Overview

Asset Classes and Financial Markets Course Overview

Understanding the landscape that you work in is a foundational part of success. After all, how can you possibly give financial advisory services without knowing financial markets?

As a financial planner or wealth management professional, you need to know financial markets and asset classes like the back of your hand. In this course, we give you an overview of financial markets – what they are, who they serve, and why a healthy one is so important for the global economy – and the three primary asset classes in them.

Asset Classes and Financial Markets Learning Objectives

By the end of the course, you will be able to:- Explain what financial markets are and their purpose

- Navigate the major asset classes and identify their characteristics and purpose

- Identify the key financial products in each asset class that financial planners and wealth managers most often encounter

- Interpret real market data and formulate an opinion on the health of financial market conditions

Who Should Take This Course?

Prerequisite Courses

Recommended courses to complete before taking this course.

Asset Classes and Financial Markets

Level 2

1h 16min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

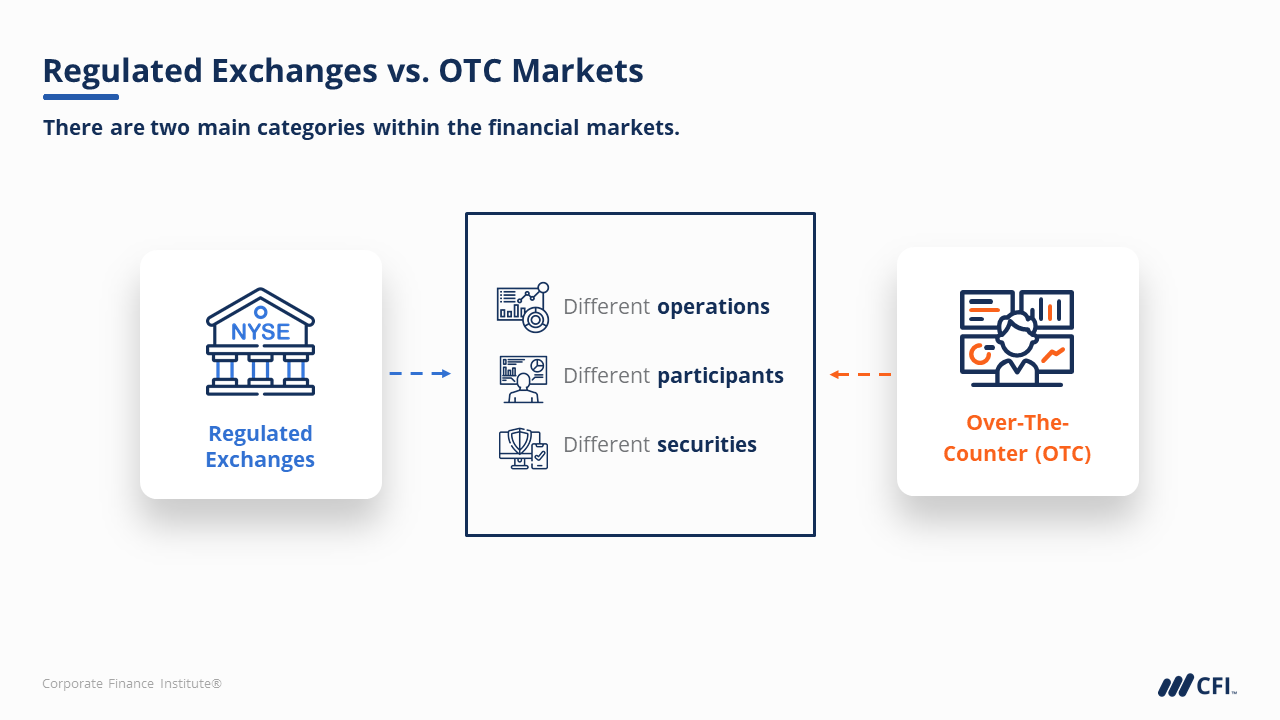

Introduction

Understanding Asset Classes

Fixed Income Securities

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager