Overview

The Generative AI Tools in Finance – ChatGPT Course Overview

Artificial intelligence is rapidly transforming the finance industry by enhancing decision-making, streamlining workflows, and unlocking deeper insights. This course explores how generative AI—specifically ChatGPT—can be used to automate routine tasks, analyze financial data, and create custom tools for specialized finance applications. With hands-on examples and expert guidance, you’ll gain the practical skills needed to confidently integrate AI into your financial analysis toolkit.

The Generative AI Tools in Finance – ChatGPT Course Learning Objectives

By the end of this course, you will be able to:

- Boost productivity by automating routine finance workflows using ChatGPT

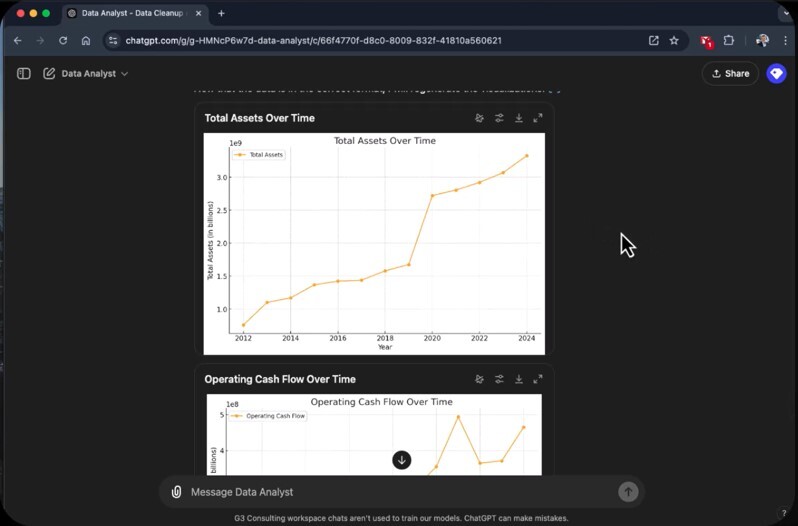

- Analyze historical financial data to uncover key trends and insights

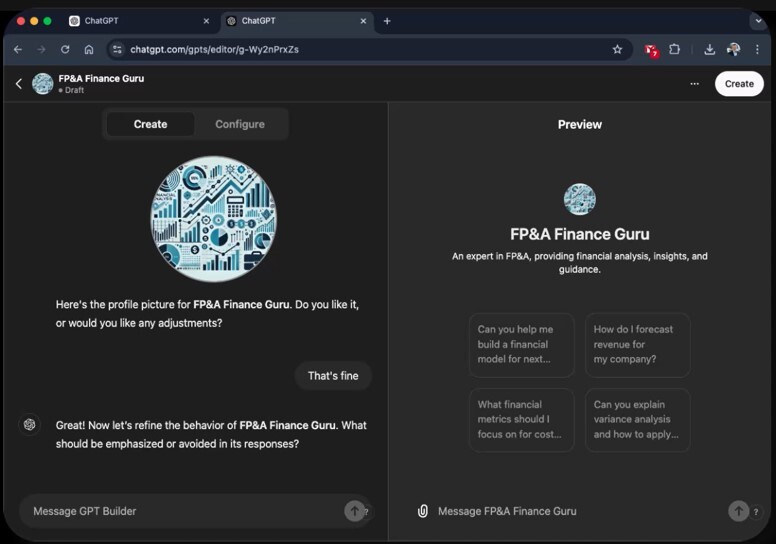

- Build custom generative AI tools tailored to specialized finance tasks

Who should take this course?

This course is ideal for FP&A professionals, investment analysts, and corporate finance leaders who want to stay competitive by integrating generative AI into their financial workflows. It’s designed for finance professionals seeking to automate analysis and enhance decision-making with cutting-edge tools.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

Generative AI Tools in Finance - ChatGPT

Level 3

37min

100% online and self-paced

Field of Study: Finance

Start Learning