Overview

Communicating and Leading with Influence Overview

As leaders, being able to make conscious choices about how we react and respond to situations and people is an important skill.

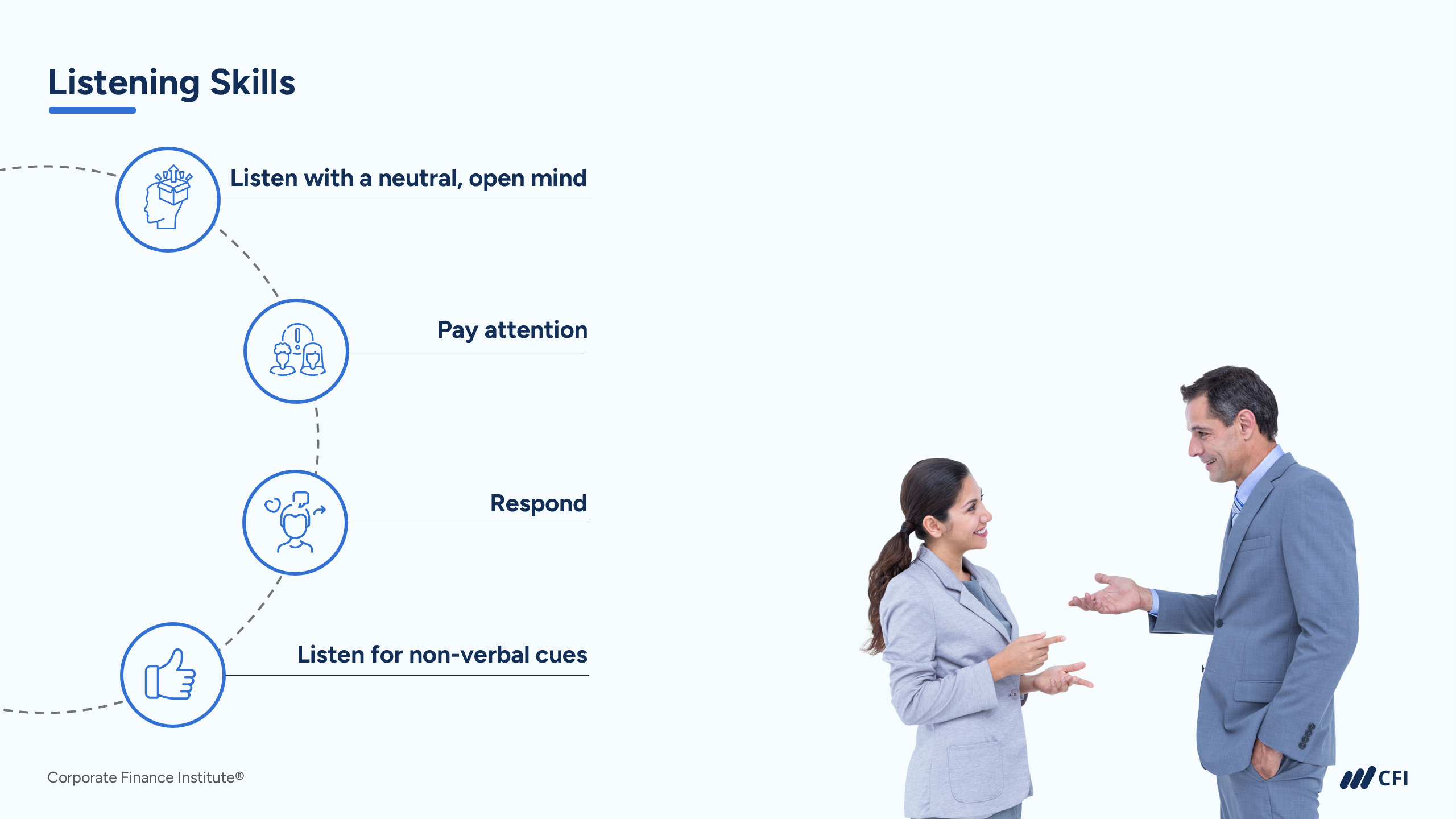

The ability to communicate as a leader starts with listening, and recognizing when you need to reframe and amend your messaging to consider the needs and concerns of your audience, having an open mind, and suspending judgments and assumptions.

Having this knowledge as a leader helps you to be more self-aware, confident in your communication and ability to influence. Leaders with strong communication skills have a greater ability to engage and connect with their teams, peers, and other stakeholders. They can effectively communicate their vision and can create meaningful relationships.

Knowing the most effective way to communicate to influence others, be assertive, and manage yourself and your impact on others can have a positive impact on business outcomes.

Communicating and Leading with Influence Objectives

Upon completing this course, you will be able to:- Understand listening skills

- Describe different communication styles

- Explain how to communicate with impact

- Describe how to build rapport

- Identify how to communicate assertively

Who Should Take This Course?

This Communicating and Leading with Influence course is perfect for investment professionals, management consultants, and financial analysts, as well as investor relations teams and senior managers at both private and public companies.

Prerequisite Skills

Recommended skills to have before taking this course.

- Communication

- Critical thinking

Communicating & Leading with Influence

Level 1

1h 28min

100% online and self-paced

Field of Study: Specialized Knowledge

Start Learning