Overview

Enterprise Deployment & Governance: Power BI Edition Overview

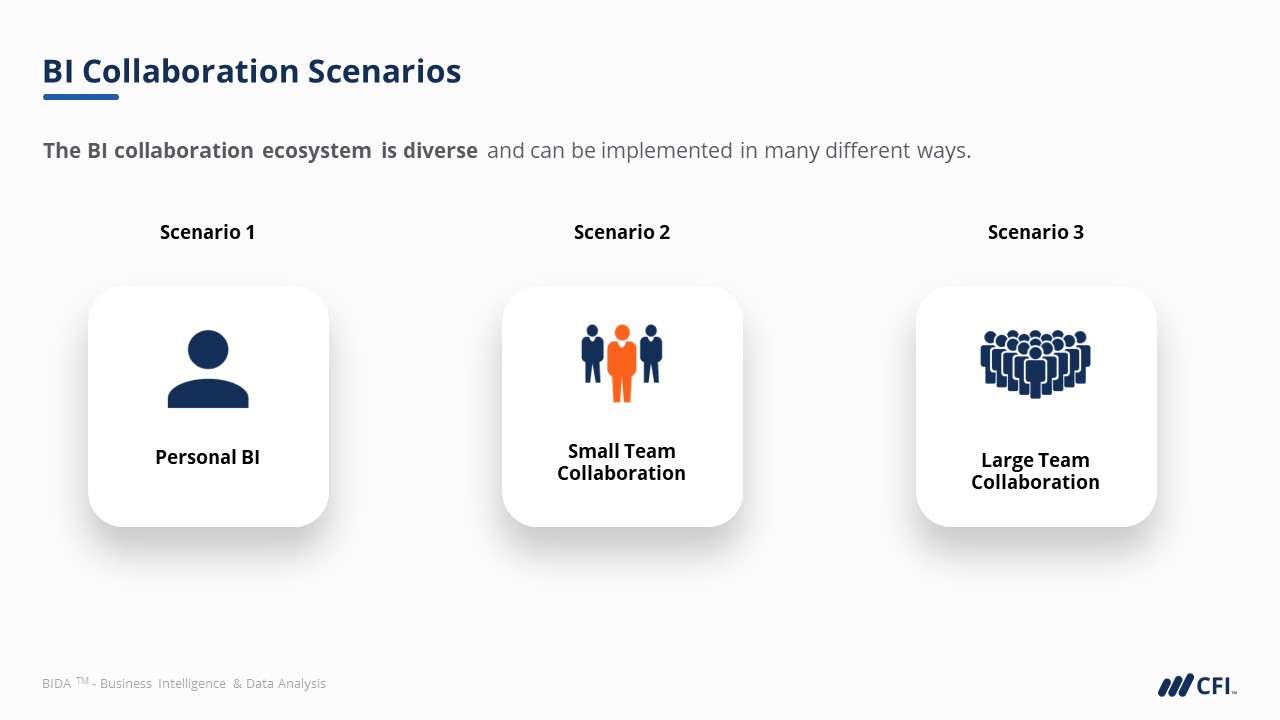

This course will give you a walkthrough of all the processes, systems, and divisions of responsibility that help us develop, test, deploy and share BI reports in team environments. From small, flexible teams to large teams that rely on operational stability and central sources of truth, there are varying levels of report maturity that require different levels of governance. You’ll learn how to consider all these moving parts to balance the pros and cons of additional governance and administration. Finally, you’ll also look at what tools and techniques exist to streamline or automate all of the above when working at scale.

Enterprise-scale BI relies on defined roles and processes to help develop and deploy dashboards efficiently and to meet business demands in an agile environment. This course will guide you through an example in Power BI, giving you all the tools, frameworks, and checklists to deploy reports in your business.

Enterprise Deployment & Governance: Power BI Edition Learning Objectives

Upon completing this course, you will be able to:

- Recall the process and user responsibilities that help build, test, and deploy reports in an enterprise environment.

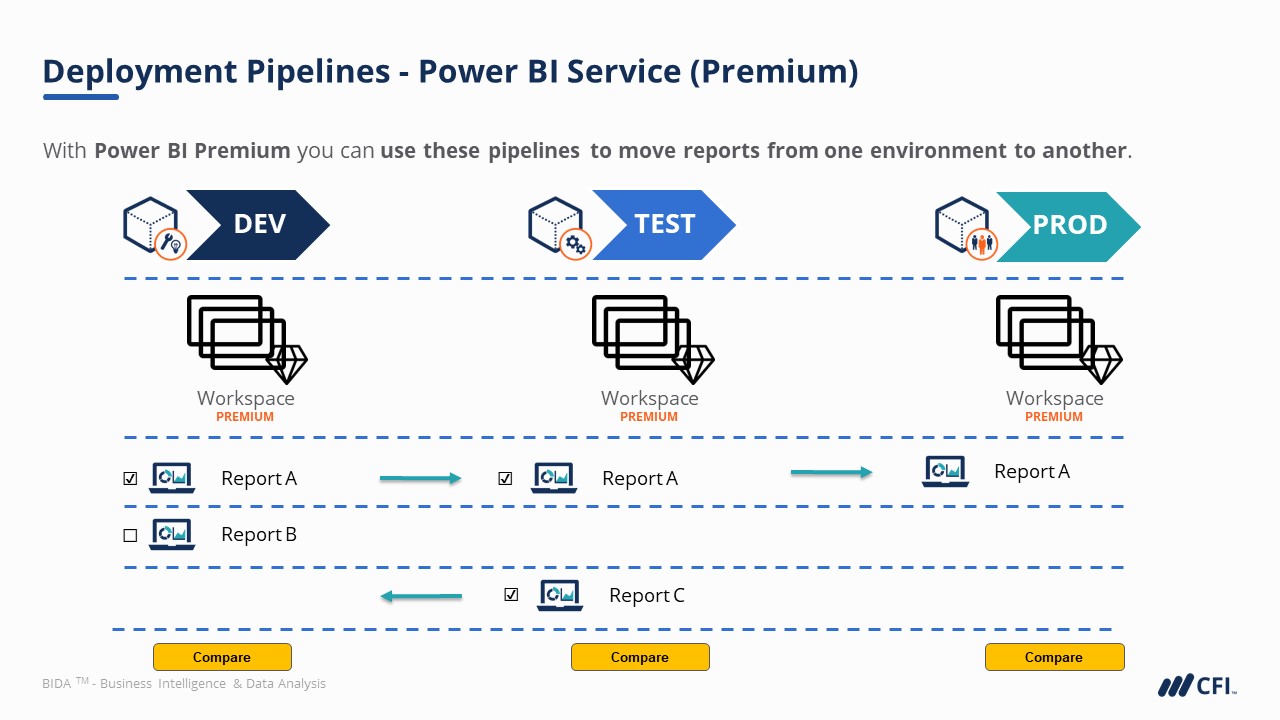

- Apply Power BI service to implement the Application Lifecycle Framework with separate environments for development, testing, and consumption.

- Apply Azure Active Directory Groups to better implement permissions and data security across medium to large organizations.

- Differentiate between centralized vs. distributed BI and the trade-off between flexibility vs. stability in BI governance.

- Deploy reports between environments using either manual or automated solutions.

- Summarize the five essential components of BI governance and administration.

Who Should Take This Course?

This advanced BI course is perfect for professionals who work with data and want to build up their understanding of business intelligence deployment. This course covers core concepts in the field and is a stepping-stone into Business Intelligence roles in management and leadership.

Enterprise Deployment & Governance: Power BI Edition

Level 4

1h 44min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Introduction to BI Deployment & Governance

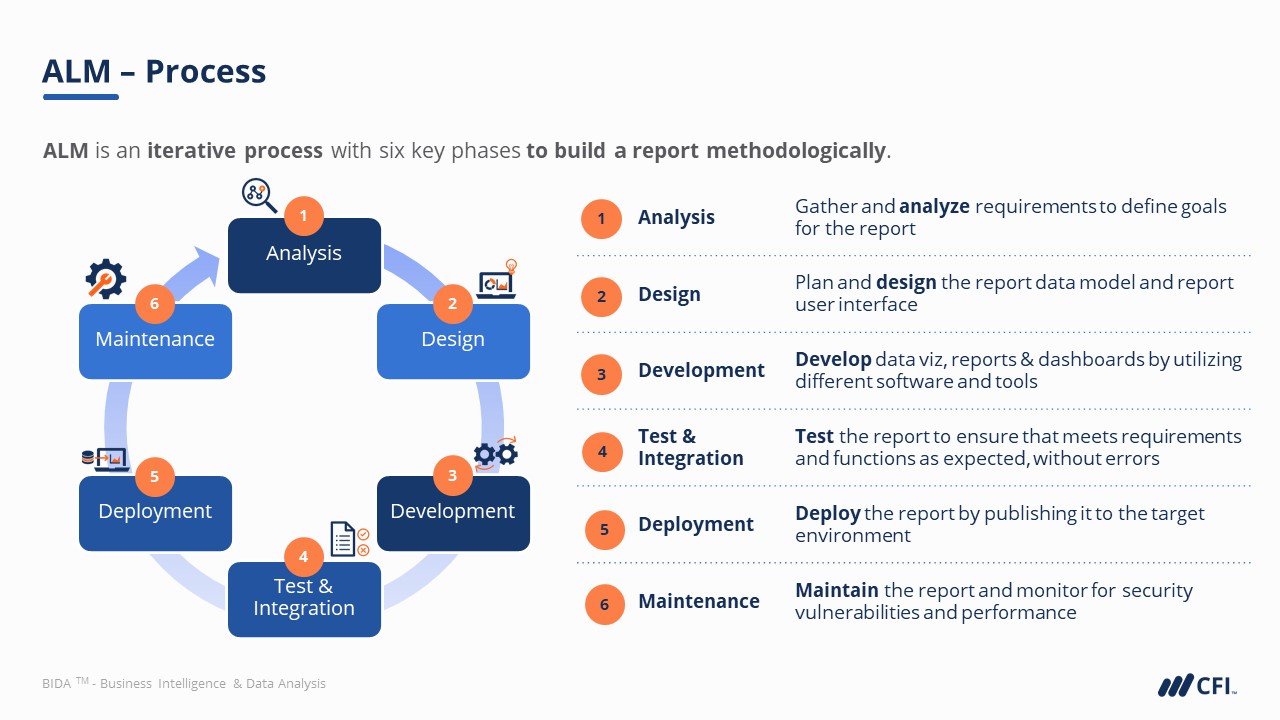

Application Lifecycle Management (ALM) Concepts

Development & Deployment Lifecycle

BI Governance & Administration

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Business Intelligence Analyst Specialization

- Skills learned Data Transformation & Automation, Data Visualization, Coding, Data Modeling

- Career prep Data Analyst, Business Intelligence Specialist, Finance Analyst, Data Scientist