Overview

Options Hedging and Trading Strategies Course Overview

Learn how options can be used and combined with the underlying asset to hedge or trade a view on market direction and volatility. This course is great for anyone who already understands the fundamentals of options and would like to advance further.

Options Hedging and Trading Strategies Learning Objectives

Upon completing this course, you will be able to:

- Review option expiry profiles

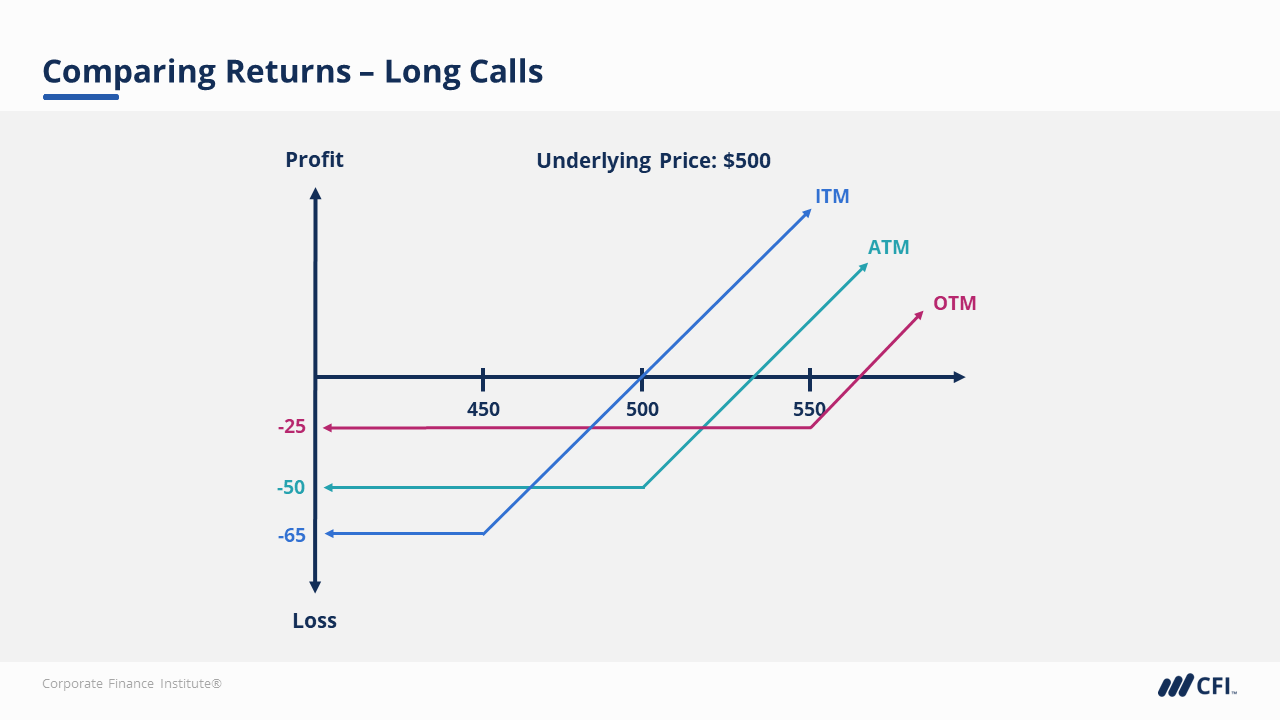

- Compare in, at, and out-of-the-money options

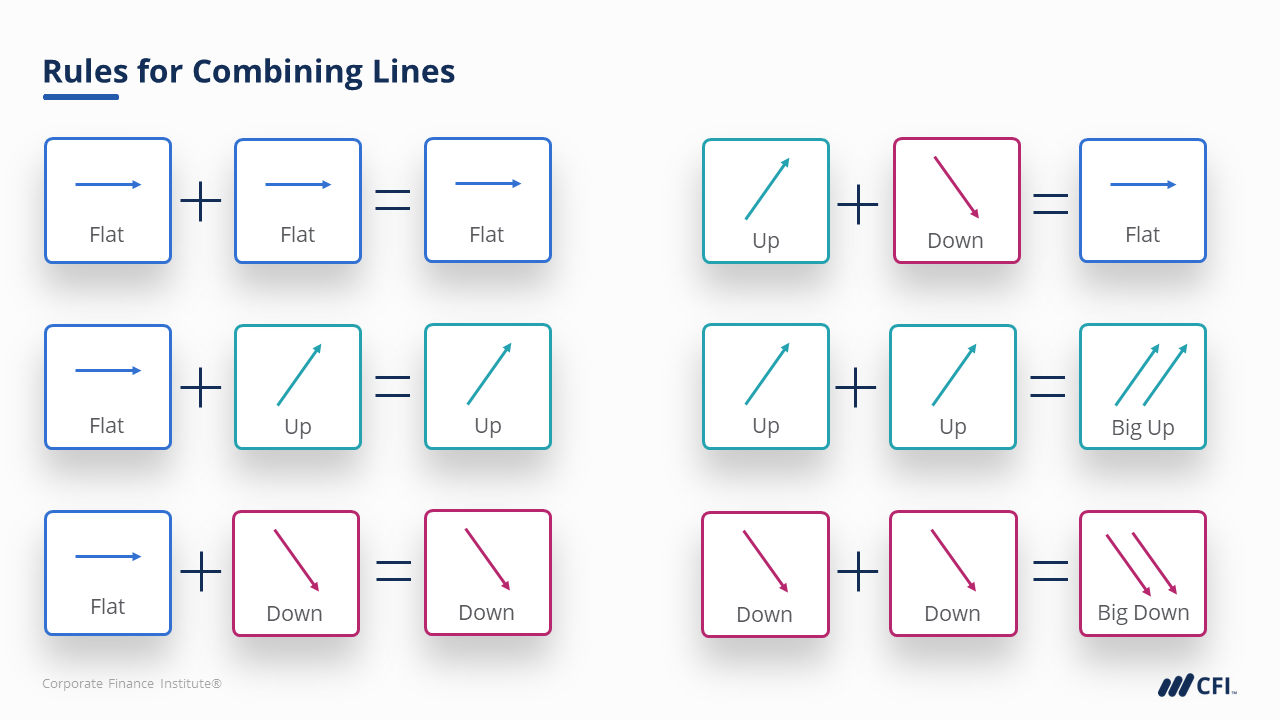

- Combine options and the underlying asset

