Overview

DAX is essential for working with data and data models in Excel and Power BI. Many analysts start building complex DAX formulas without a solid grounding in DAX basics, context manipulation, and time intelligence.

In this DAX course, we’ll quickly review the basics of DAX formulas for creating Measures and Calculated Columns. We’ll also explore the difference between DAX functions that return a scalar value and those that return a table. With this deep understanding of scalar values and tables, we’ll show you the ins and outs of data modeling and context manipulation.

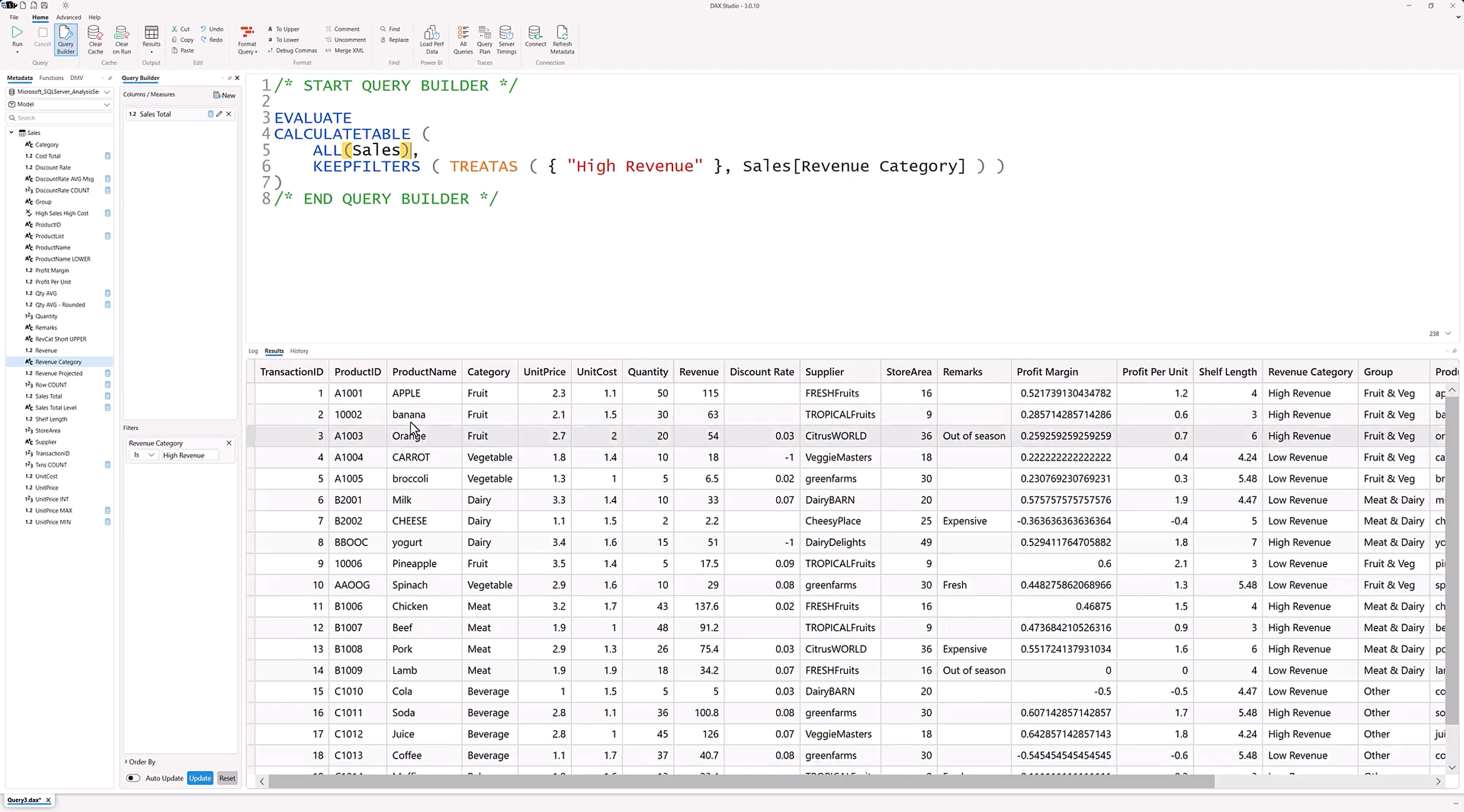

DAX Formulas data

Additionally, we’ll demonstrate how DAX Studio can integrate with Excel and Power BI, speeding up your DAX development process. If you want to get better at using Excel and Power BI and understand the power of DAX Studio, this DAX course is for you. We keep it simple, clear, and focused, so you can learn fast and start applying your new skills right away.

