Overview

Pitch Deck Essentials for Lenders Course Overview

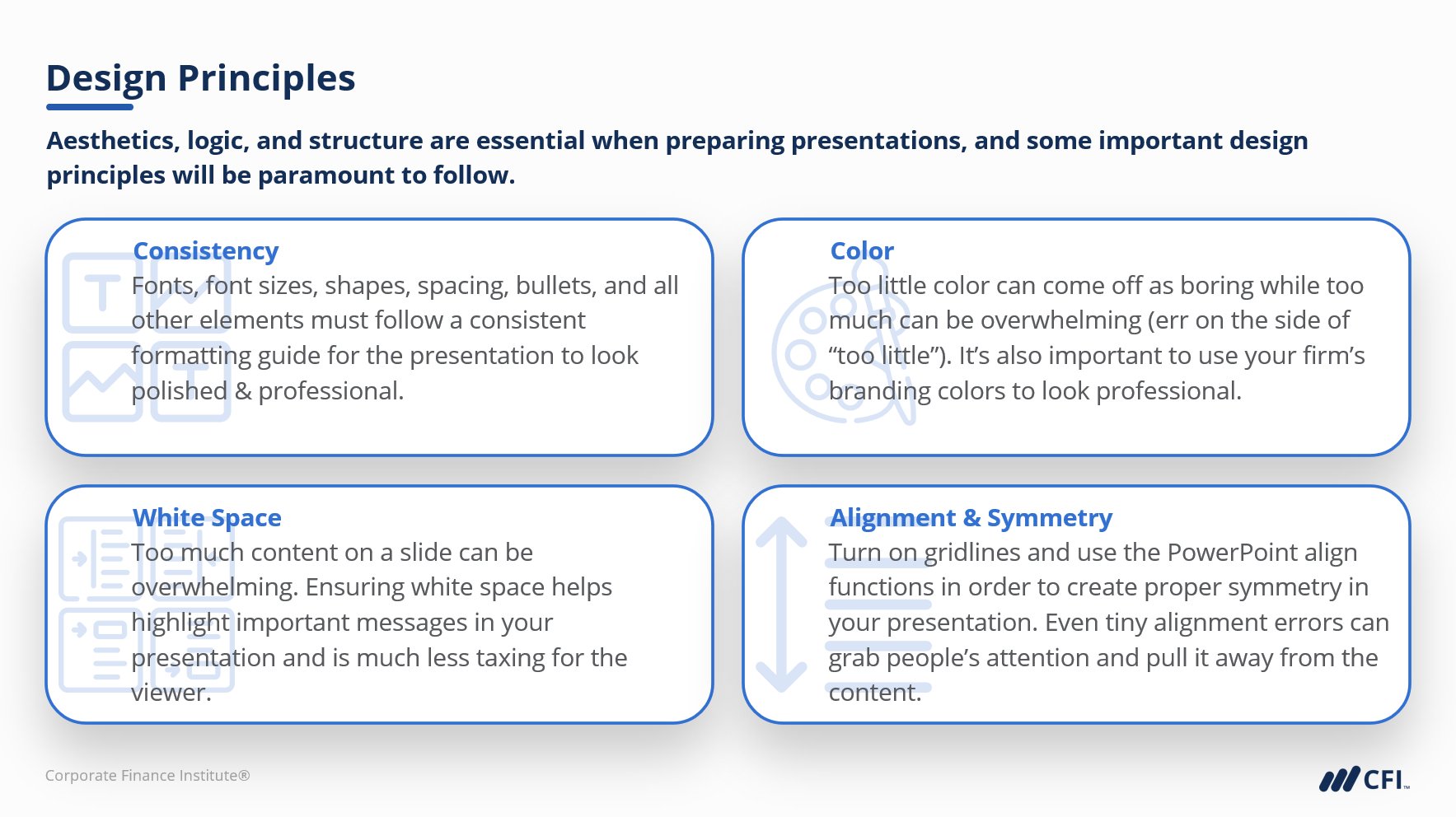

Pitch Deck Essentials for Lenders is a course designed to help bankers and other credit professionals pitch loan proposals to their clients and prospects. In this course, we start with the essentials of a high-quality pitch deck or presentation before covering tips and design principles to help you produce sharp and accurate client correspondence that will really WOW your clients and prospects.

We’ve also included a pitch deck template for lenders, as well as some tricks and Macabacus resources to help turbo-charge your turnaround times so you can compete on speed and value (instead of price)!

Pitch Deck Essentials for Lenders Learning Objectives

Upon completing this course, you will be able to:

- Identify the key pitch deck components for a business or commercial borrowing prospect.

- Calculate payments and other important loan characteristics for an example borrower using Excel.

