Overview

Data Analysis in Excel Case Study Overview

Dive into the world of Excel data analysis with this engaging case study, featuring seven unique challenges. Each challenge, growing progressively more complex, offers a practical opportunity to sharpen your Excel skills through real-world problem-solving scenarios. You’ll be provided with different datasets for each challenge, where your task is to manipulate, analyze, or visually represent the data using Excel’s diverse set of tools. These challenges are not just about mastering Excel functions; they’re designed to apply these skills to solve actual problems you might encounter professionally.

Data Analysis in Excel Case Study Learning Objectives

By the end of the practice lab, you should be able to:

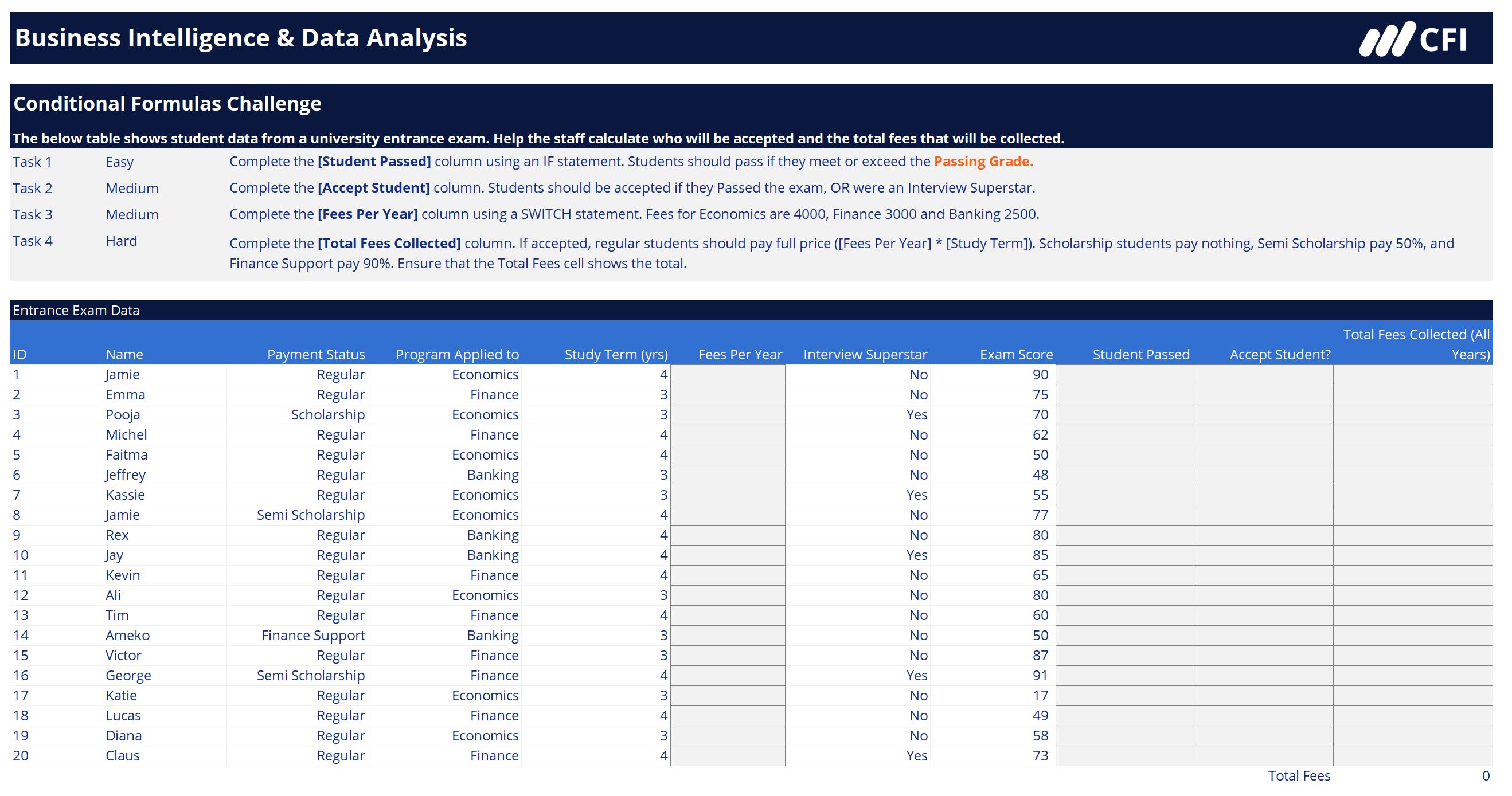

- Transform data with conditional formulas, Lookup functions, and SUMPRODUCT

- Analyze data to highlight insights with conditional formatting, Excel Tables, and Dynamic Arrays

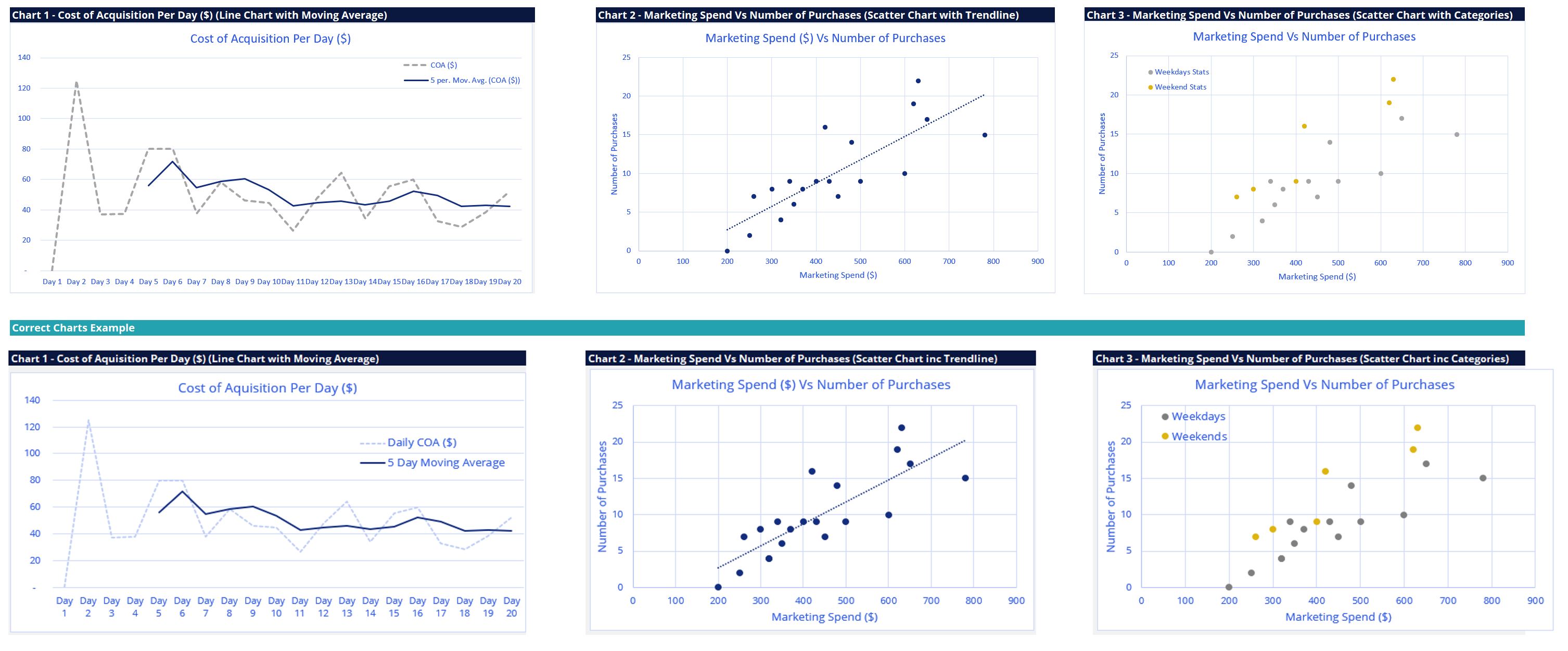

- Visualize data effectively by creating and formatting Excel Charts

Who Should Take This Case Study?

This Excel Case Study is perfect for those who want to put their knowledge about Data Analysis in Excel into practice with selected, real-life scenarios. This makes the case study a great follow-up to BIDA’s Fundamentals of Data Analysis in Excel.

Prerequisite

Ideally some basic Excel skills including formulas and basic pivot tables.

Software Requirements

Excel

Prerequisite Courses

Recommended courses to complete before taking this course.

Fundamentals of Data Analysis in Excel - Case Study

Level 3

1h 5min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Case Study Introduction

Conditional Formatting

Excel Tables

Dynamic Arrays

Case Study Wrap-Up

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Data Analysis in Excel Specialization

- Skills Learned Data Modelling & Analysis, Data Transformation, Data Visualization

- Career Prep Data Analyst, Business Intelligence Specialist, Data Scientist, Finance Analyst

Business Intelligence Analyst Specialization

- Skills learned Data Transformation & Automation, Data Visualization, Coding, Data Modeling

- Career prep Data Analyst, Business Intelligence Specialist, Finance Analyst, Data Scientist