Overview

Cash-to-Accrual Accounting Course Overview

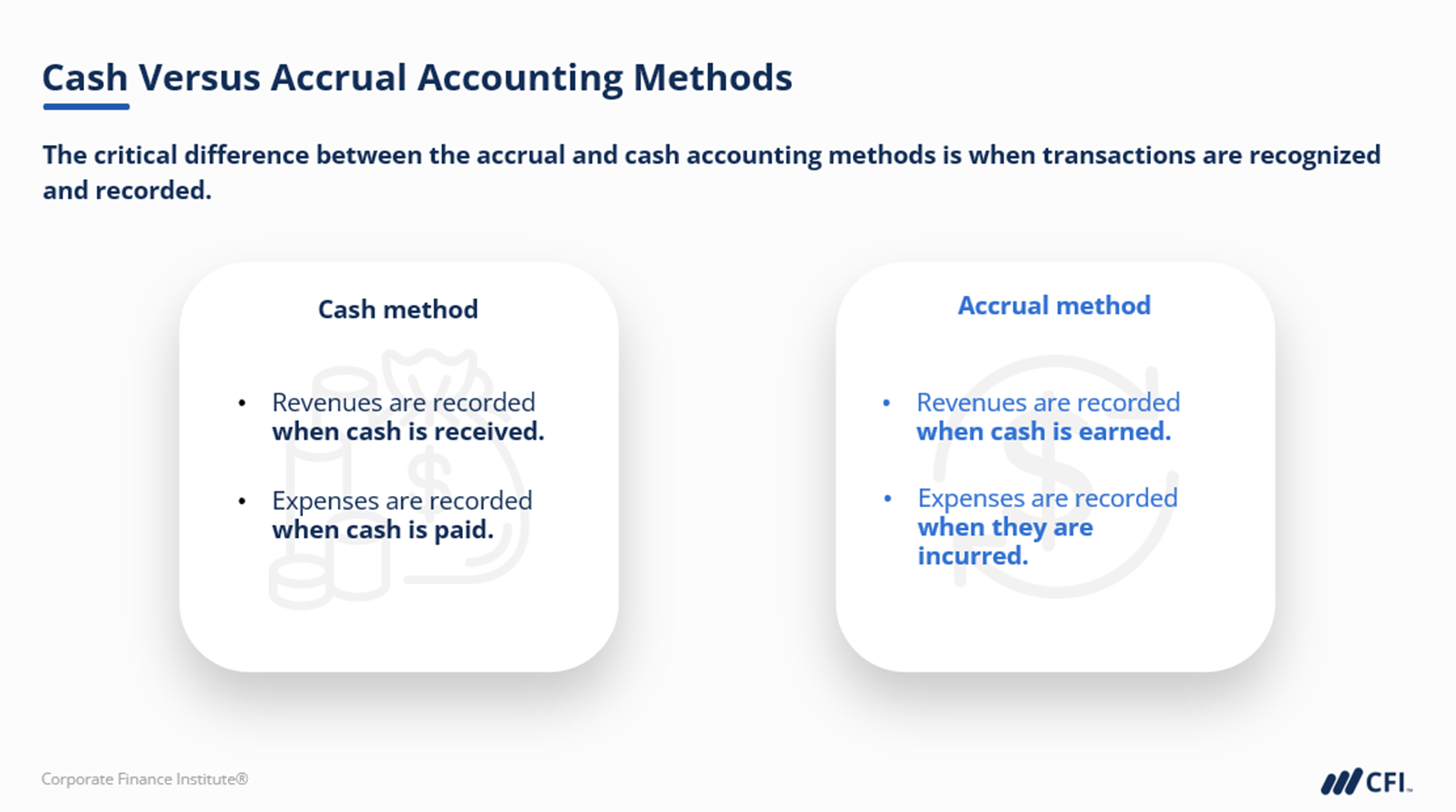

Cash is king? Not when it comes to accrual information! Learn why cash-only information presents an incomplete picture for many users of financial data and how professionals work under such circumstances.

