Overview

Deconstructing Options Overview

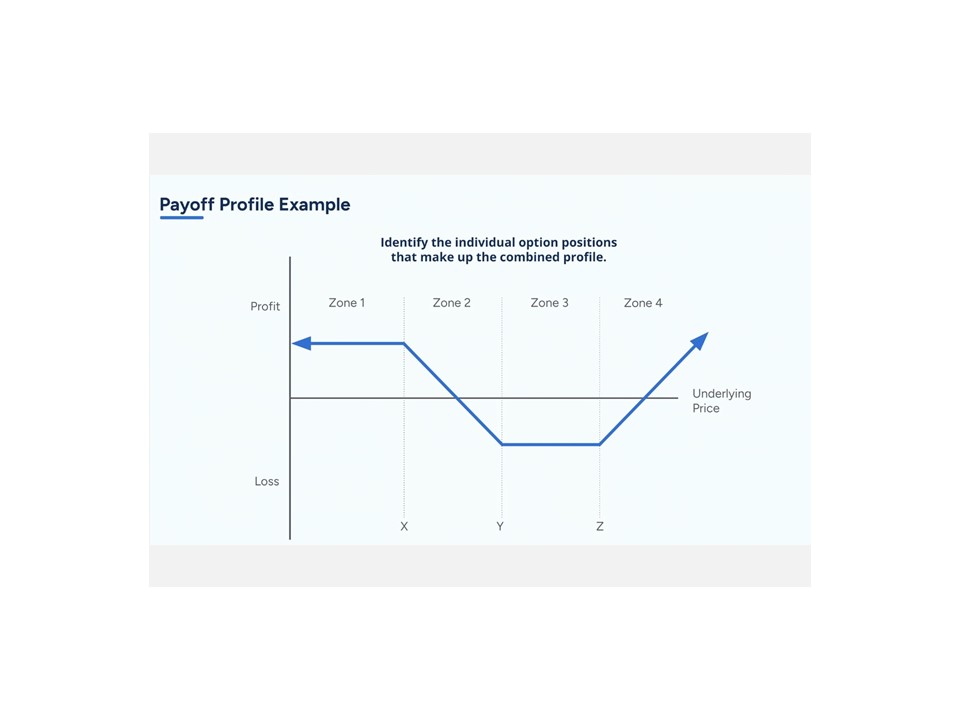

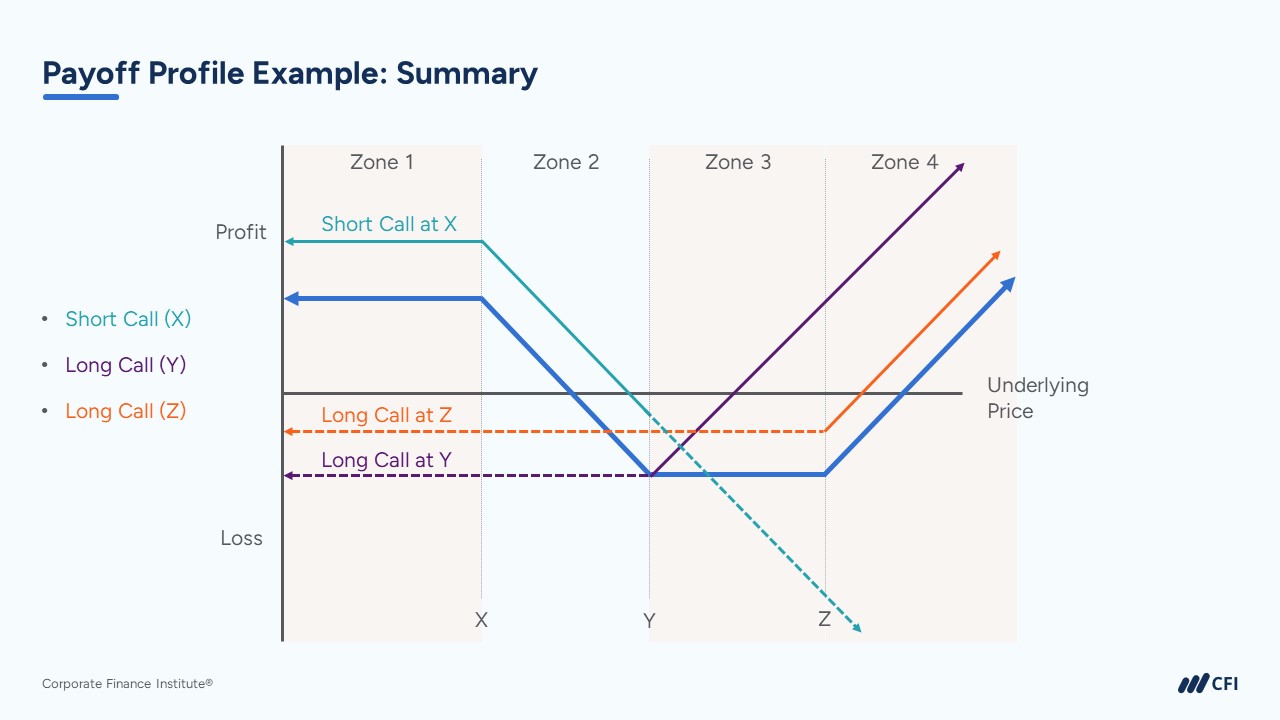

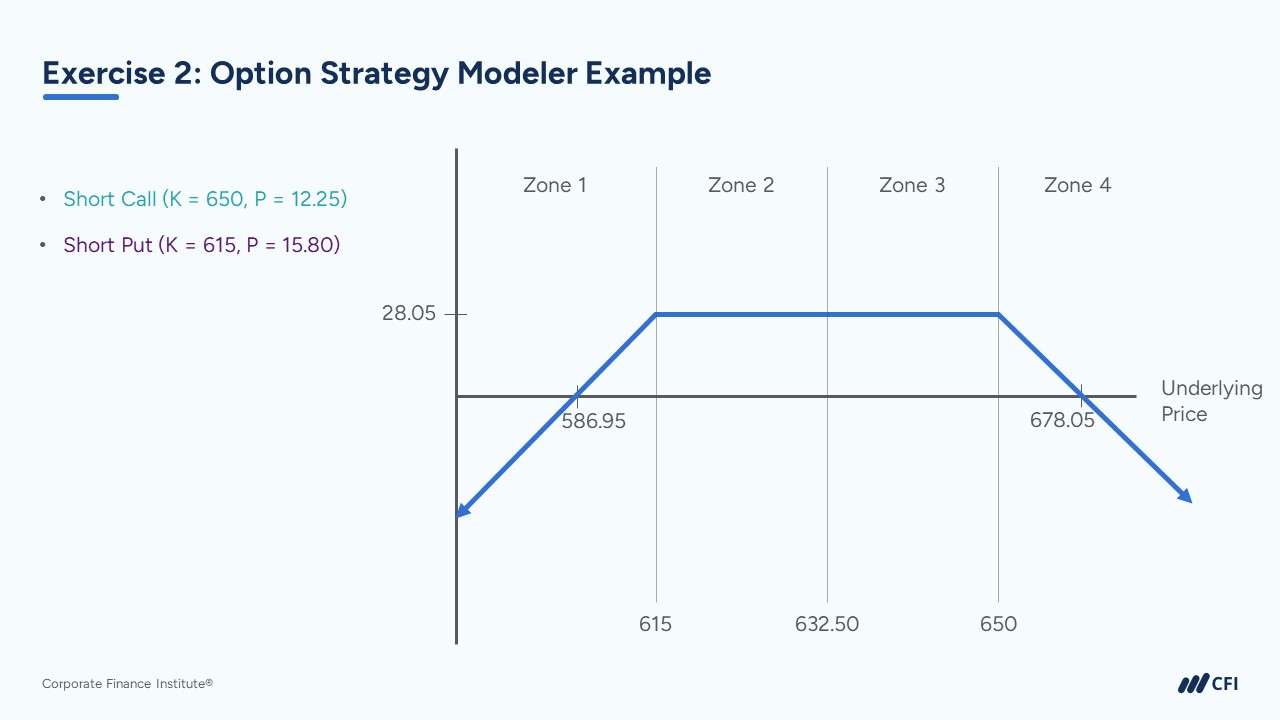

Options play a crucial role in financial markets by offering unique ways to manage risk and make profits. In this course, we will teach you how to break down options payoff diagrams into their single option positions. By doing this, you will better understand how options traders construct trading strategies to express very specific views on the price direction of the underlying asset. You will use a pre-built Excel model to help determine strike prices for various positions, along with the payoffs for different underlying asset prices. You will learn how to analyze and interpret options payoff diagrams with confidence through practical examples and exercises.

Deconstructing Options Learning Objectives

- Identify the individual options that make up a given payoff diagram.

- Use a pre-built Excel options modeler to recreate payoff diagrams in Excel.

- Identify why a trader may conduct different options strategies.

Deconstructing Options Overview

This practice lab is perfect for anyone who understands the fundamentals of options and would like to become more confident in analyzing and deconstructing payoff diagrams.

Prerequisite Courses

Recommended courses to complete before taking this course.

Deconstructing Options

Level 4

37min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Deconstructing Options

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side