Overview

Carbon Market Fundamentals Overview

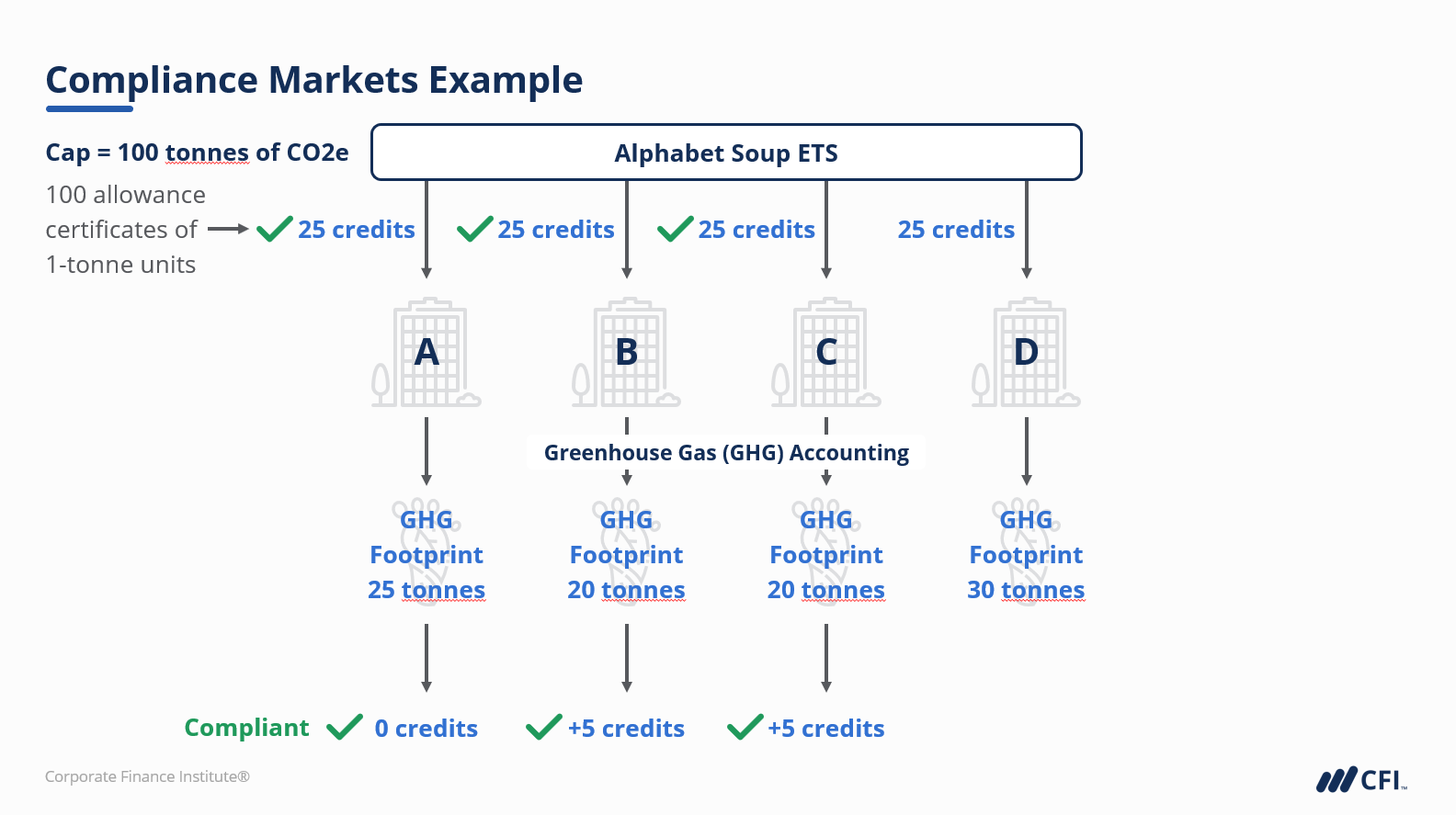

As corporate stakeholders demand that organizations reduce emissions to limit contributions to climate change, carbon markets have become more relevant than ever. It’s important to understand these markets and how to responsibly engage with them to reduce the risks of an ineffective carbon management plan. We will start the course with the basics of carbon markets: purpose, terminology, and key events and drivers that have converged to create today’s market dynamics. Next, we will discuss compliance and voluntary markets and how these differ, along with examples.

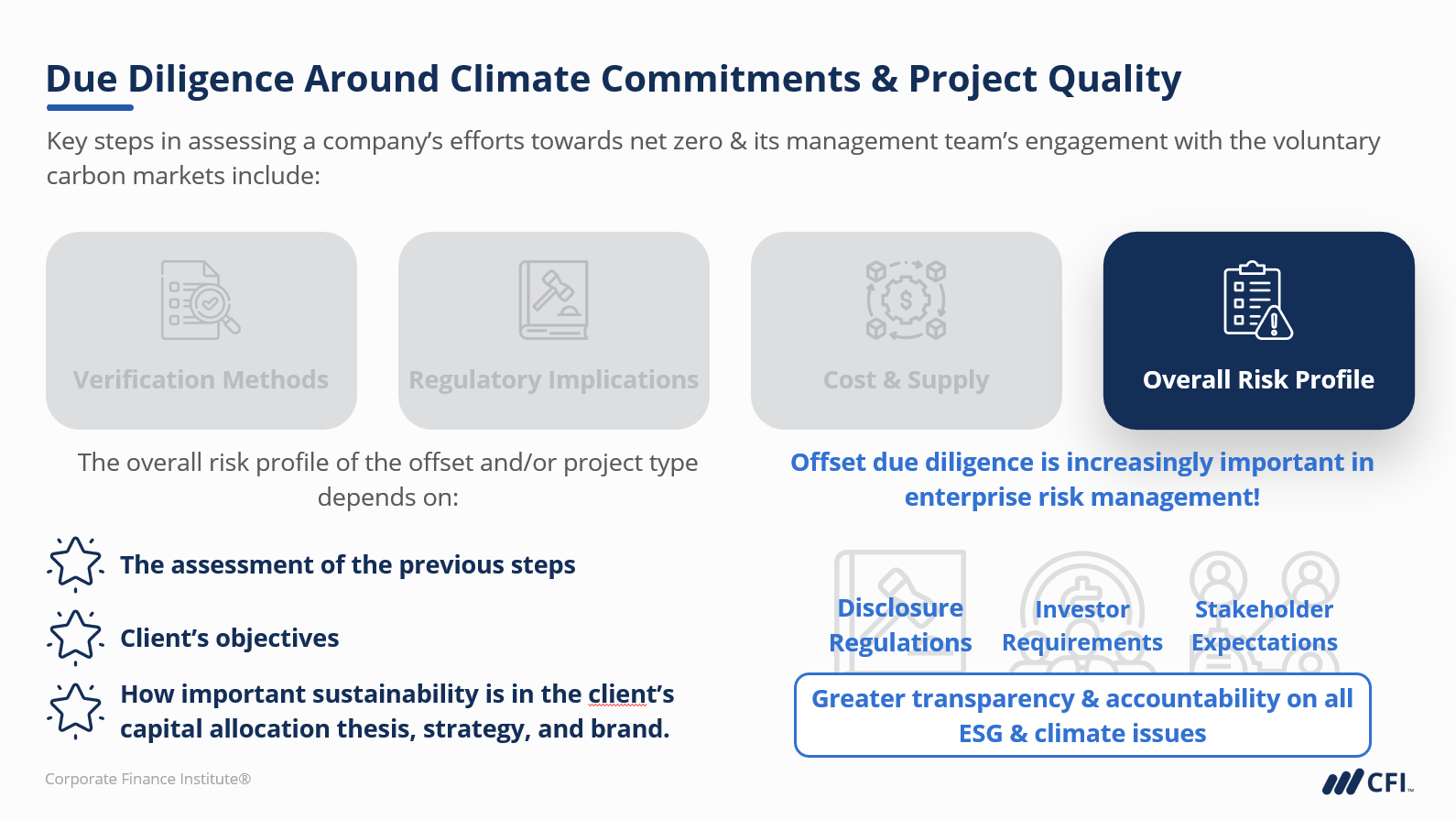

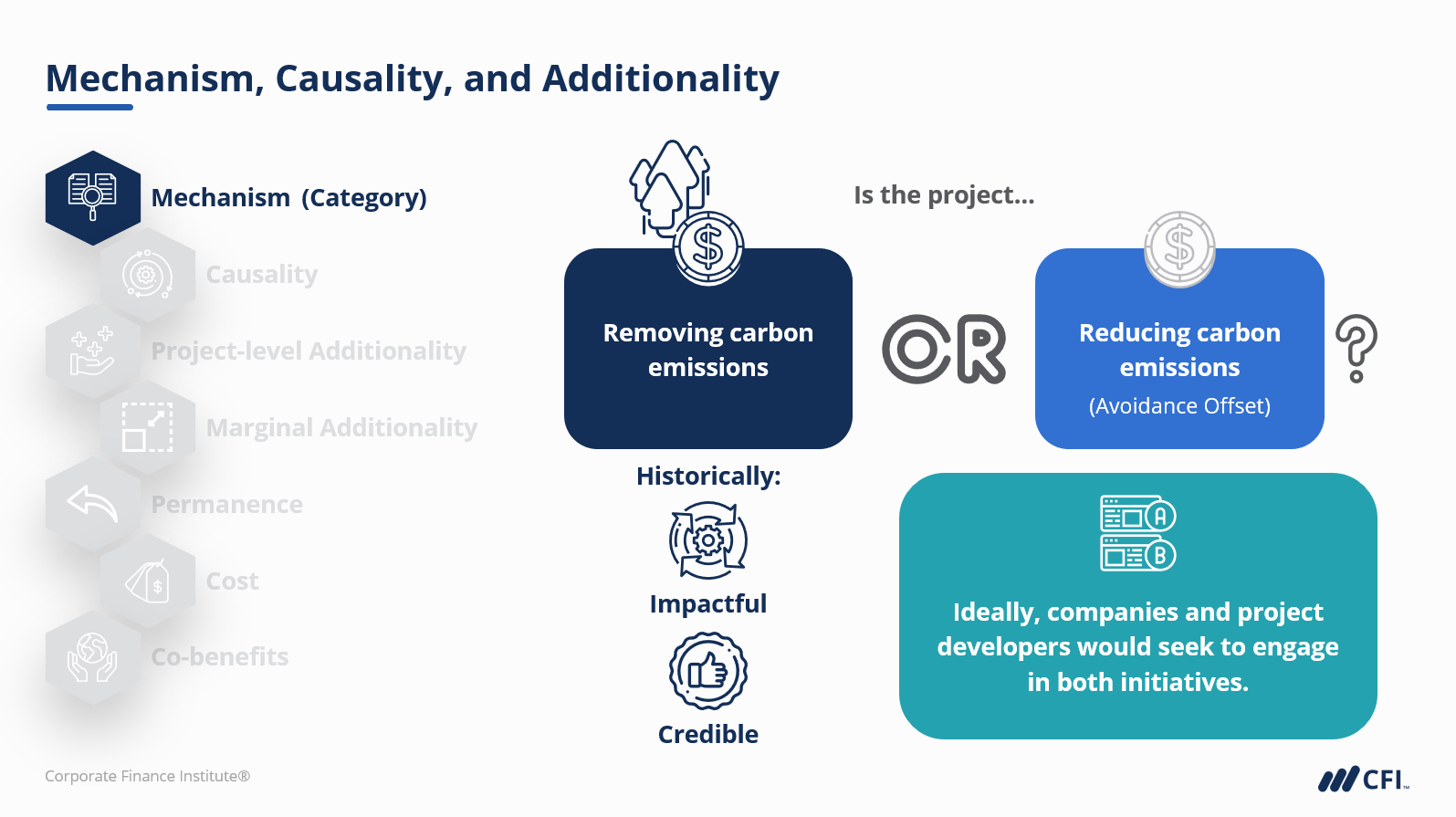

We will assess different types of projects, and their characteristics (in terms of the number of offsets generated vs. the value of those offsets), before discussing the seven key metrics used to assess projects. We will end the course by examining how analysts and management teams can engage with carbon markets and conduct due diligence around project quality.

Carbon Market Fundamentals Learning Objectives

- Define the purpose of carbon markets and carbon credits.

- Explain key concepts & terminology.

- Determine carbon credit quality, as well as associated risks and benefits.

- Provide insight on the role of carbon offsets in achieving corporate climate commitments.

- Compare compliance markets and voluntary markets.

- Assess the value of different project types and their associated implications.

Who Should Take This Course?

This course is designed for management teams, business analysts, management consultants, and financial analysts of all stripes at both private and public companies.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

Carbon Market Fundamentals

Level 3

1h 13min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Current State & Market Trends

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Environmental Social, and Governance Specialization

- Skills Learned ESG Analysis, ESG Integration, ESG Investing, ESG & Business Intelligence

- Career Prep Asset Management, Management Consulting, Business Analyst, Credit Analyst, Corporate Development, Senior Leadership