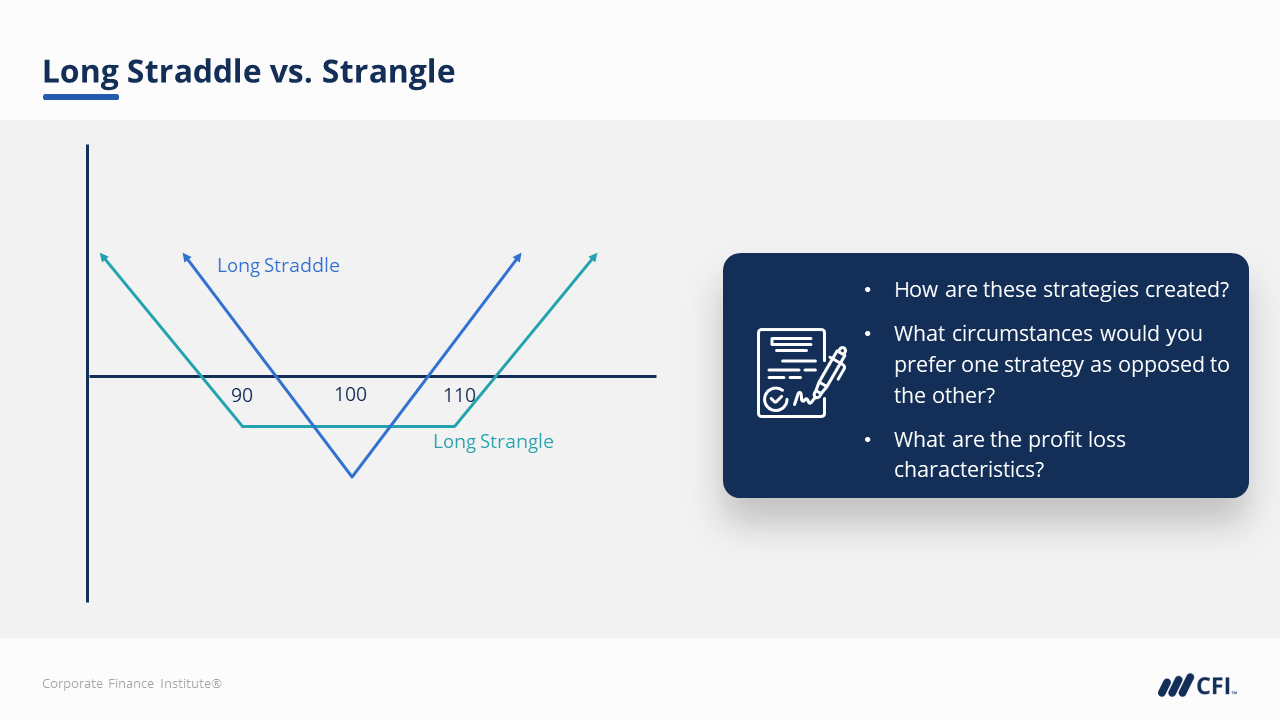

- Interpret and create option strategies

- Identify near-date option (curve) profiles

Who Should Take This Course?

Options Hedging and Trading Strategies is an excellent course for those who want to trade and use multi-leg options strategies.Prerequisite Courses

Recommended courses to complete before taking this course.

Options Hedging and Trading Strategies

Level 4

40min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Comparing ITM/ATM/OTM Expiry Profiles

Combining Options & Underlying

Near Date Options Curve

Common Options Strategies

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side