Overview

AI for Excel Formulas Course Overview

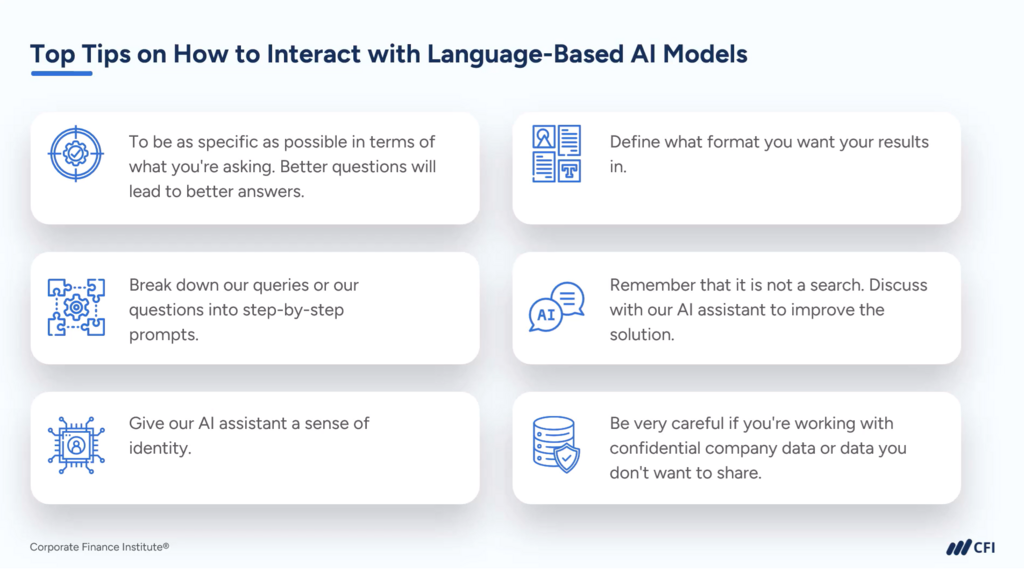

AI tools are changing every industry without exception. The analysts of the future will be able to combine their domain knowledge with technical skills and AI assistants to get their work done faster.

“In

just a few steps we were able to build a Custom Excel Formula AI model that

could consistently give us the best results, and save us time!”

Seb

Taylor – BIDA

AI for Excel Formulas Cours Objectives

Upon completing this course, you will be able to:

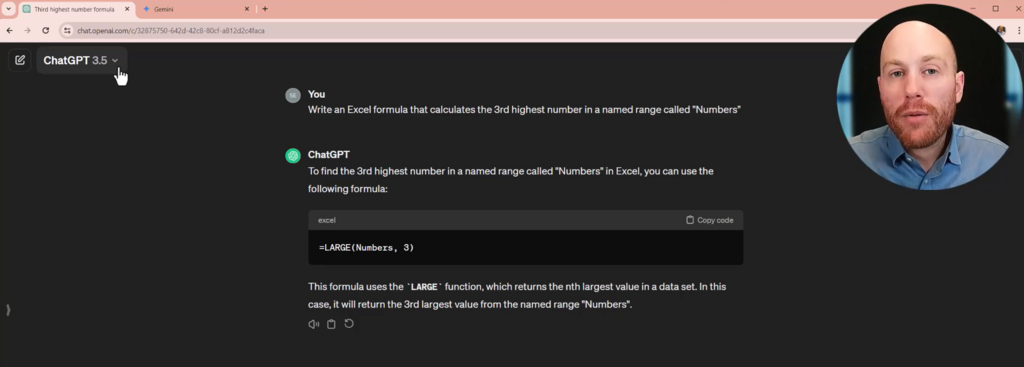

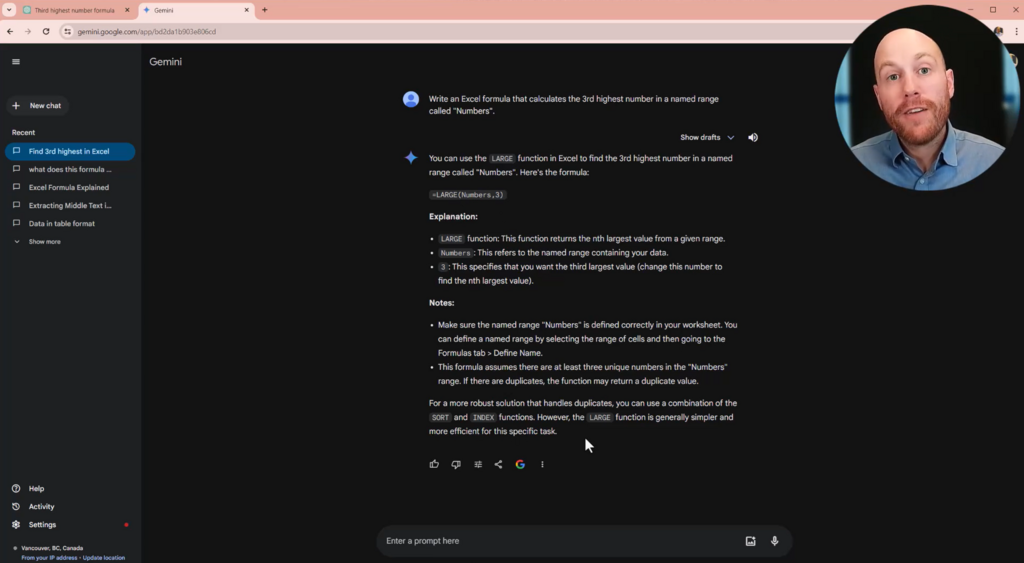

- Use Chat GPT & Gemini to solve basic Excel formula tasks.

- Build an understanding of when using AI is appropriate and when it is not.

- Compare outputs from different AI tools to understand strengths and weaknesses.

- Solve problems from formula simplification to logic explanations and text formulas.

Who Should Take This Course?

Analysts who want to start building AI into their Excel workflow to help them stay at the forefront of technology and become more efficient analysts.AI Tool Requirement: This course requires ChatGPT for hands-on data analysis tasks, including data cleaning, formula generation, and visualization. While the free version offers these features with certain limitations, a paid subscription such as ChatGPT Plus (https://openai.com/chatgpt) is recommended to ensure higher usage limits and full functionality.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

AI for Excel Formulas

Level 2

53min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Getting Started with AI for Data Analysis

Case Study Review

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Business Essentials Certificate

- Skills Learned Microsoft Excel, Word, PowerPoint, Business Communication, Data Visualization, Ethics

- Career Prep Sales Skills, People Management Skills, Relationship Management Skills, Business Analysis Skills

Data Analysis in Excel Specialization

- Skills Learned Data Modelling & Analysis, Data Transformation, Data Visualization

- Career Prep Data Analyst, Business Intelligence Specialist, Data Scientist, Finance Analyst

AI for Finance Specialization

- Skills You’ll Gain AI-Driven Financial Analysis, Excel Automation, and Applied AI Skills

- Great For Financial Analyst, FP&A Analyst, Business Intelligence Analyst, Investment Bankers, Equity Research and more