- Create charts and other visual aids to more clearly relay important information.

- Build better slides and presentation components in PowerPoint that will really WOW your clients and prospects.

- Leverage Macabacus technology to turbocharge your turnaround times and eliminate embarrassing (and costly) errors.

Who Should Take This Course?

Aspiring or early-stage credit professionals, including business and commercial bankers, credit analysts, real estate lenders, equipment finance teams, loan & mortgage brokers, and other private (non-bank) lenders.

Prerequisite Courses

Recommended courses to complete before taking this course.

Pitch Deck Essentials for Lenders

Level 1

1h 11min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

What Goes into a Lender’s Pitch Deck

Credit Structuring – The Basics

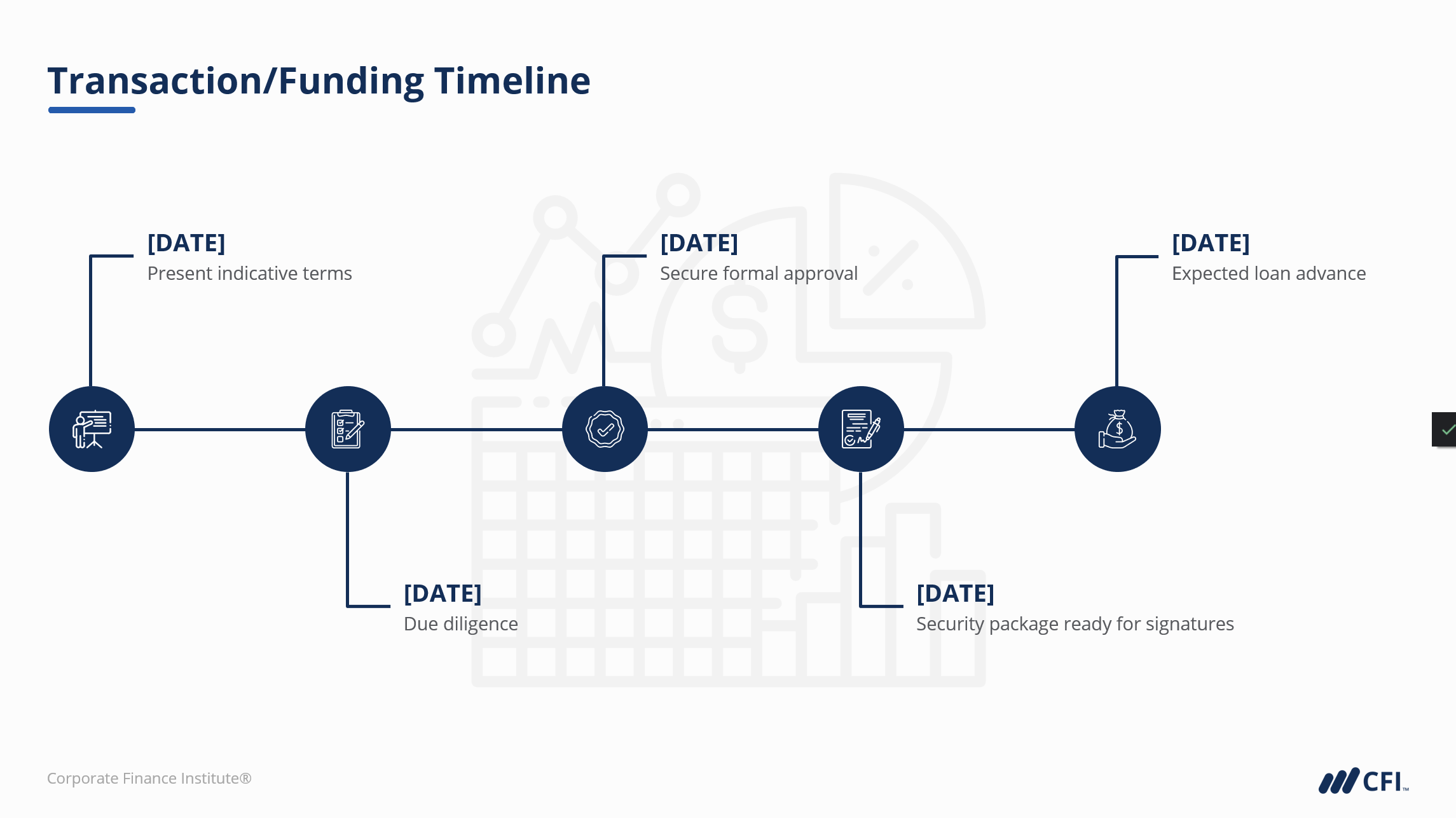

The Pitch Deck

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending