Overview

Data Visualizations & Dashboards – The Basics Overview

Data Visualizations & Dashboards – The Basics Learning Objectives

By the end of this course, you will learn to:- Define the purpose and audience for your visualization.

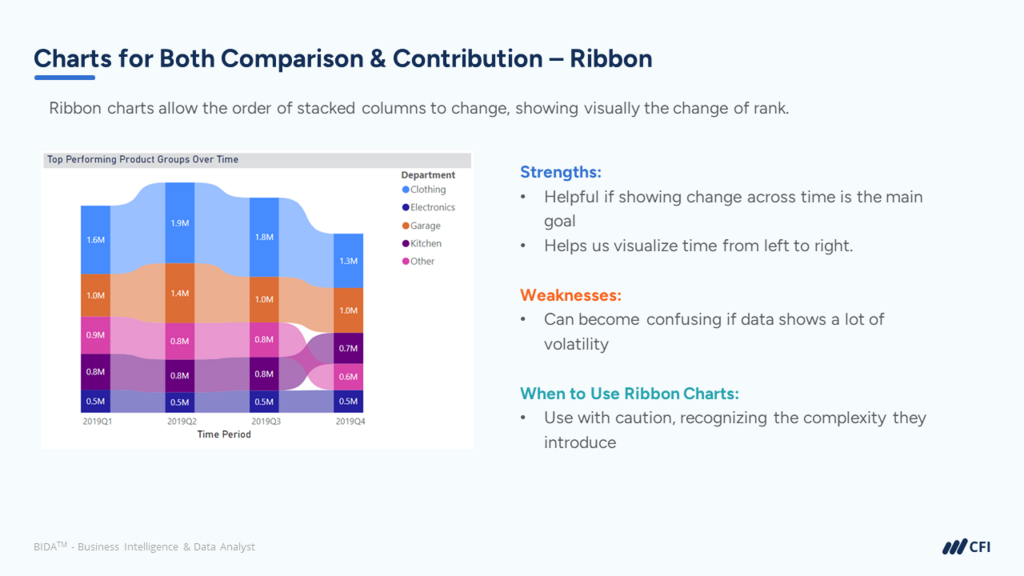

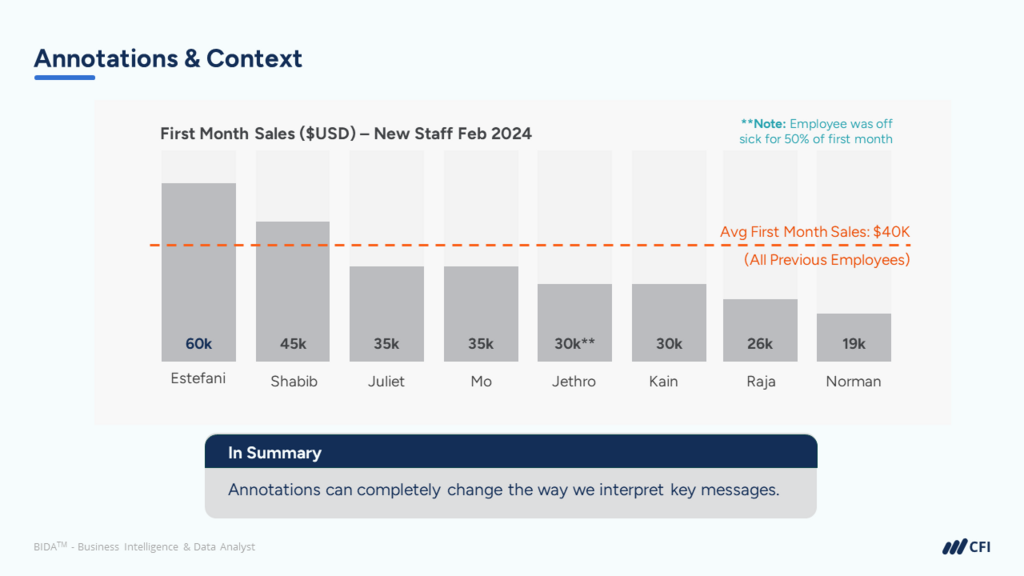

- Select the appropriate visual to tell the story or communicate the message.

- Focus attention on the key message using data viz best practices.

- Design professional and accessible visuals and dashboards to build trust.

- Create meaningful dashboards that tell stories and inspire decision-making.

- Identify examples of bad data visualization and dashboarding.

Who should take this course?

Financial Analysts working in Excel who need to regularly present outputs from models. Any analysts with an interest in Business Intelligence, modern data skills, and pursuing skills like Excel, Power BI and Tableau.

Prerequisite Skills

Recommended skills to have before taking this course.

- Basic data analysis

Data Visualization & Dashboards - The Basics

Level 2

1h 16min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Getting Started

Design & Focusing Attention

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Financial Planning & Analysis (FP&A) Specialization

- Skills Learned Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, and more.

- Career Prep Financial Analyst, Project Evaluator, FP&A Manager and more