Overview

Build a Presentation with Macabacus Overview

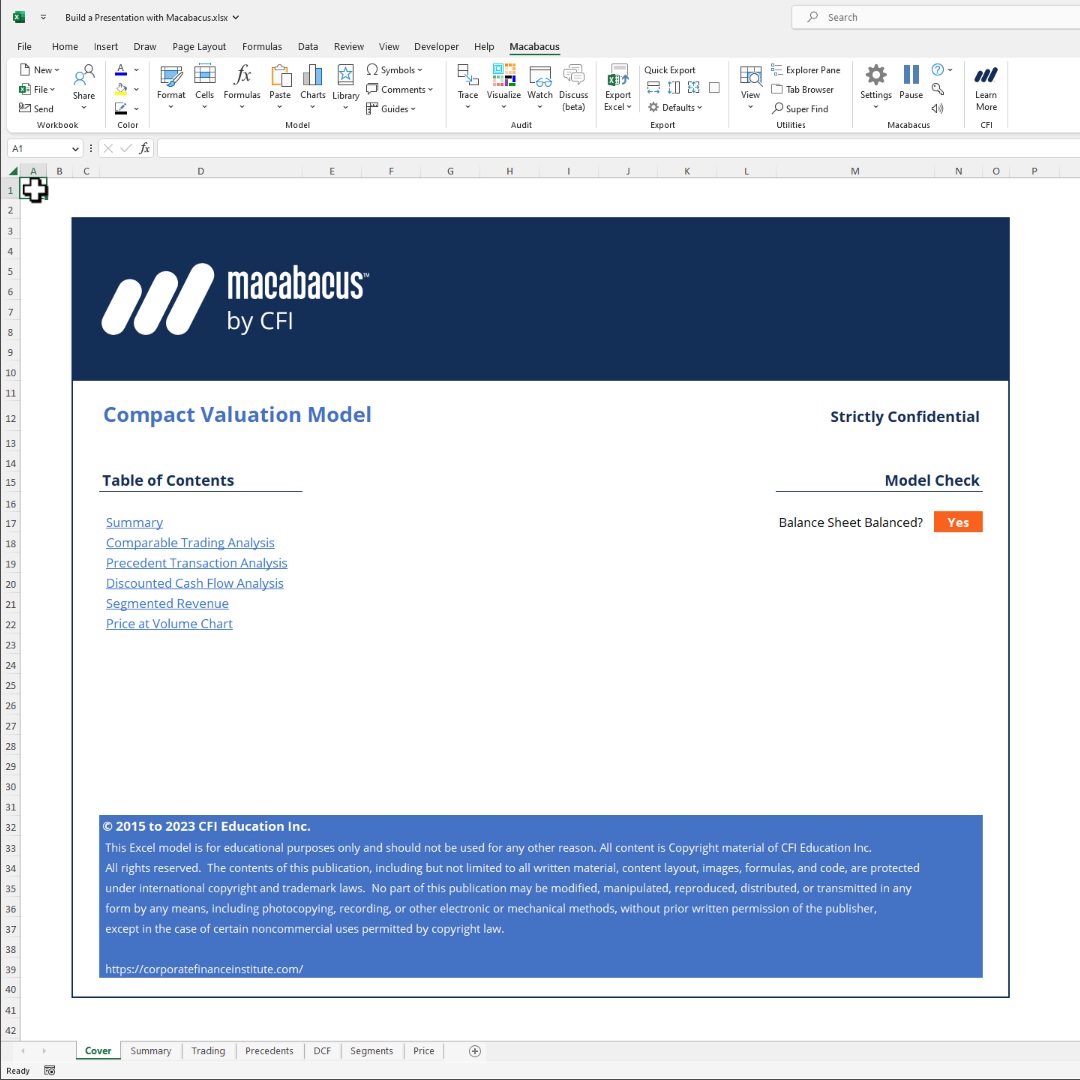

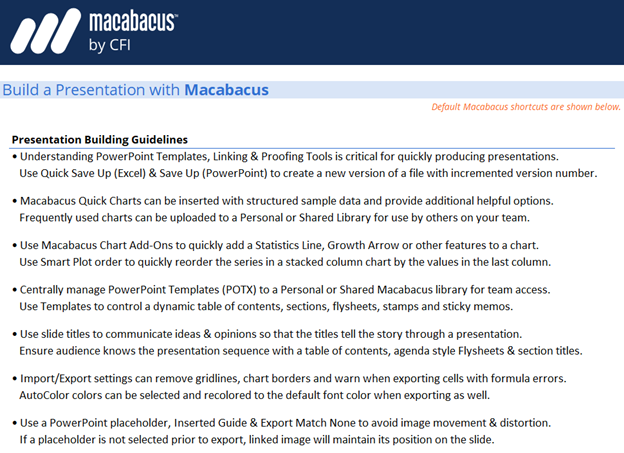

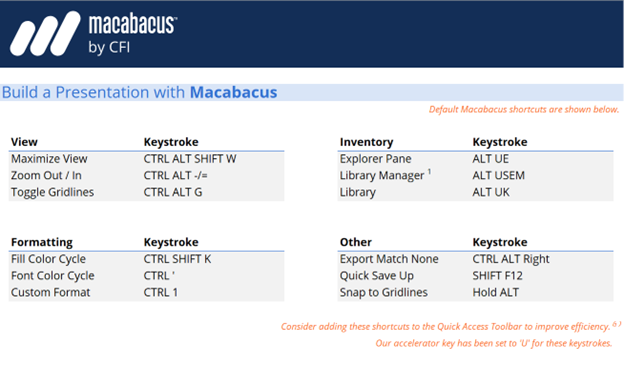

This course will show you how to use Macabacus to quickly create brand-compliant presentations in PowerPoint that are dynamically linked to Excel files.- Learn how to install and utilize Macabacus PowerPoint templates to create an automated table of contents, flysheets, section titles, and stamps.

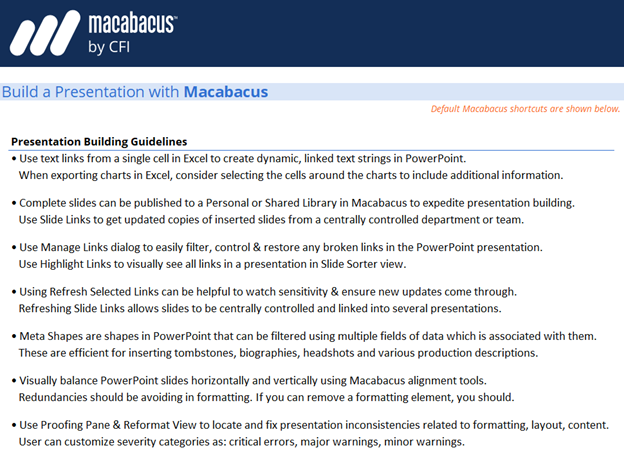

- Discuss the various ways in which content in Excel can be linked into PowerPoint presentations in a reliable fashion using Macabacus.

- Use the proofing pane and the reformat tool to categorize, locate, and fix potential issues in the presentation quickly.

Finance professionals work in very dynamic environments with large amounts of quantitative data that can change quickly. It is important for them to know how to quickly assemble a brand-compliant presentation that meets very high standards. Dynamic linking from the PowerPoint files back to source files in Excel is critical in order to be able to update the figures quickly and reliably in slide decks. Sourcing content from Macabacus Libraries can also be helpful as it can be maintained by other groups allowing the finance professionals to focus on tailoring the content for their specific audience.

Build a Presentation with Macabacus Learning Objectives

- Learn how to install and use the main features of Macabacus PowerPoint templates.

- Understand various linking options that Macabacus offers between Excel and PowerPoint as well as the linking of slides from a library into PowerPoint.

- Know how to use the proofing tools in Macabacus to categorize, evaluate, and fix potential issues and inconsistencies in presentations.

Who Should Take This Course?

This course is suited for those using Macabacus individually or as a part of a corporation. It is also suitable for those that are new to the software. This course is designed for individuals interested in learning the most efficient and brand-compliant methods for preparing presentations in PowerPoint with dynamic links to underlying source files in Excel.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Power Point

- Valuation

Build a Presentation with Macabacus

Level 2

1h 52min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Building a Presentation

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Macabacus Specialist

- Skills learned Configuration of Key Macabacus Settings, Format & Present a Financial Model, Financial Model Auditing, Modular Model Building, Reliable Linking to PowerPoint and Word

- Career prep Investment Banking, Private Equity, Valuation, Financial Planning & Analysis, Equity Research