Overview

Risk Management and Insurance Planning Overview

Risk management and insurance play crucial roles in creating a comprehensive financial plan. While we all hope not to face major tragedies – the death of a spouse, an injury that prevents working, or a major health crisis – planning for them helps best protect the interests of the client, their family, and any business interests they may have.

Risk Management and Insurance Planning Learning Objectives

Upon completing this course, you will be able to:

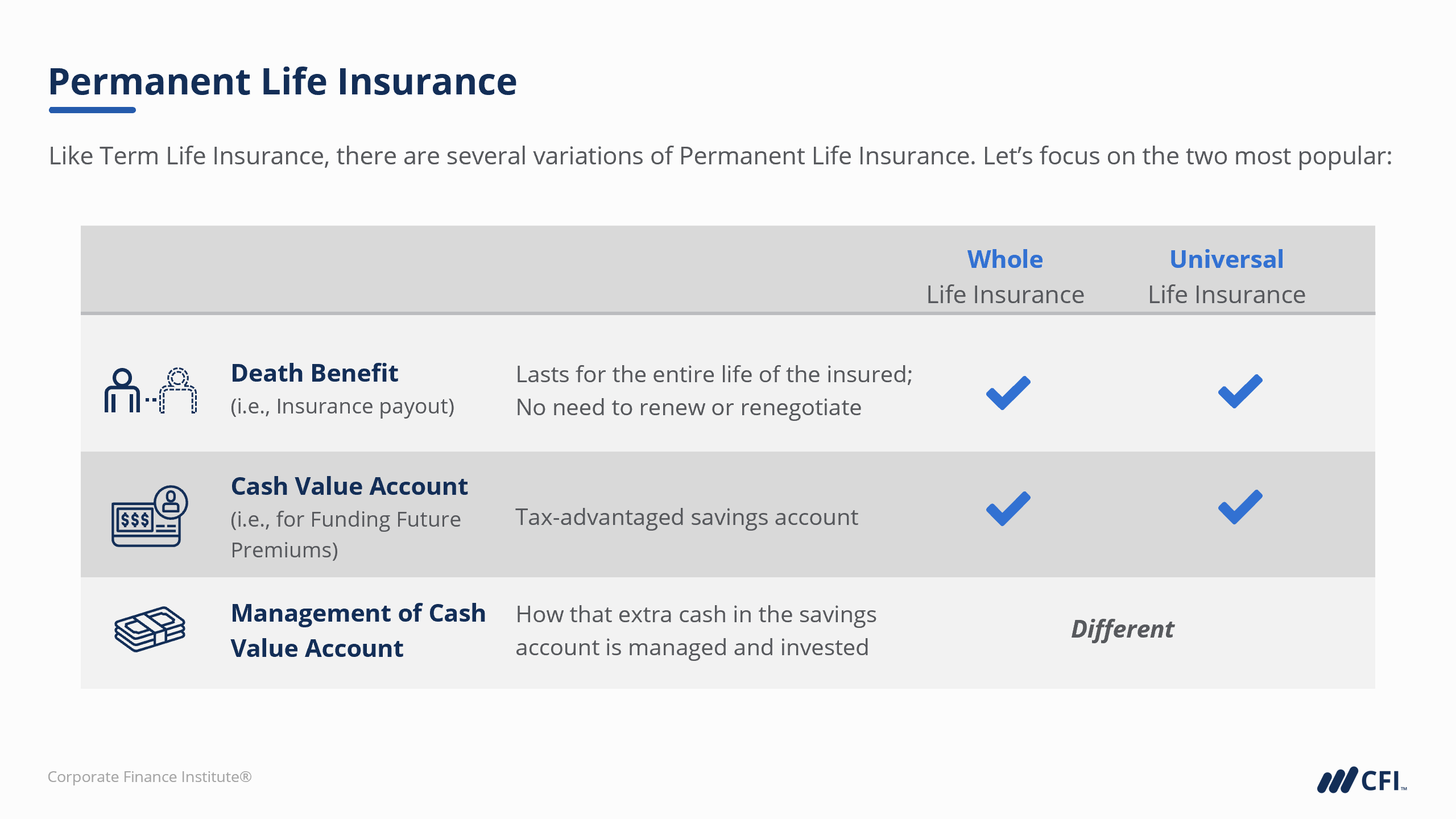

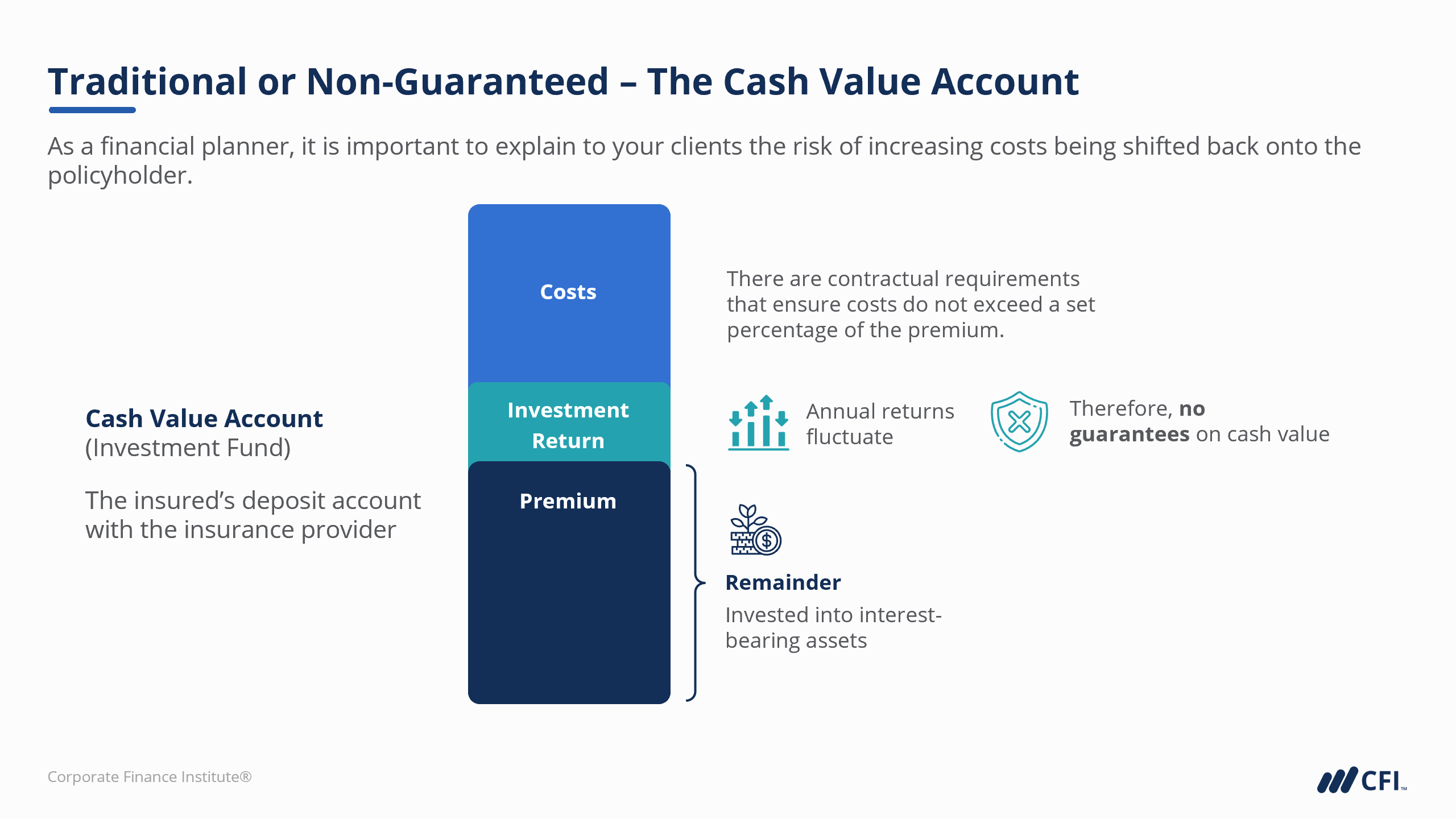

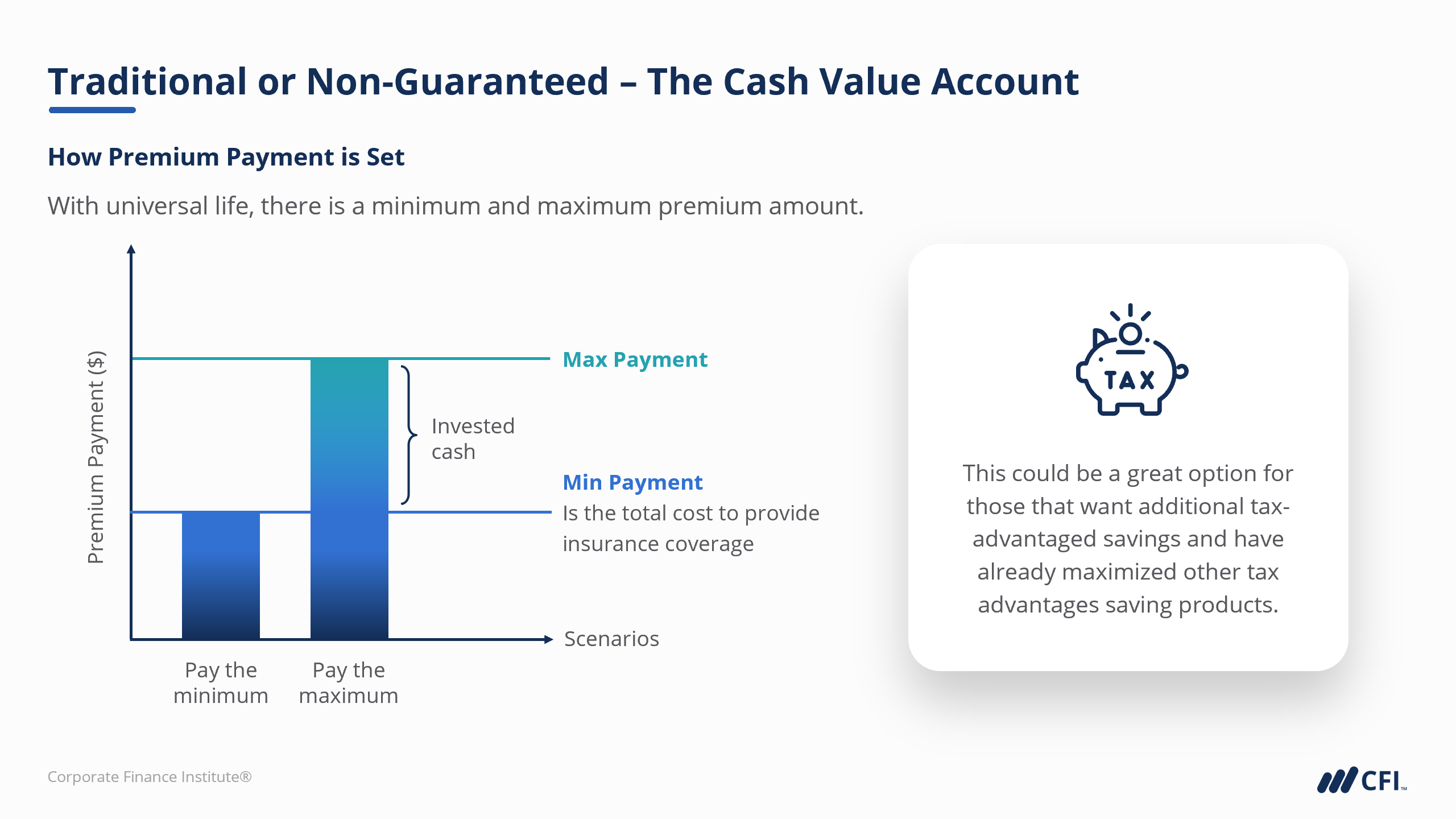

- Develop a comprehensive risk management strategy using insurance products in three key categories: life, disability, and health.

- Conduct a needs-based analysis and create a recommendation of insurance products based on a client’s goals.

- Understand and be able to speak to the benefits and drawbacks of the main types of insurance products: life, disability, and health.

Who Should Take This Course?

This course is essential for anyone looking to pursue a role as a financial planner.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

Risk Management and Insurance Planning

Level 2

1h 24min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction to Risk Management and Insurance Planning

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager