Overview

FP&A Professional Excel Forecast Model Design Overview

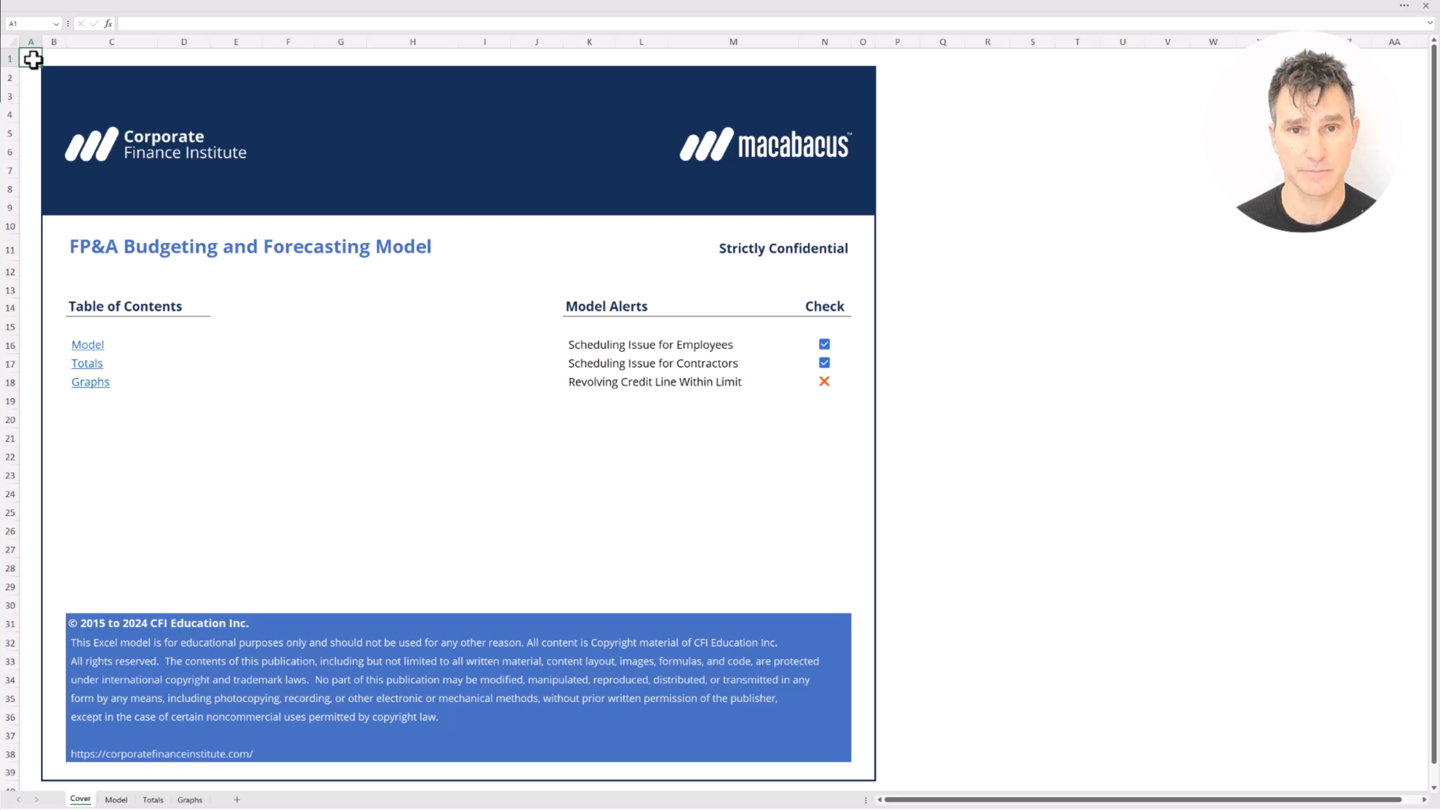

CFI’s “FP&A Professional Excel Forecast Model Design” course will help learn best-in-class approaches to FP&A model design. This course will also teach you about the importance of cover pages as well as using hyperlinks to create a table of contents for the model.

FP&A Professional Excel Forecast Model Design Learning Objectives

Upon completing this course, you will be able to:- Apply best-in-class practices for FP&A model design used in the financial modeling community.

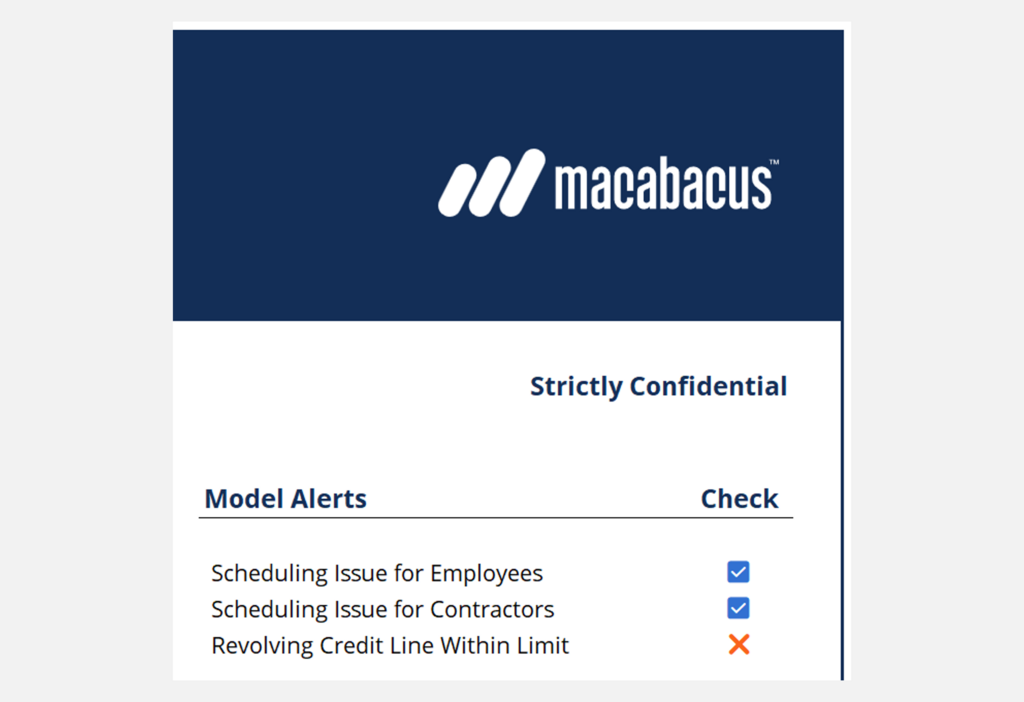

- Understand the importance of the cover page in forming a first impression with your audience and instilling confidence in the decision-makers.

- Explore the use of hyperlinks to create a helpful table of contents in the FP&A model.

Who Should Take This Course?

This course is perfect for FP&A professionals at a beginner, intermediate, or even advanced level. This course is a part of a series of FP&A courses.Prerequisite Courses

Recommended courses to complete before taking this course.

FP&A Professional Excel Forecast Model Design

Level 3

39min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Analysis (FP&A) Specialization

- Skills Learned Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, and more.

- Career Prep Financial Analyst, Project Evaluator, FP&A Manager and more