Overview

Understanding Ethereum Course Overview

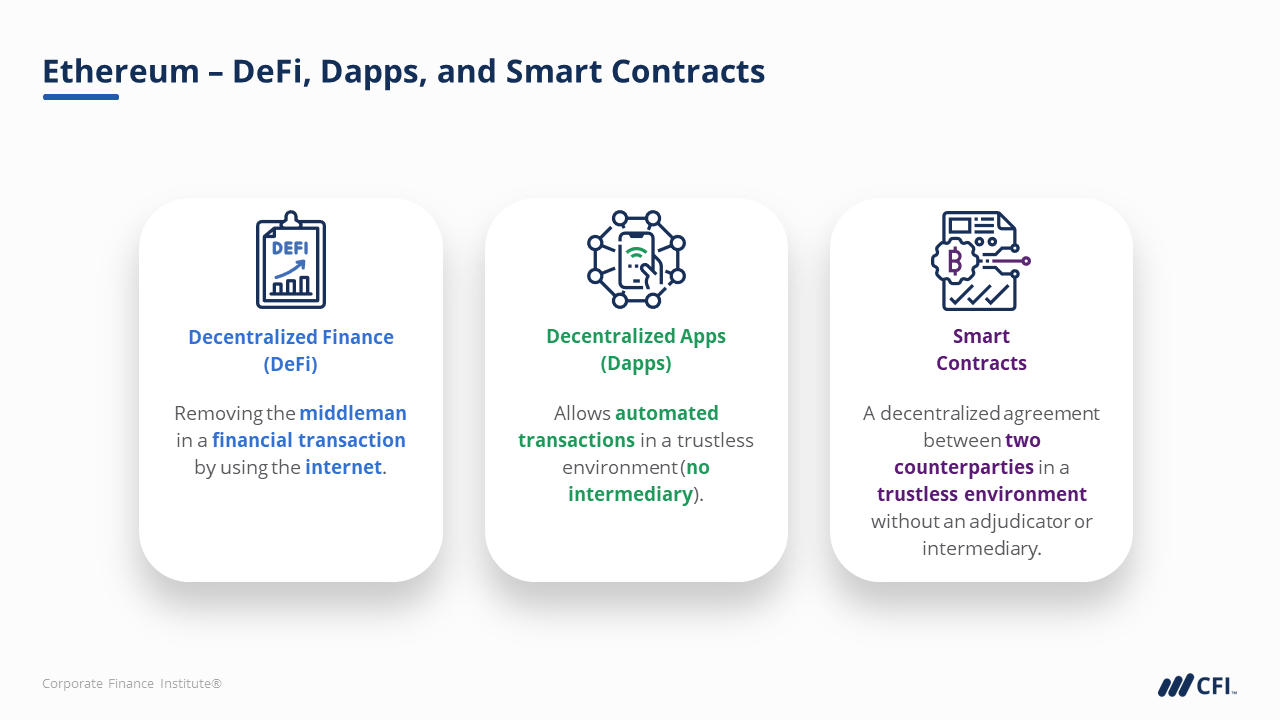

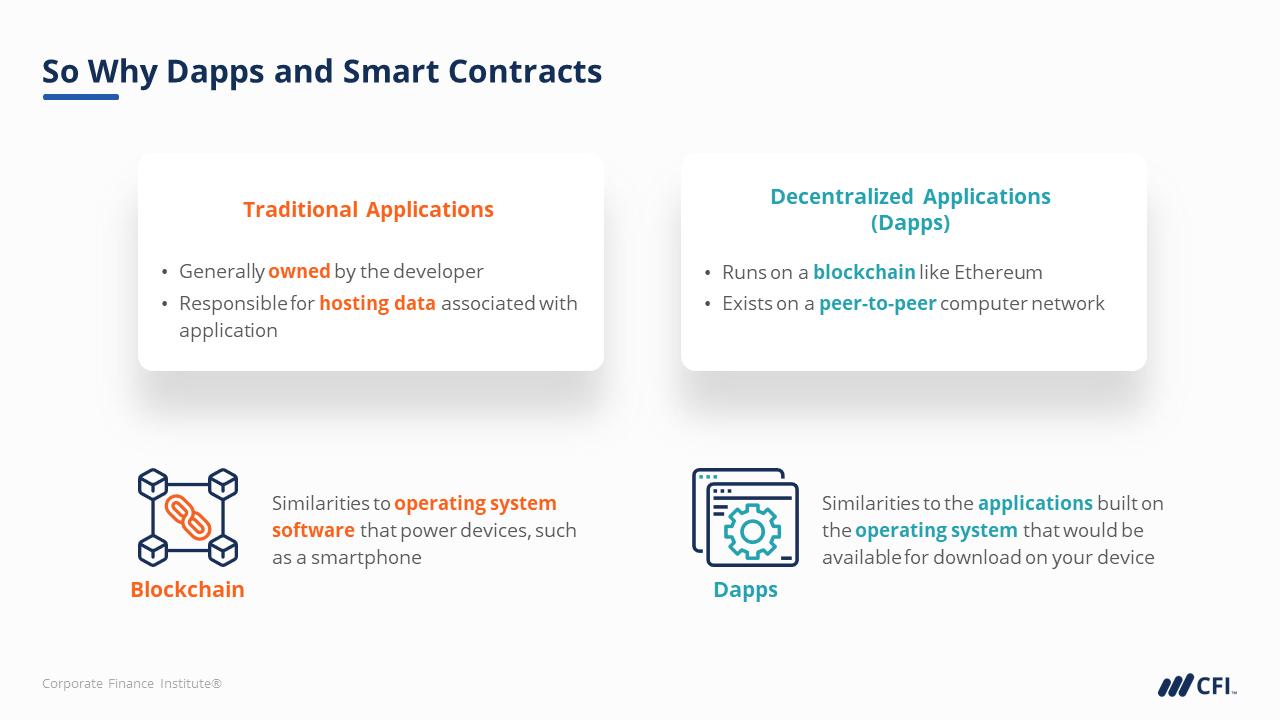

In this course, we will examine the origins and purpose of Ethereum. We will also compare how its purpose is different from Bitcoin as digital currency because Ethereum allows the use of Smart Contracts and Decentralized Applications (Dapps). We will also teach you how the supply and demand fundamentals of Ethereum is unique. After taking this course, you will have a greater appreciation for the Ethereum network.

Lesson Objectives

- Understand what is Ethereum and the difference between Ether and Ethereum

- Differentiate between proof of work and proof of stake.

- Learn about the purpose and background of Ethereum.

- Understand what Smart Contracts and Dapps are.

- Be able to explain how the concept of Gas works in Ethereum.

Who Should Take This Course?

Understanding Ethereum is aimed at learners who want to learn more about how Ethereum fits into the exciting new field of Decentralized Finance (DeFi).

Prerequisite Courses

Recommended courses to complete before taking this course.

Cryptocurrency Intermediates: Understanding Ethereum

Level 2

1h 1min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

The Origins of Ethereum

Dapps and Smart Contracts

Case Study: The DAO Heist

Supply and Demand Factors of Ethereum

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

FinTech Industry Professional (FTIP®)

- Skills Learned Financial Technology Fundamentals, Data Science and Machine Learning, Cryptocurrencies and Blockchain

- Career Prep Data Science and Machine Learning, Data Analyst, Business Analyst, Software Developer

Cryptocurrencies and Digital Assets Specialist

- Skills Learned Purpose of Cryptocurrencies, Technical understanding of Digital Assets, Cryptocurrency Analysis

- Career Prep Crypto Fundraiser, DeFi Analyst, Blockchain Product Manager, Tokenomics Specialist, Crypto Fund Investment Manager