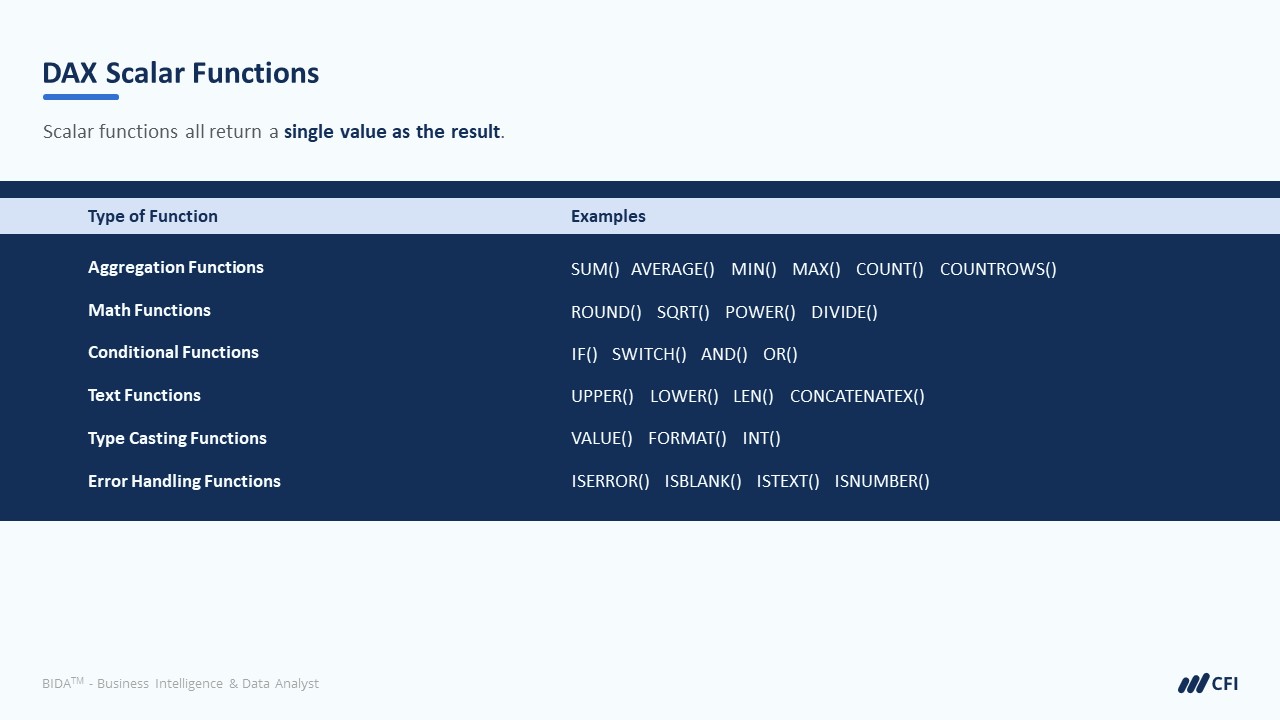

DAX Scalar Functions

Intermediate DAX & Time Intelligence Learning Objectives

By the end of the DAX course, you should be able to:

- Recall the core concepts of DAX: measures, calculated columns, row & filter Context

