Overview

Audit a Financial Model With Macabacus Overview

This course will show you how to use Macabacus to efficiently audit a financial model.

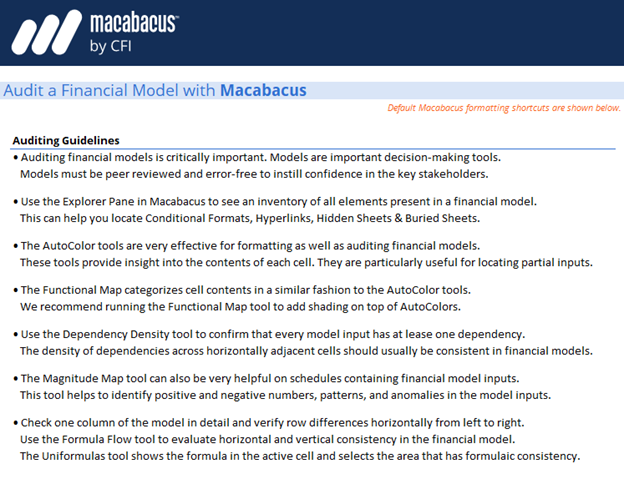

- Utilize powerful visualization tools from Macabacus to highlight potential areas of concern in financial models.

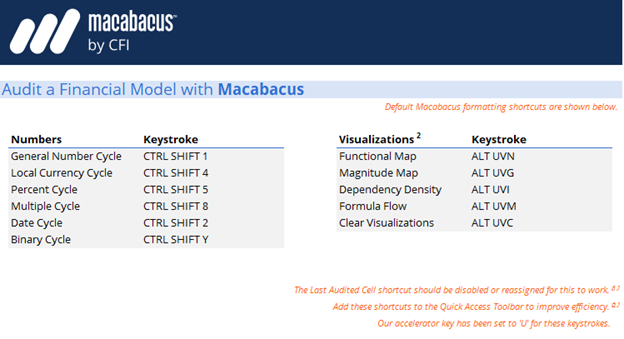

- Learn common keyboard shortcuts to expedite auditing operations.

- Discuss the approach used by CFI for our own financial models.

Auditing financial models is critical to ensure the models are error-free. This will instill confidence in stakeholders to use the model for important decision-making. This course helps learners understand the approach and Macabacus tools that we use for model auditing at CFI. They will also learn to use keyboard shortcuts to activate model auditing tools.

Audit a Financial Model With Macabacus Learning Objectives

- Discuss why model auditing is so important for financial models.

- Explain common audit review approaches to reveal areas of concern.

- Apply the most common keyboard shortcuts used for auditing tools.

Who should take this course?

This course is suited for those using Macabacus individually or as a part of a corporation. It is also suitable for those that are new to the software. This course is designed for individuals interested in performing faster and more effective financial model audits.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

Audit a Financial Model With Macabacus

Level 3

1h 56min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Audit a Financial Model with Macabacus

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Macabacus Specialist

- Skills learned Configuration of Key Macabacus Settings, Format & Present a Financial Model, Financial Model Auditing, Modular Model Building, Reliable Linking to PowerPoint and Word

- Career prep Investment Banking, Private Equity, Valuation, Financial Planning & Analysis, Equity Research