Overview

Managing Your Stakeholders Overview

Effective stakeholder management is essential for career success and to support your organization’s business performance. Whether you’re leading a project, driving strategic initiatives, or managing day-to-day tasks, understanding how to identify, analyze, and engage stakeholders can mean the difference between success and failure. Poor stakeholder management can lead to miscommunication, delays, and resistance, while strong relationships foster collaboration, alignment, and better decision-making.

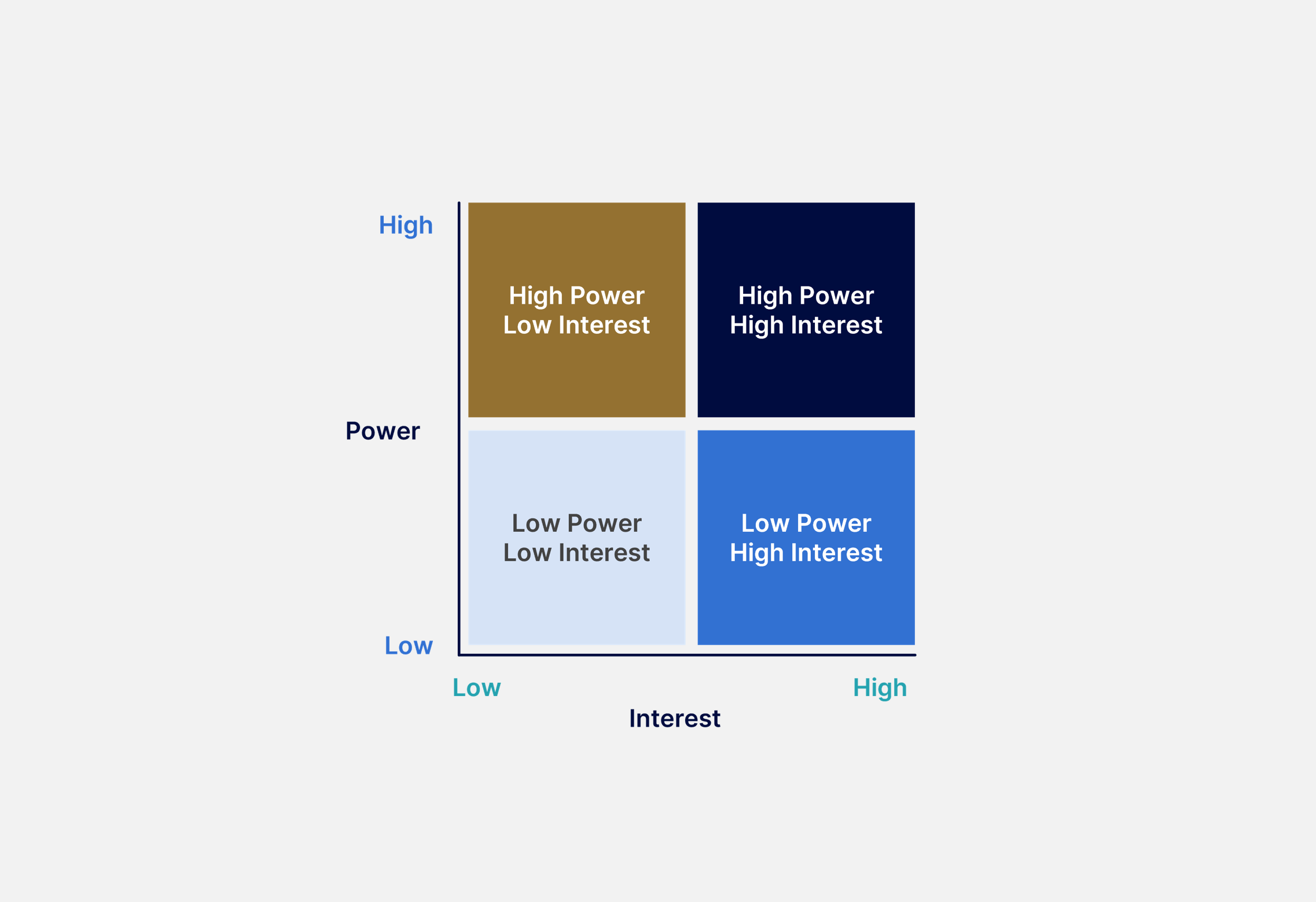

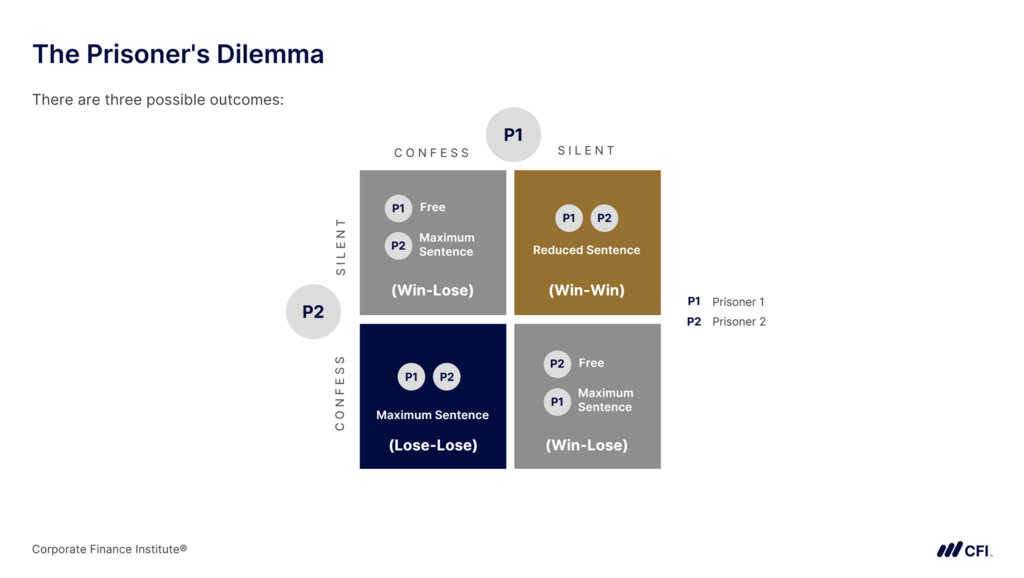

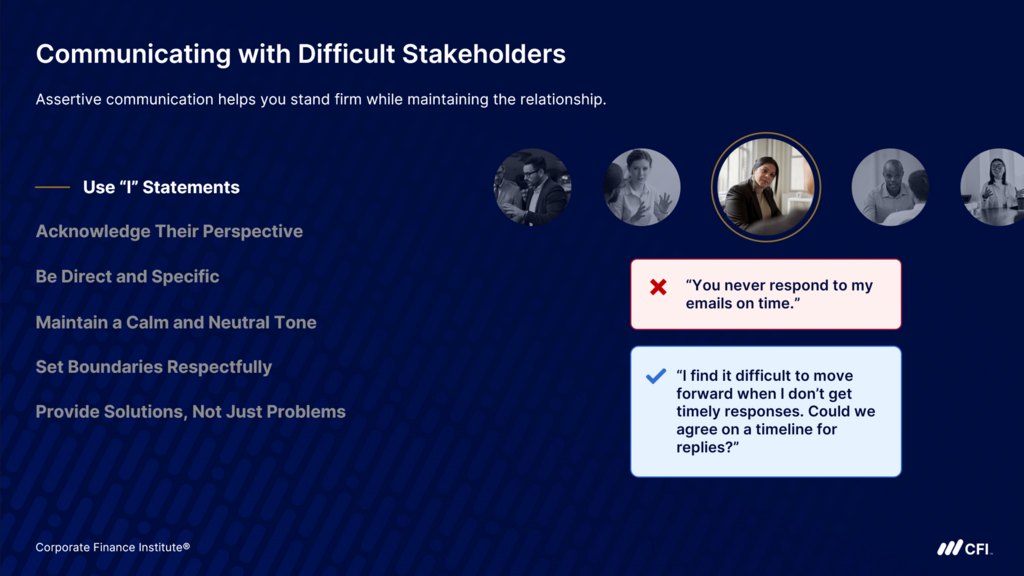

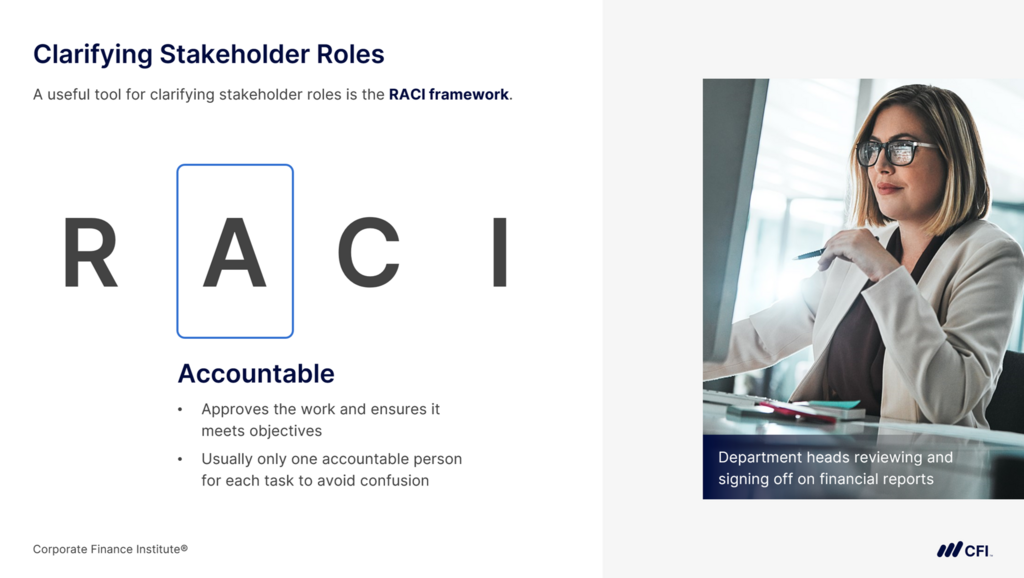

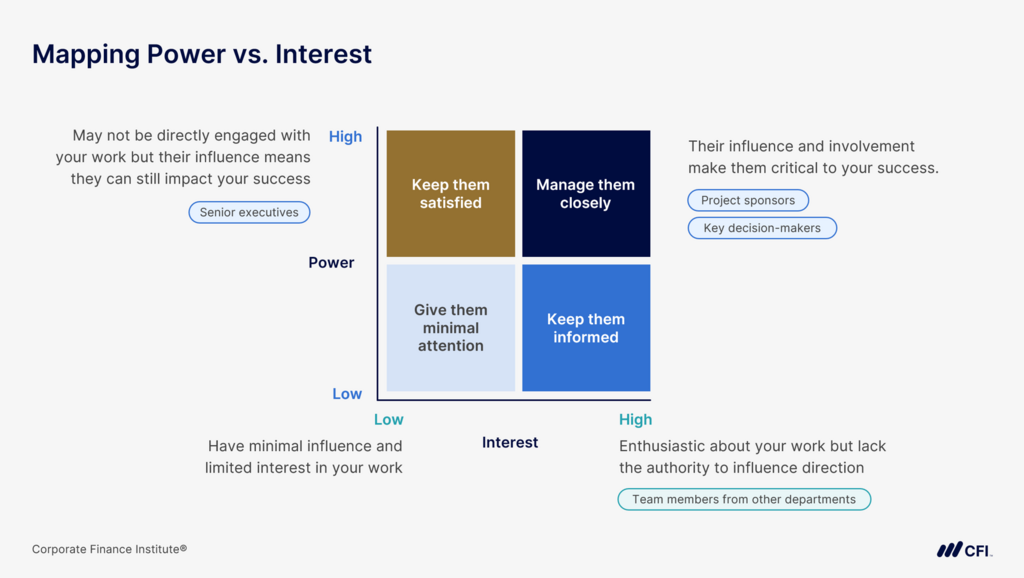

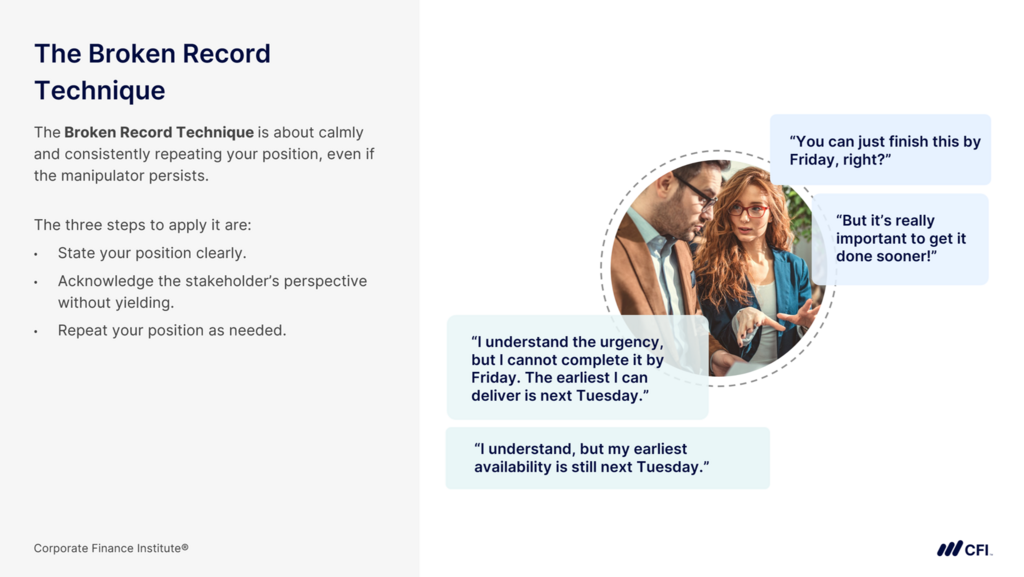

This course covers the fundamentals of stakeholder management, including stakeholder identification, classification, and mapping techniques to assess influence and interest levels. You’ll learn strategies to build strong relationships, manage expectations, and navigate conflicts effectively. The course also explores practical communication techniques for engaging with different stakeholder types, including difficult or manipulative individuals.

By the end, you’ll have the tools to prioritize stakeholders, align interests, and drive successful outcomes in any professional setting—making you a more effective, influential, and strategic finance professional.

Managing Your Stakeholders Learning Objectives

Upon completing this course, you will be able to:- Identify and classify key stakeholders in a business setting

- Analyze stakeholder needs, priorities, and levels of influence using structured frameworks

- Develop and apply strategies to manage stakeholder relationships, expectations, and conflicts

- Communicate effectively with different types of stakeholders, including difficult or manipulative ones

Who Should Take This Course?

This course is designed for professionals across finance, business, consulting, and project management who regularly engage with stakeholders in their roles. It is ideal for those pursuing careers in corporate finance, investment banking, asset management, private equity, consulting, project management, or leadership positions where effective stakeholder management is critical for success.Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Logical thinking

Managing Your Stakeholders

Level 1

54min

100% online and self-paced

Field of Study: Finance

Start Learning