Overview

How to Read a Commercial Real Estate Appraisal Course Overview

This course on commercial real estate appraisals examines a key piece of the commercial real estate value chain from the perspective of a credit analyst. You’ll explore why appraisals are an integral part of the real estate due diligence process and key sections of a commercial real estate appraisal document. This course will explore the nuances of completing a commercial real estate appraisal and give you a practical demonstration of how to complete a real estate appraisal checklist from the perspective of a credit analyst.

How to Read a Commercial Real Estate Appraisal Course Learning Objectives

Upon completing this course, you will be able to:- Understand why appraisals are such an important part of the real estate due diligence process

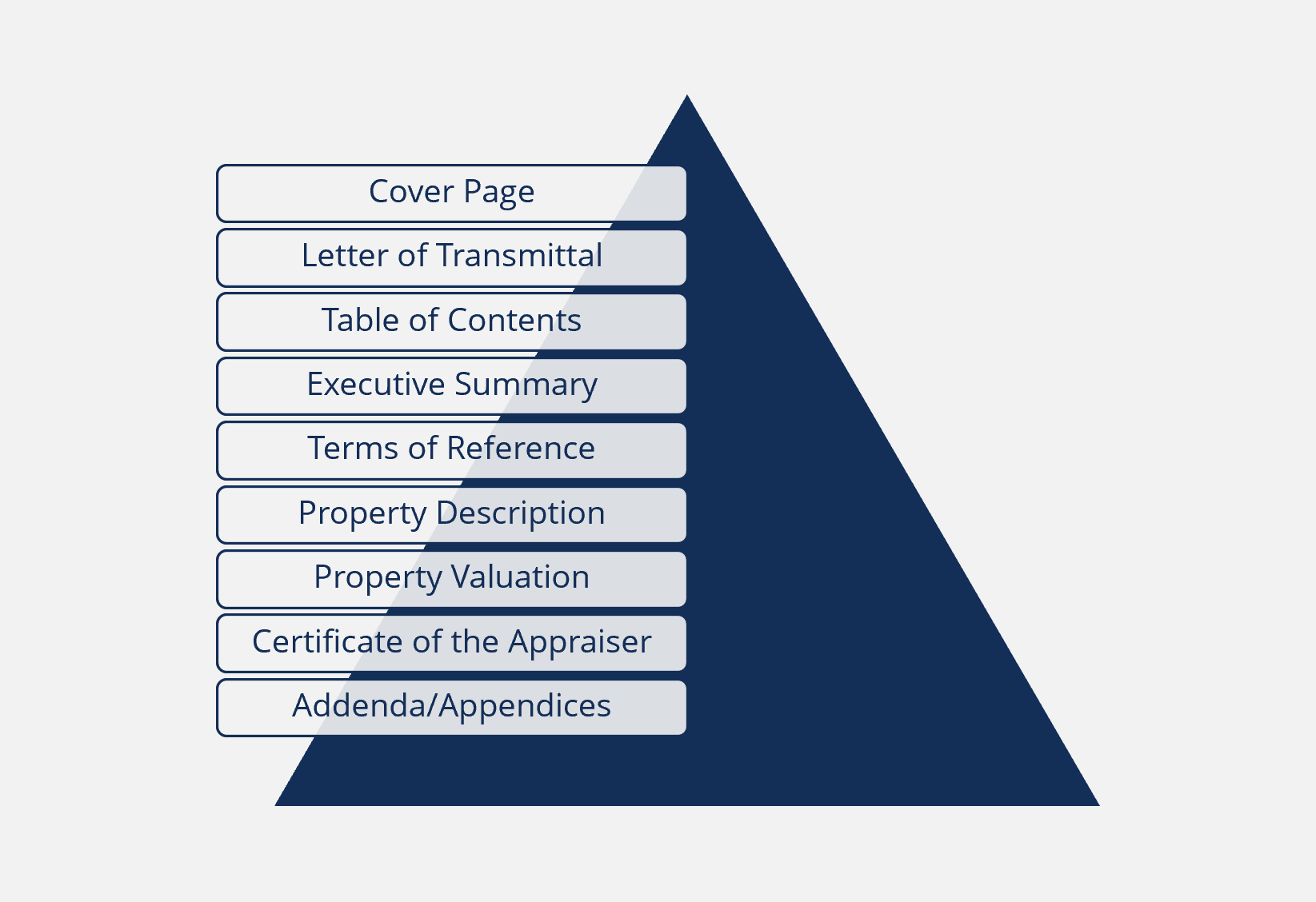

- Identify key sections of the report and where to find the most important information

- Complete a real estate appraisal checklist

- Analyze multiple valuation approaches

- Understand how the appraiser uses comparable properties

- Identify what makes a good comparable property

Who Should Take This Course?

This How to Read a Commercial Real Estate Appraisal course is perfect for any aspiring credit analyst that would like to make a career for themselves in the real estate lending sector. This course explores concepts useful for beginner and intermediate-level banking and real estate professionals or business and finance students seeking to better understand a key part of due diligence in making commercial real estate financing decisions.

The exercises and tools explored in this course will also be useful for any financial analyst that wishes to work in credit analysis, business banking, commercial banking and lending, and other areas of credit evaluation as well as relationship management and risk management.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Excel

How to Read a Commercial Real Estate Appraisal

Level 3

1h 11min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Transmittal, Summary, and Terms of Reference

Property Valuation

Addenda and Conclusions

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers