Overview

Modeling Taxes for Different Business Structures Overview

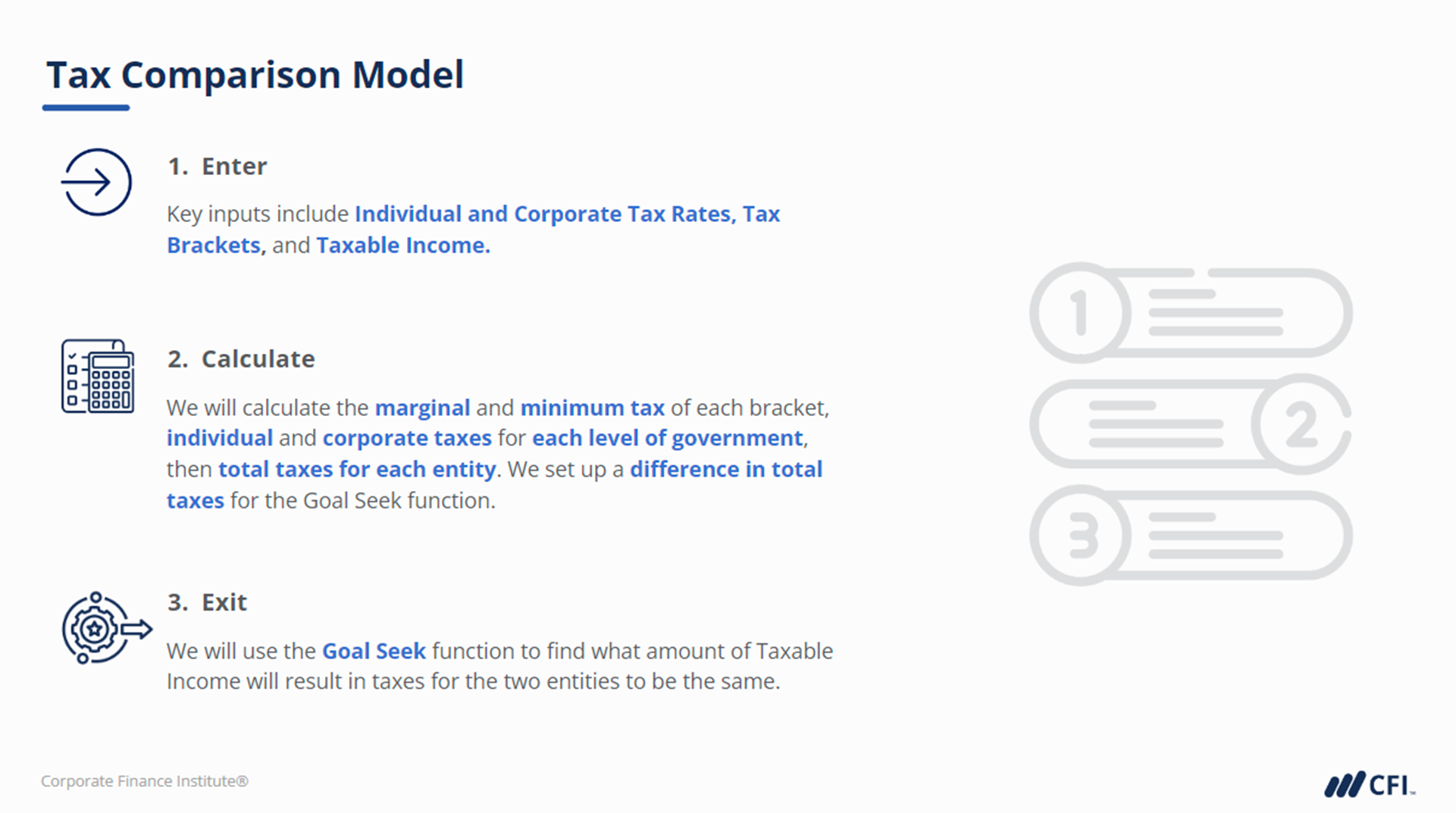

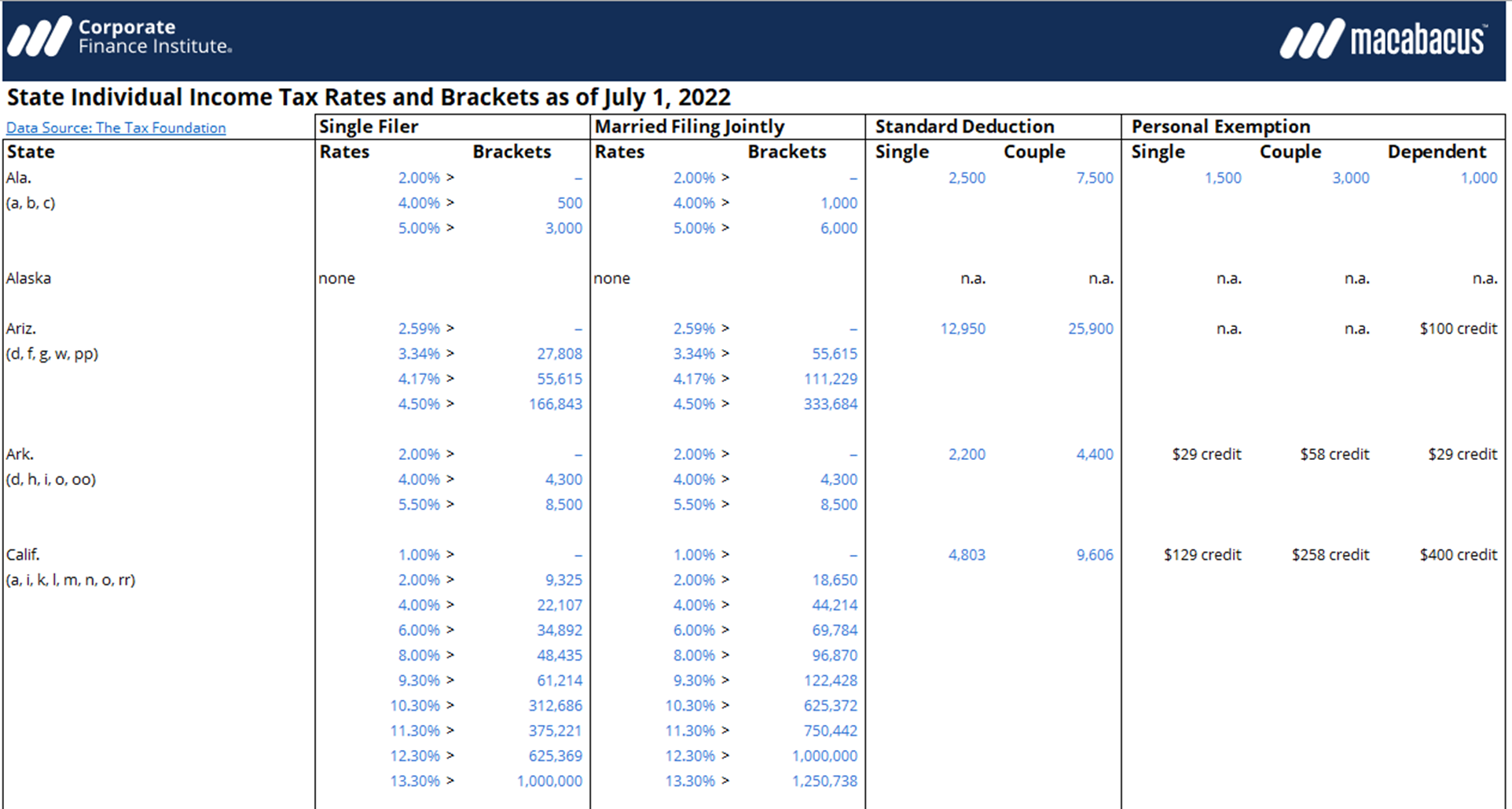

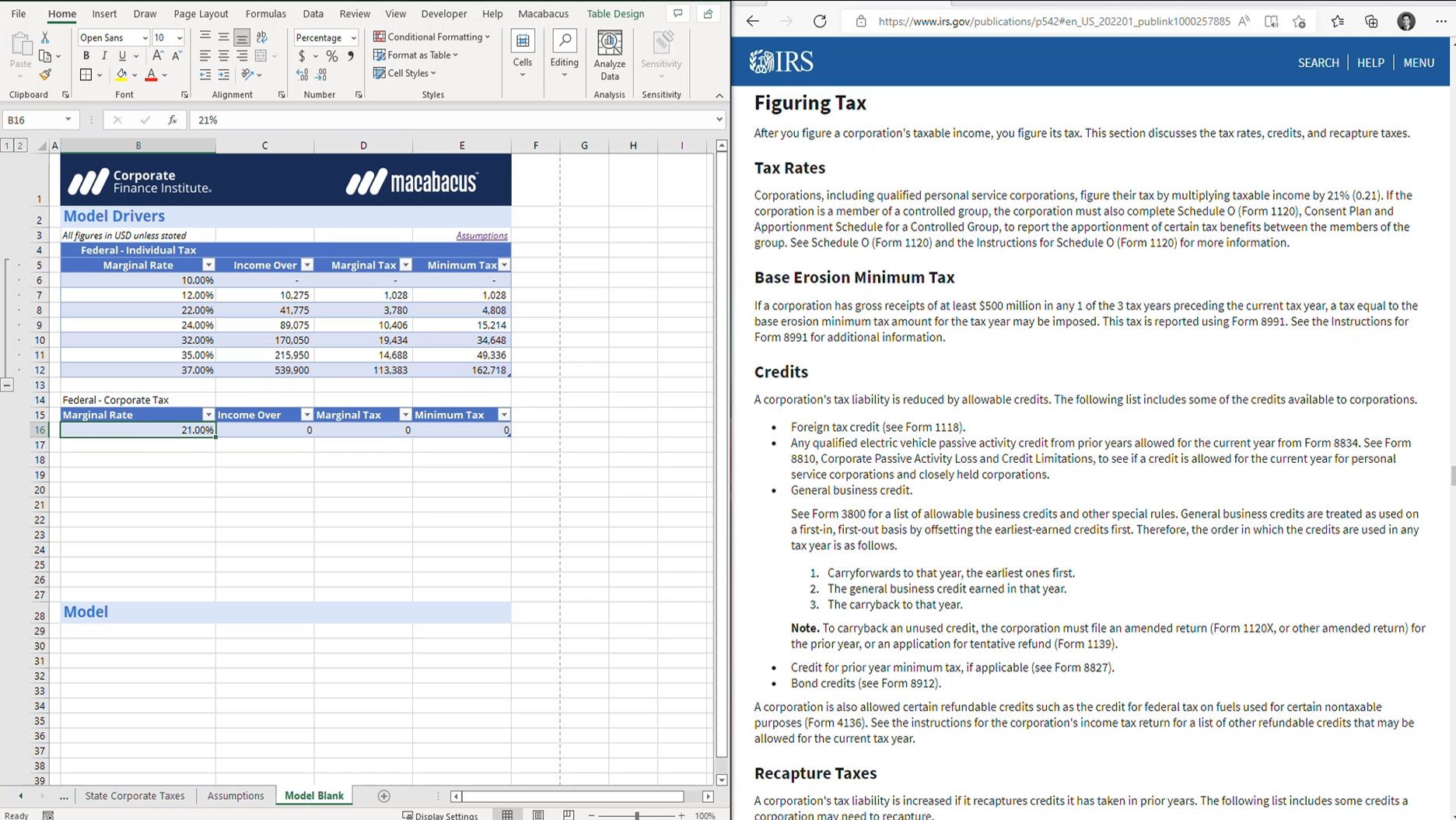

In this guided Practice Lab, we will use personal and corporate tax information to create a basic income tax model and understand how forms of business structure give rise to different taxes. We will enhance your productivity by practicing several different keyboard shortcuts and format models using best practices, work with Excel tables, and gain comfort around analysis calculations. By the end of this lab, you will understand how to set up tables in Excel and perform modeling with data using tools such as MATCH, INDEX, XLOOKUP, and Goal Seek.

Modeling Taxes for Different Business Structures Learning Objectives

- Analyze different models to use and their tax implications.

- Practice various keyboard shortcuts to work through Excel efficiently.

- Develop foundational modeling skills using Excel Tables and Structured references.

- Interpret key financial data to inform business decisions.

- Estimate taxes at two levels of government and under progressive and flat tax regimes.

Who Should Take This Course?

This Modeling Taxes for Different Business Structures Practice Lab is perfect for any aspiring or early-stage credit professionals, including business and commercial bankers, credit analysts, real estate lenders, equipment finance, loan & mortgage brokers, and other private (non-bank) lenders.

Prerequisite Courses

Recommended courses to complete before taking this course.

Modeling Taxes for Different Business Structures

Level 2

1h 1min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Working with Tables in Excel

Preparing a Model in Excel

Course Summary

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending