Overview

Reading Financial Statements Overview

A thorough knowledge of financial statements and company reports is crucial to becoming a world-class financial analyst. In this course, learn how to read and understand financial statements. We use real company annual reports and financial statements to better understand and analyze the financial strength of a company and help us make more informed decisions.

Learning Objectives

- Learn the contents of an annual report.

- Understand a company’s operations and business strategy.

- Realize the many risk factors a company must navigate.

- Analyze company financial statements, as well as its different business segments.

- Read and comprehend the Management Discussion & Analysis (MD&A) section.

- Review the notes to the financial statements for additional detail.

Who Should Take This Course?

This course is designed for anyone who wants to review accounting fundamentals and master the ability to read and interpret financial statements and reports. It will also be useful for current finance professionals who want to review concepts necessary for financial modeling and valuation in some of CFI’s core courses.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Critical thinking

- Basic computer skills

Reading Financial Statements

Level 2

1h 45min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Understanding the Annual Report

Understanding Financial Statements

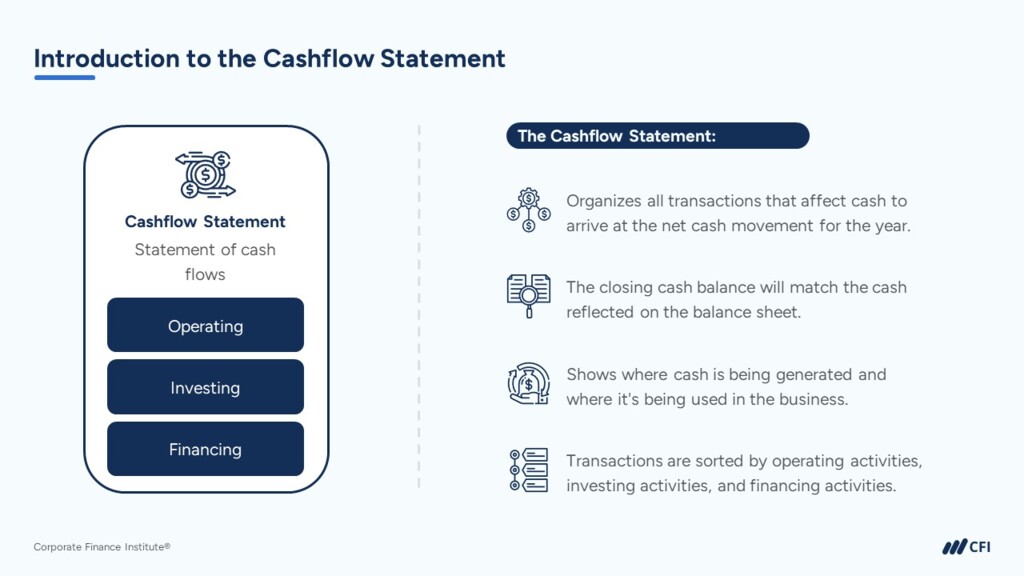

Income Statement and Cashflow Statement

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager

Accounting for Financial Analysts Specialization

- Skills learned Accounting, Financial Analysis, Reading Financial Statements and more

- Career prep Financial Planning & Analysis (FP&A), Corporate Development, Investment Banking, Private Equity, Equity Research, and more.

Finance for Non-Finance Managers

- Skills You’ll Gain Accounting, Finance, Budgeting and Forecasting, Strategy

- Great For Operations, Marketing or Sales Managers, Department Heads/Team Leaders, Strategy Consultant, Non-Finance Executive Roles (e.g. COO, CTO) and more