Overview

Pricing Options and Option Sensitivities Overview

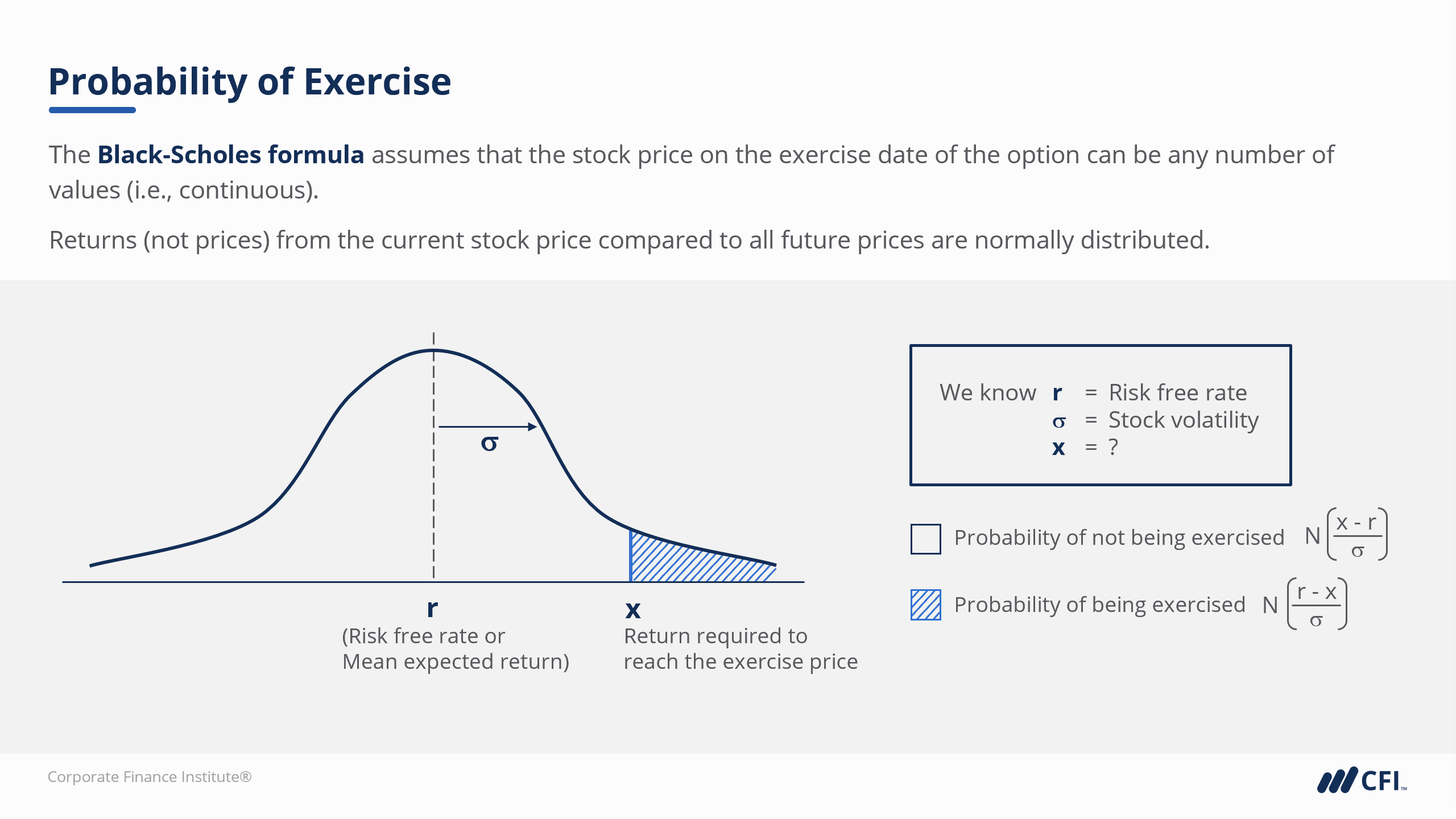

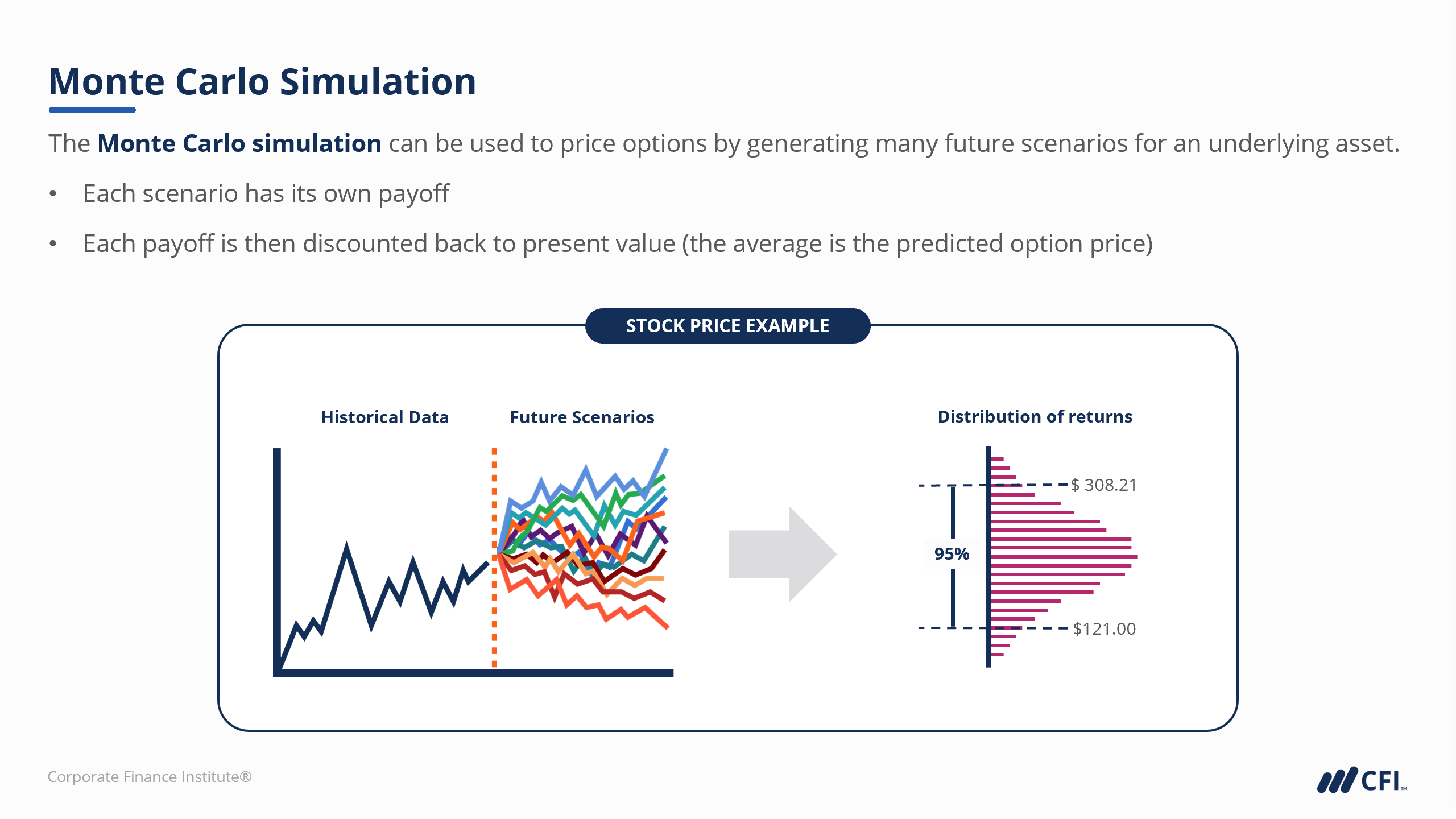

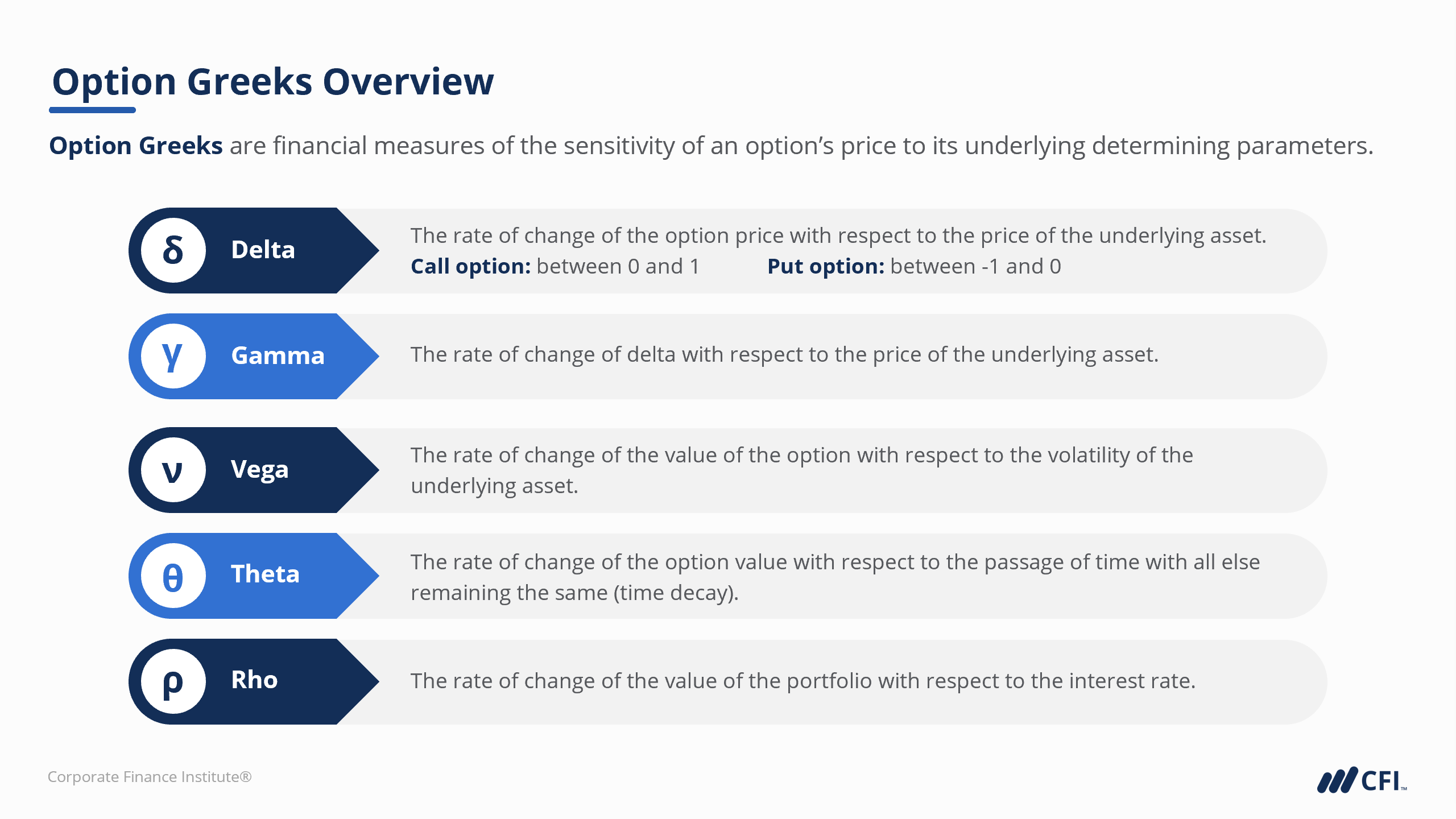

In this course, we focus on valuing options using three pricing models: Black-Scholes, binomial, and the Monte Carlo simulation. Starting with the Black-Scholes model, we break it down and simplify the complex formula to ensure each and every component is understood. We then move on to learning the fundamentals of the one-step binomial model before progressing to additional steps. Finally, we look at the Monte Carlo simulation and show how it can be created in Excel. Our last module in the course focuses on option Greeks, which measure the sensitivity of an option price relative to a change in different variables.

Pricing Options and Option Sensitivities Objectives

Upon completing this course, you will be able to:

- Identify the drivers and key inputs required for different option pricing models

- Use Excel to estimate an option value using multiple option pricing models

- Explain the Greeks and interpret the different values of each

- Calculate the option price given changes in factors such as volatility, price of the underlying asset, and time

Who Should Take This Course?

This course is great for anyone interested in enhancing their understanding of derivatives and may be deciding to work in a role where the knowledge of options is expected or appreciated.

Prerequisite Courses

Recommended courses to complete before taking this course.

Pricing Options and Option Sensitivities

Level 5

1h 34min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Black-Scholes Model

Monte Carlo Simulation

The “Greeks”

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side