Overview

Power Query Challenges Overview

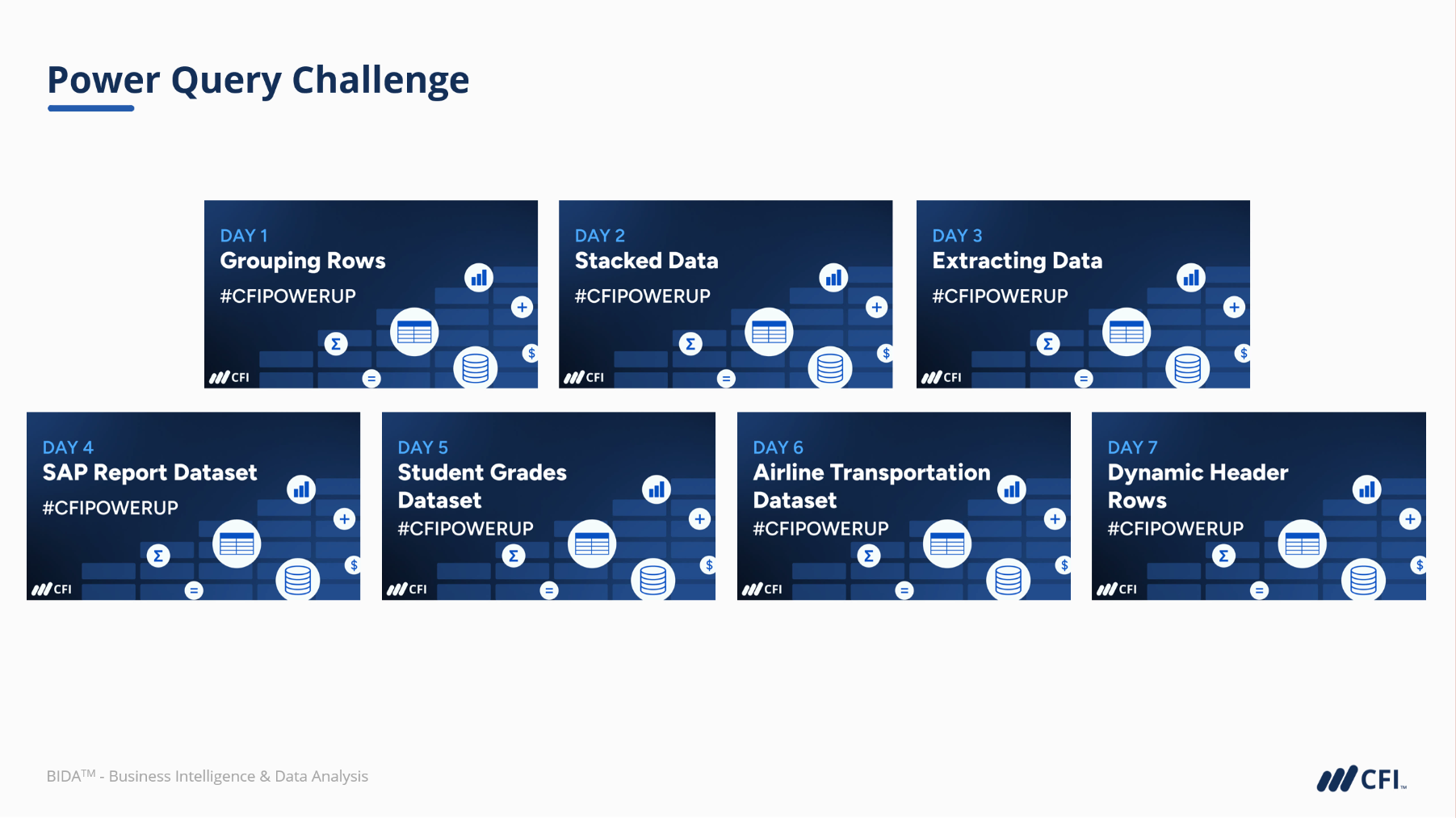

Test your Power Query problem-solving skills with this short challenge-based case study. From easy table manipulations, through to more complex challenges that require dynamic solutions, this case study will test a range of skills and approaches.

Each challenge is introduced with a set of requirements, followed by a guided walkthrough of best practices, hints, and tips that allow learners to improve their solutions.

Mastering Business Intelligence skills is all about practice. This Power Query challenge was designed to provide exactly that environment.

