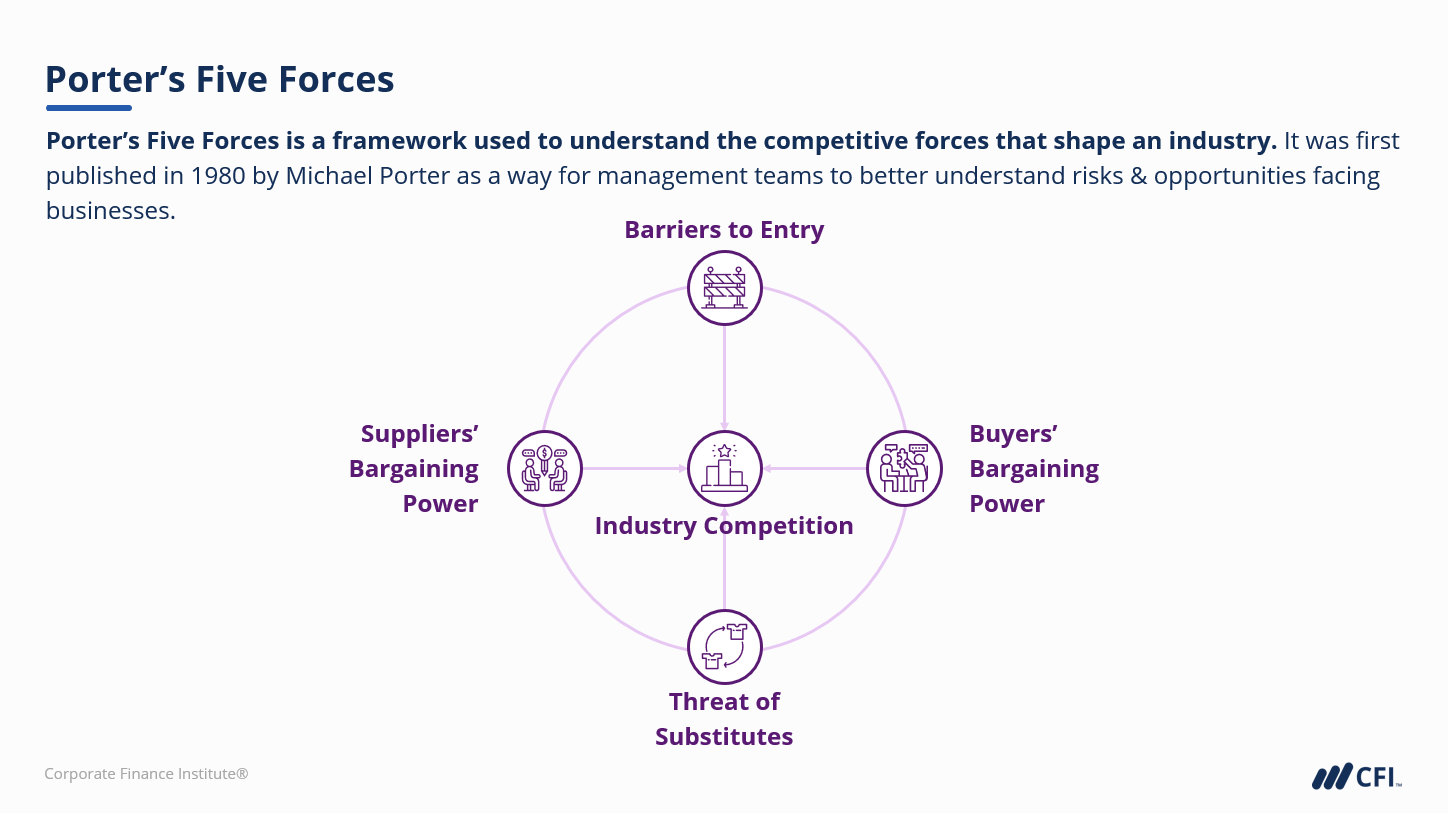

Understanding growth drivers and business risks are essential parts of analyzing a business or in formulating a solid corporate strategy. This can be achieved using a top-down approach, by first looking at the broader economy, followed by industry analysis, then at the company itself; this course introduces frameworks to assess each level in specific detail. We’ll look at how to conduct a PESTEL analysis before diving into the Porter’s 5 Forces framework to help understand the bargaining power of suppliers and of buyers, as well as the threat of new entrants.