- Apply functions that return a single, scalar value of various data types

- Manipulate source data with Table Functions

- Apply DAX concepts and functions on a Data Model

- Analyze data over time with Date & Time Intelligence functionality

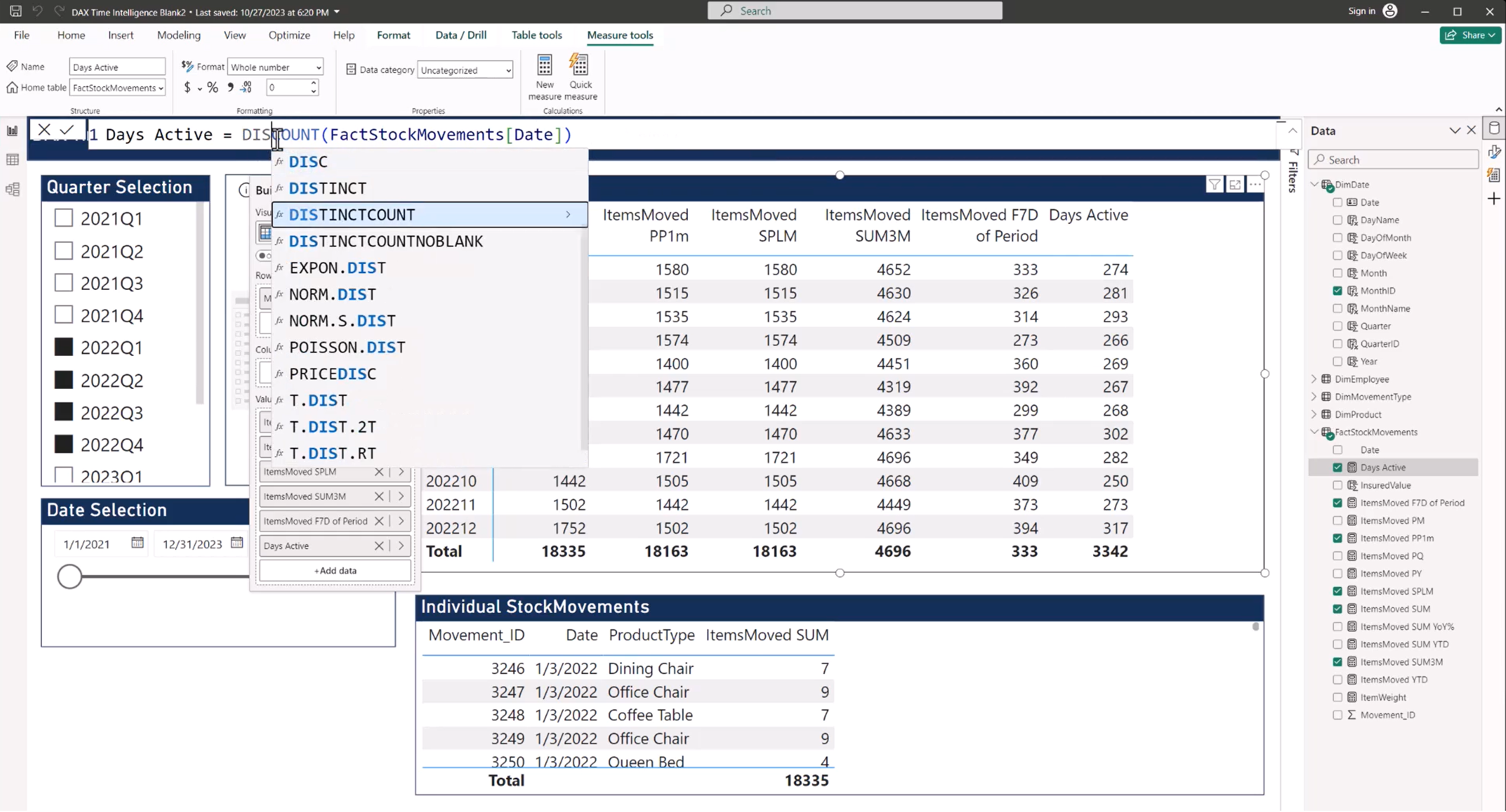

DAX and Time Intelligence Data

Who Should Take This DAX Course?

This DAX course is perfect for anyone who would like to build up their understanding of Business Intelligence in Excel and Power BI. This course is designed to equip anyone who desires to supercharge their career in data analysis, business intelligence, or other areas of finance with the fundamental knowledge of DAX.

Prerequisite Courses

Recommended courses to complete before taking this course.

Intermediate DAX & Time Intelligence

Level 4

2h 55min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Course Introduction

Data Modeling & Context

Date & Time Intelligence

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Business Intelligence Analyst Specialization

- Skills learned Data Transformation & Automation, Data Visualization, Coding, Data Modeling

- Career prep Data Analyst, Business Intelligence Specialist, Finance Analyst, Data Scientist