Overview

Accounting for Diluted Shares & Earnings per Share Course Overview

One of the most challenging topics in finance and accounting is calculating a company’s diluted share count and earnings per share. But it’s absolutely crucial to master this since the diluted share count is necessary to calculate earnings per share and is also used when valuing a company. In this course, we’ll cover the most common types of dilutive securities and how to account for these. We’ll also discuss other common adjustments to consider when calculating diluted shares.

Accounting for Diluted Shares & Earnings per Share Learning Objectives

Upon completing this course, you will be able to:- Understand the difference between authorized, issued, and outstanding shares.

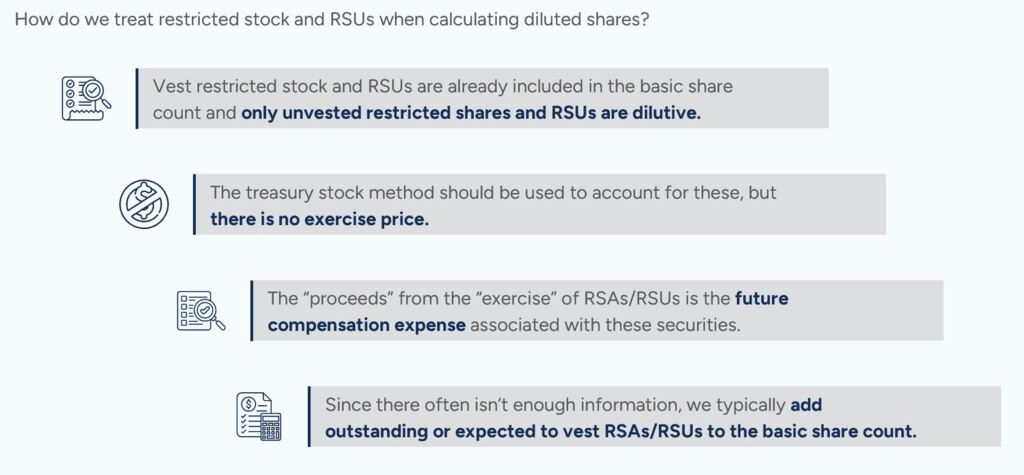

- Basic EPS vs Diluted EPS The most common potentially dilutive securities.

- Applying the Treasury Stock Method.

- The If-Converted Method and related adjustments.

- Dealing with stock splits.

Who Should Take This Course?

Accounting is the language of business so it’s critical for finance professionals to have a solid understanding of different accounting rules and conventions since these can lead to different financial results. This course is perfect for anyone that uses financial statements, including investment bankers, equity research analysts, and financial planning and analysis (FP&A) professionals.

Courses we recommend you take in advance

These prerequisite courses are optional, but we recommend you complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Prerequisite Courses

Recommended courses to complete before taking this course.

Accounting for Diluted Shares and Earnings per Share

Level 3

1h 6min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Accounting for Diluted Shares & EPS

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Accounting for Financial Analysts Specialization

- Skills learned Accounting, Financial Analysis, Reading Financial Statements and more

- Career prep Financial Planning & Analysis (FP&A), Corporate Development, Investment Banking, Private Equity, Equity Research, and more.

Investment Banking & Private Equity Modeling Specialization

- Skills You’ll Gain Accounting, Advanced Financial Modeling, Excel, Financial Statement Analysis, Forecasting, Valuation, and more.

- Great For Investment Banking, Private Equity, Equity Research, and more