Power Query Challenges Learning Objectives

In this case, you’ll practice:

- Extracting data from Excel and CSV files.

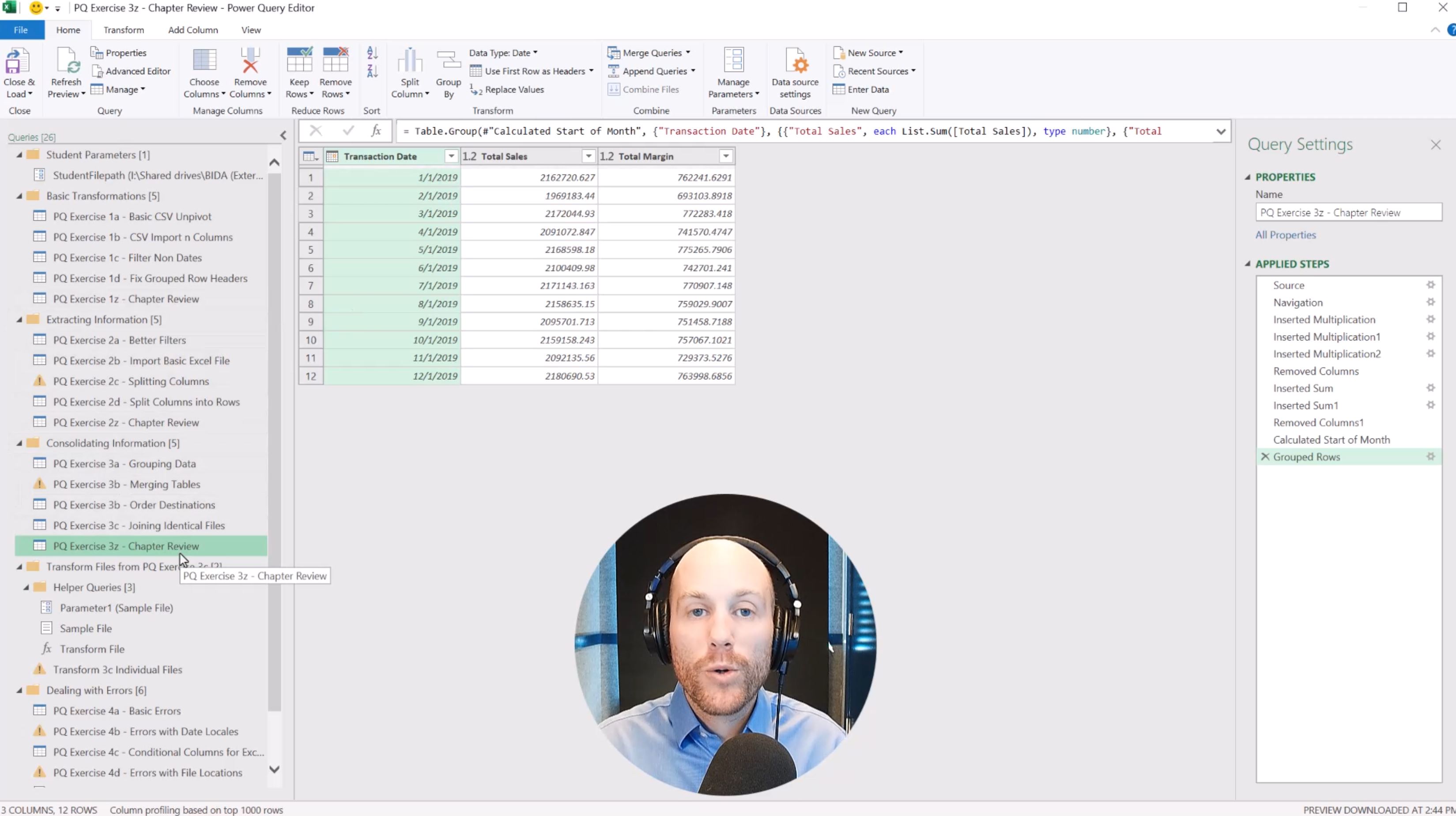

- Problem-solving using grouped rows

- Column splitting functions to extract data

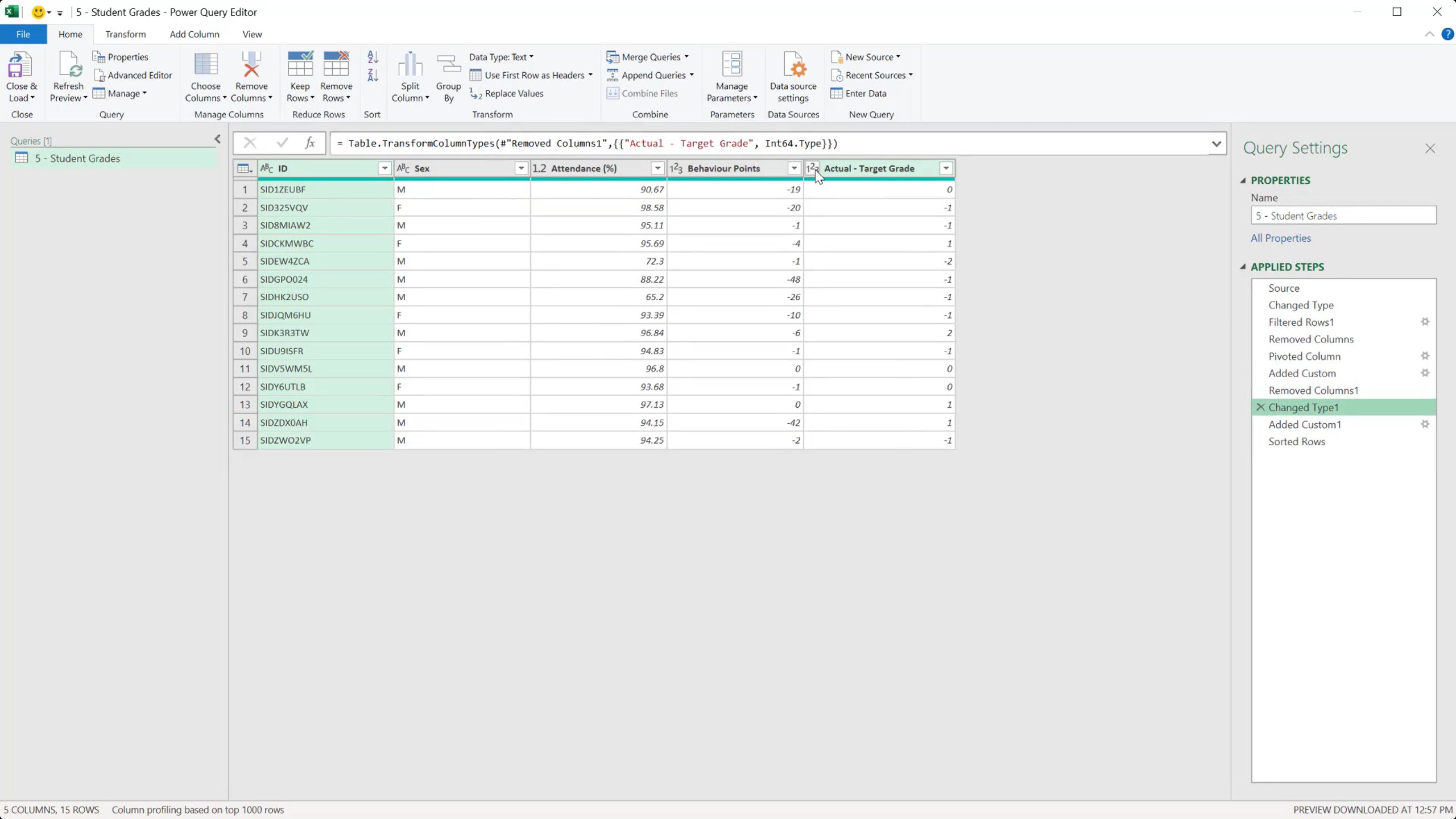

- Switching layouts by pivoting data

- Solving logical scenarios with conditional columns

- Problem-solving dynamic scenarios with header rows

Who Should Take This Course?

If you have completed the Power Query Fundamentals course, or feel that you have a good grasp of Power Query functionality, this course is an appropriate next step for you to practice your skills.

Prerequisite Courses

Recommended courses to complete before taking this course.

Power Query Fundamentals Case Study

Level 3

46min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Introduction

SAP Report Dataset

Student Grades Dataset

Airline Transportation Dataset

Dynamic Header Rows

Challenge Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Data Analysis in Excel Specialization

- Skills Learned Data Modelling & Analysis, Data Transformation, Data Visualization

- Career Prep Data Analyst, Business Intelligence Specialist, Data Scientist, Finance Analyst