Overview

SQL Fundamentals Course Overview

Delve into the world of SQL, the cornerstone of Business Intelligence, with our SQL Fundamentals course. Designed for beginners and aspiring data professionals, this course introduces you to the foundational syntax and transformative capabilities of SQL. You’ll learn how to effectively extract and manipulate data from databases, a critical skill for any analyst.

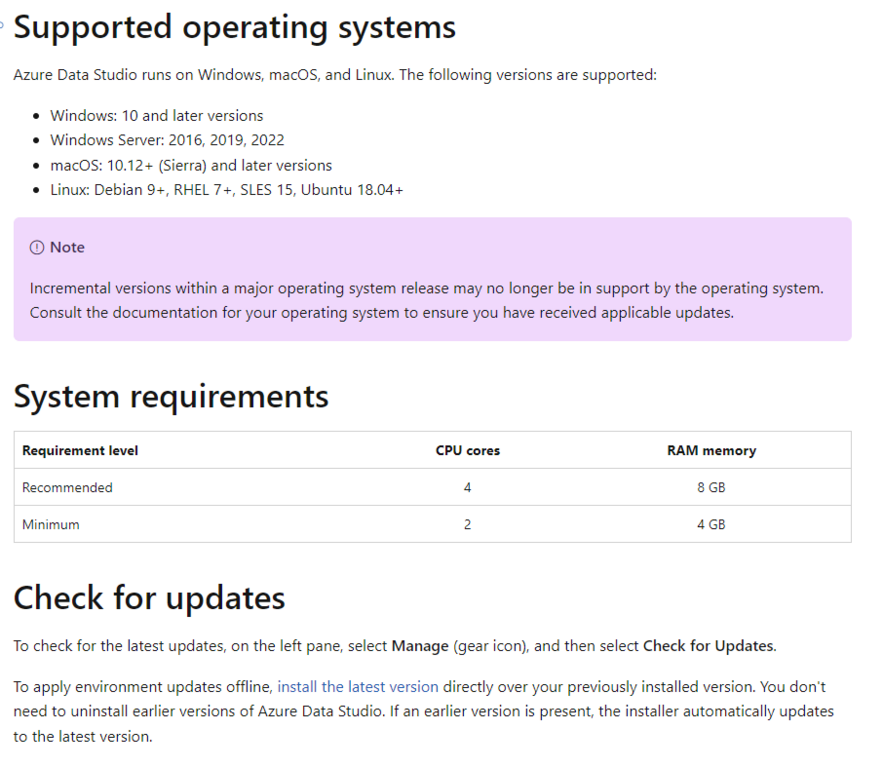

Starting with basic data retrieval and filtering techniques, the course progressively guides you through more complex aspects of SQL, including data transformation functions and combining data from multiple tables. We provide hands-on experience through an accessible Azure Data Studio data warehouse, ensuring you can practice your skills in a real-world environment, regardless of your operating system.

By the end of this course, you’ll possess the fundamental skills necessary to navigate and manipulate database data confidently. You’ll understand best practices and common pitfalls in SQL, equipping you with the knowledge to become a proficient business analyst and a valuable asset in any data-driven role.

SQL Fundamentals Learning Objectives

Upon completing this course, you will be able to:- Retrieve and filter data using basic SQL syntax

- Transform data with the help of numerical, date, and text functions

- Understand essential terminology related to SQL, databases, and data warehouses

- Combine data from multiple tables efficiently for a more advanced analysis

Who should take this course?

This SQL Fundamentals course is ideal for beginners in data analysis, business professionals seeking to understand database interactions, and Excel users venturing into more advanced data management. It’s crafted to provide foundational skills in SQL, setting the stage for anyone looking to deepen their business intelligence and data analysis capabilities. The course lays the groundwork for transforming raw database information into meaningful insights, making it a crucial first step for aspiring data analysts and business intelligence professionals.Software requirements

https://learn.microsoft.com/en-us/azure-data-studio/download-azure-data-studio?tabs=win-install%2Cwin-user-install%2Credhat-install%2Cwindows-uninstall%2Credhat-uninstallPrerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Basic Math

SQL Fundamentals

Level 3

4h 7min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Introduction

Basic SQL Queries

Manipulating Values with Functions

Working with Multiple Tables

Advanced Functions and Queries

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Business Intelligence Analyst Specialization

- Skills learned Data Transformation & Automation, Data Visualization, Coding, Data Modeling

- Career prep Data Analyst, Business Intelligence Specialist, Finance Analyst, Data Scientist