Cash-to-Accrual Learning Objectives

Upon completing this course, you will be able to:- Differentiate the rationale for using cash and accrual information

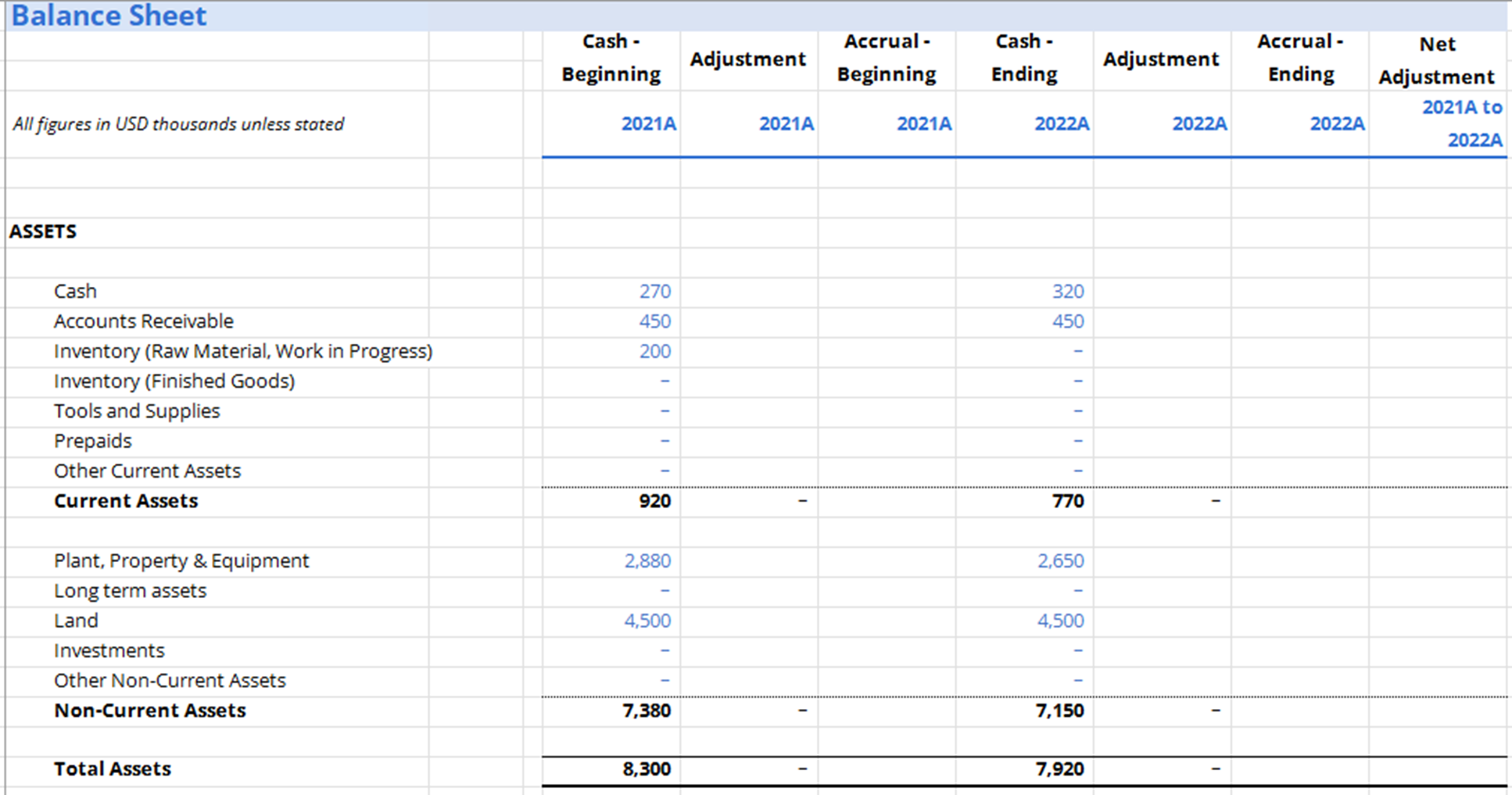

- Establish the approach to convert cash receipts and disbursements to relevant accrual data

- Practice and adjust assets, liabilities, revenues, and expenses to get cash statements closer to an equivalent set of accrual statements

- Link the different financial statements and distinguish their differences when looking at financial metrics

Who Should Take This Course?

This course is for all general business owners who work with lenders and financial professionals working with prospects and clients who rely on cash-based statements.

Cash-to-Accrual Accounting

Level 2

1h 13min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Cash Receipts

Cash Disbursements

Other Cash and Non-Cash Expenses

Conclusion and Impact

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending