Overview

Developing an ESG Governance Structure Overview

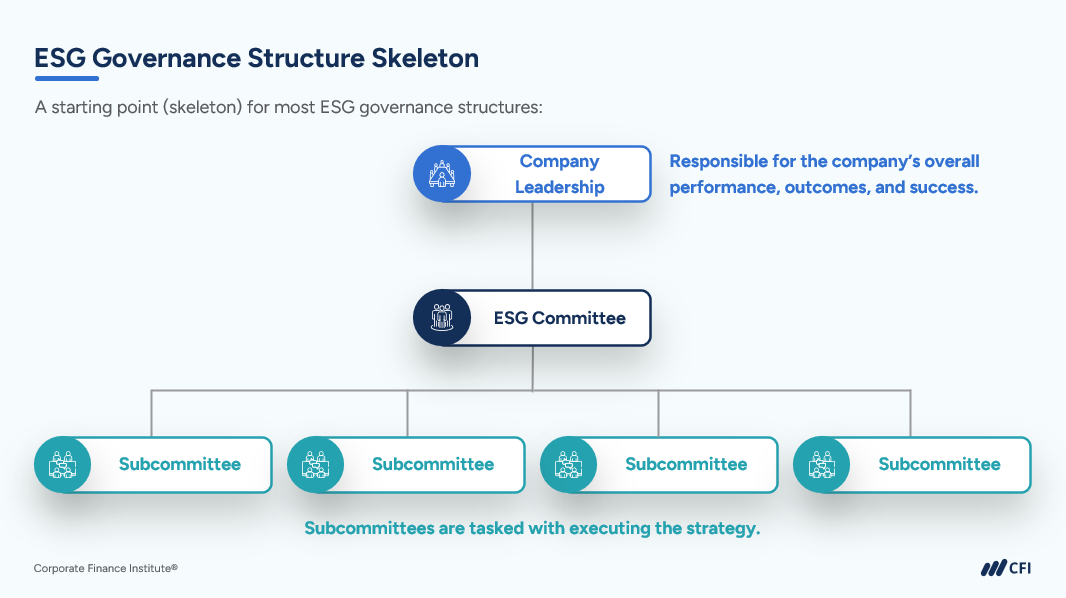

The governance, or management structure, for overseeing ESG within a company is crucial for the effective implementation of an ESG Strategy and achieving associated goals.

This practice lab will unpack the strategic and operational value of developing an internal ESG governance structure as well as provide tactics you can deploy to strengthen the effectiveness of that structure. We’ll dive deep into various models of ESG governance and best practices for managing them within an organization.

Developing an ESG Governance Structure Objectives

- Describe the key steps in standing up an internal governance structure for ESG oversight

- Compare and contrast different approaches to ESG governance

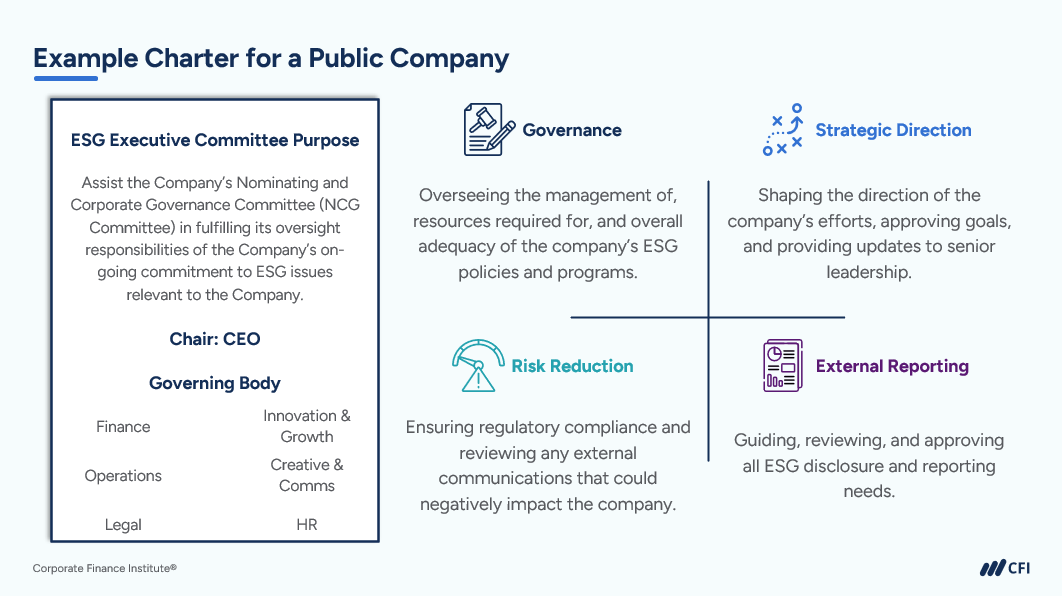

- Explain the core content of an ESG governance charter

- Provide insight on what roles and functions should be involved in ESG Governance

- Demonstrate how ESG governance is critical to achieving ESG commitments

Who Should Take This Practice Lab?

This practice lab is recommended to any ESG analyst, practitioner, or aspiring director (or enthusiast), as well as anyone interested in or responsible for contributing to ESG performance within an organization. Compliance, risk management, finance, and operations executives, as well as management consultants, will find this content helpful as well.

Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

- Critical thinking

Developing an ESG Governance Structure

Level 2

17min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Background

Case Study

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Environmental Social, and Governance Specialization

- Skills Learned ESG Analysis, ESG Integration, ESG Investing, ESG & Business Intelligence

- Career Prep Asset Management, Management Consulting, Business Analyst, Credit Analyst, Corporate Development, Senior Leadership