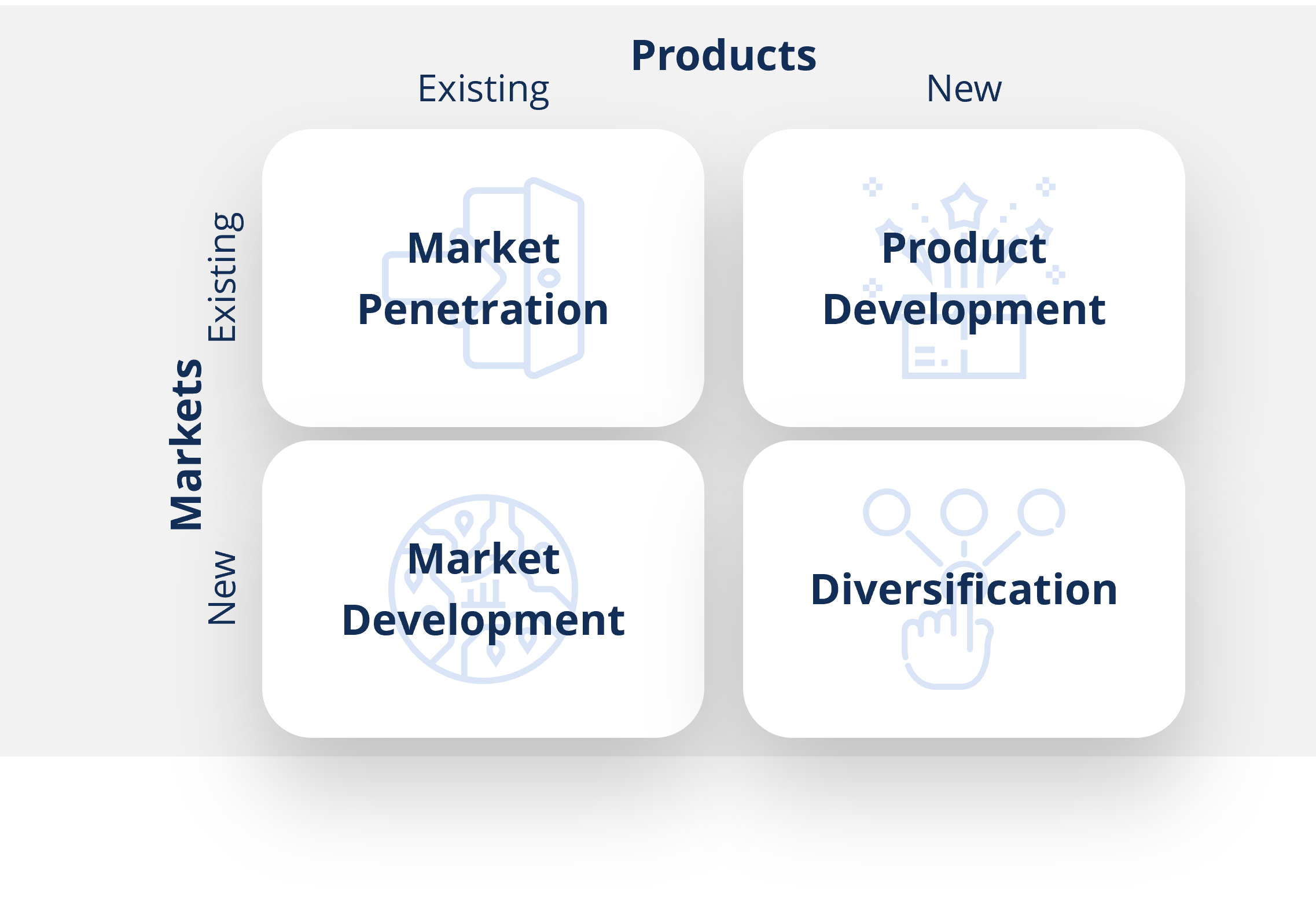

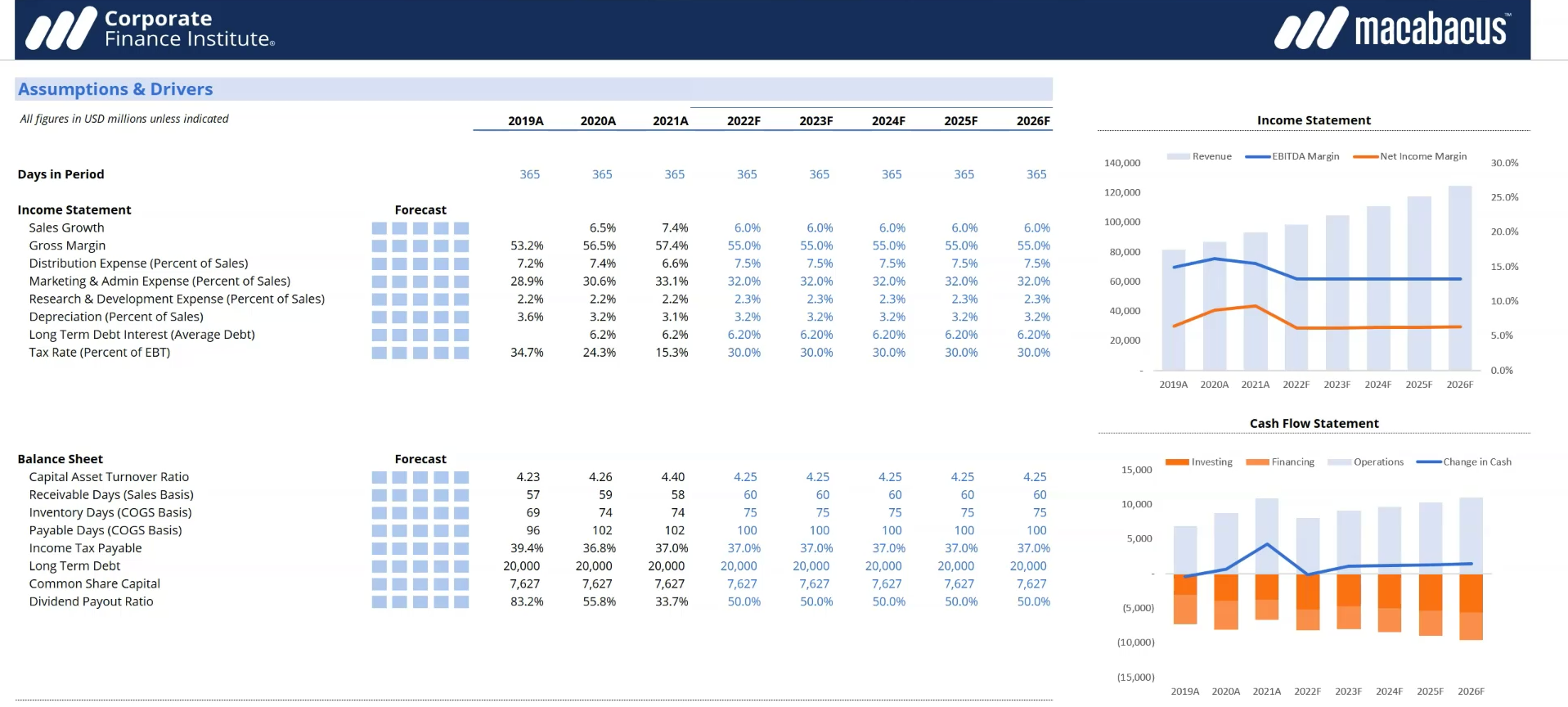

We’ll also explore the industry life cycle, competitive advantage and positioning, as well as Ansoff’s Matrix, before completing a SWOT analysis. Finally, we’ll work on two example case studies to demonstrate how the findings from these frameworks might help inform an analyst’s model assumptions.

Analyzing Growth Drivers & Business Risks Learning Objectives

Upon completing this course, you will be able to:

- Define key categories of growth drivers and business risks

- Compare different business analysis frameworks

- Define how economic, industry and company-level characteristics may influence business strategies and outcomes

- Interpret the results of qualitative assessments

- Explain how these results may inform financial analysis

Who Should Take This Course?

This course is perfect for beginner and intermediate business and finance enthusiasts, including aspiring financial analysts, management consultants, and entrepreneurs.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

Analyzing Growth Drivers & Business Risks

Level 1

1h 6min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Analyzing the External Business Environment

Analyzing the Industry

Connecting the Frameworks to Financial Analysis

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending