Overview

Advanced Tableau – Data Model Overview

This Advanced Tableau course dives into the methods we have available to connect data in Tableau. You’ll combine data using joins, relationships, and blends to bring related data into visuals. We’ll work through a scenario with evolving business requirements. These requirements will need more and more data added to our model as we progress. Each time you do this, you’ll be introduced to new options for joining, relating, and blending data, common problems, and methods for optimizing your data model for performance.

By the end, you’ll have learned to think more carefully about the structure of your data, the types of connections you should use, and the performance options that are best for your dataset.

Advanced Tableau – Data Model Learning Objectives

Upon completing this course, you will be able to:

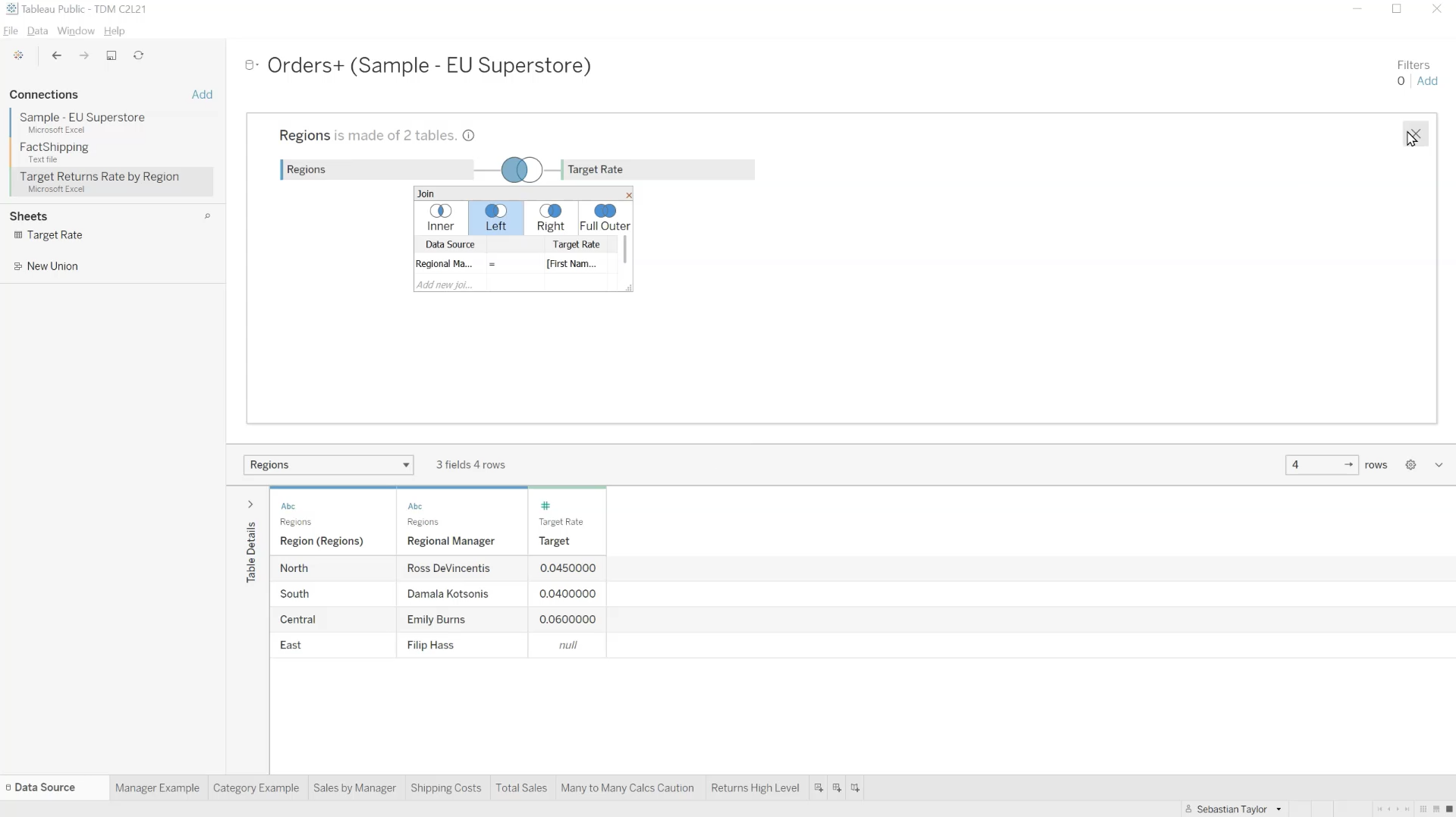

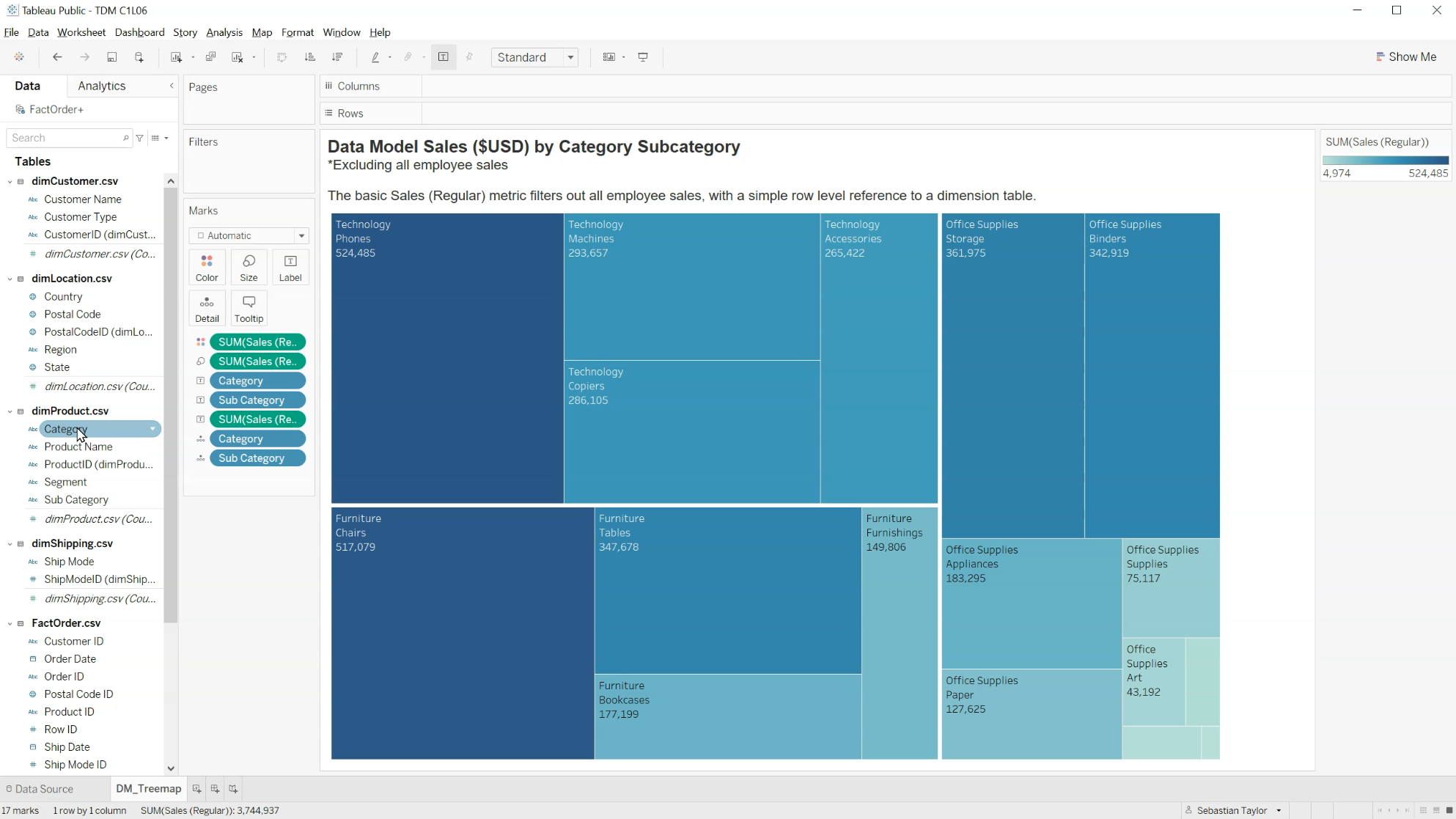

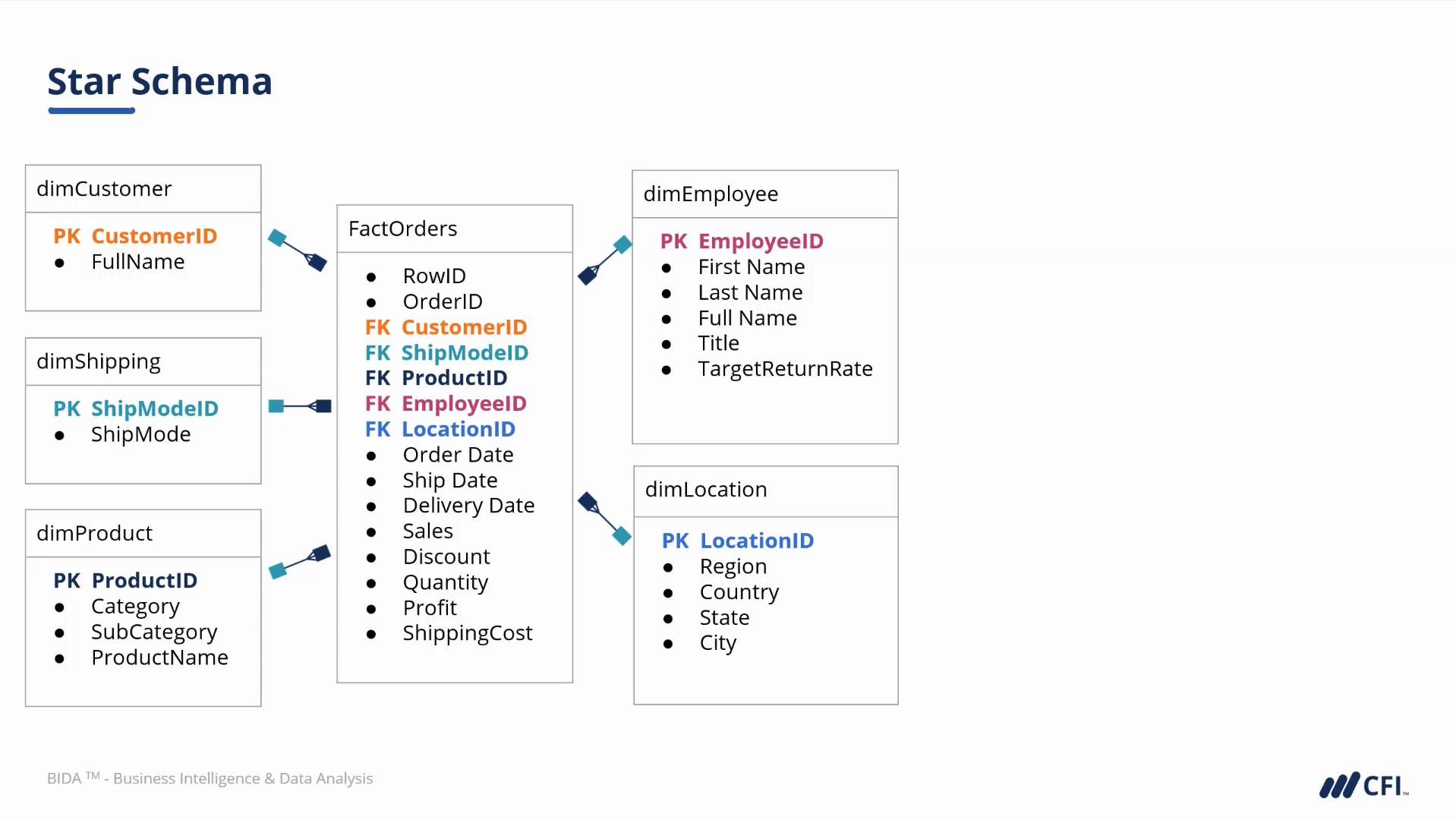

- Build a basic data model using Tableau’s relationship feature

- Optimize data model relationships using performance tuning

- Differentiate between joins, relationships, and blends

- Adapt a data model based on an expanding set of requirements

- Handle common cases like nulls, many-to-many relationships, one-to-one relationships, and filtering

- Understand how ETL tools can make life easier to create an optimal Star Schema

Who Should Take This Course?

This Tableau course is perfect for professionals who have a solid understanding of Tableau and want to solidify their knowledge of data modeling. If you want to know how to make good data modeling decisions in Tableau, this course is for you.

Prerequisite Courses

Recommended courses to complete before taking this course.

Advanced Tableau - Data Model

Level 4

1h 18min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

A Basic Data Model

Course Review

Qualitative Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Business Intelligence Analyst Specialization

- Skills learned Data Transformation & Automation, Data Visualization, Coding, Data Modeling

- Career prep Data Analyst, Business Intelligence Specialist, Finance Analyst, Data Scientist