Overview

Introduction to LBOs Overview

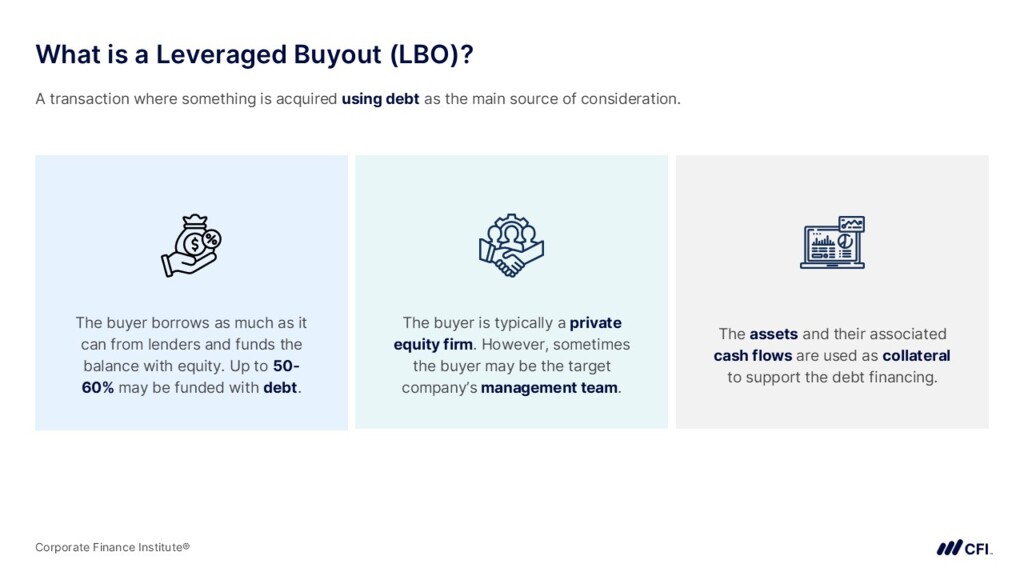

This course reviews what a leveraged buyout (LBO) is and the advantages of using a considerable amount of debt in a transaction. We will review how to build a sources & uses schedule to understand the amounts of capital used in the transaction.

A forecast of the company’s income statement and discretionary cash flow will be constructed. We will also build debt and equity schedules to assess the return to equity investors.

Finally, we will use various Excel tools to sensitize the outputs from the LBO model. Model alerts will also be constructed using custom and conditional formatting.

Introduction to LBOs Learning Objectives

- Define what a leveraged buyout (LBO) is and why considerable leverage is used in these transactions.

- Identify the key inputs for an LBO transaction and build a sources & uses schedule.

- Create a forecast of EBITDA & discretionary cash flow to value an LBO transaction.

- Build debt & equity schedules to complete the analysis of an LBO transaction.

- Use Excel tools to sensitize & present the outputs from an LBO model.

- Create LBO model alerts using custom & conditional formatting in Excel.

Who should take this course?

This course is ideal for those pursuing a career in investment banking or private equity. The course helps learners understand the basic concepts behind an LBO transaction and how to create a simple model of an LBO.

Recommended prerequisites

Excel, Financial Modeling, and Valuation

These are beneficial for fully engaging with the course material.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial modelling

- Valuation

Introduction to Leveraged Buyouts (LBOs)

Level 3

1h 2min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Building Sources and Uses

Forecasting EBITDA & Cash Flow

Forecasting Debt & Equity

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Investment Banking & Private Equity Modeling Specialization

- Skills You’ll Gain Accounting, Advanced Financial Modeling, Excel, Financial Statement Analysis, Forecasting, Valuation, and more.

- Great For Investment Banking, Private Equity, Equity Research, and more