Overview

FP&A Professional Headcount Forecasting & Analysis Overview

CFI’s “FP&A Professional Headcount Forecasting & Analysis” course will help you filter through any past challenges you may have had to learn best-in-class approaches to forecasting headcount and employee costs in FP&A models. This course will also include using corkscrews and advanced techniques for both custom formatting and conditional formatting.

FP&A Professional Headcount Forecasting & Analysis Learning Objectives

Upon completing this course, you will be able to:- Understand how corkscrews work and why they are considered a best practice for certain schedules in FP&A models.

- Apply advanced custom formatting techniques to understand how to control the format for entries that are positive, negative, zero, and text.

- Explore advanced conditional formatting approaches used to install limits and alert model users when inappropriate entries have been put into a model.

- Use more advanced conditional formatting techniques to highlight changes to figures that are input across a single row in an FP&A model.

Who Should Take This Course?

This course is perfect for FP&A professionals at a beginner, intermediate, or even advanced level. This course is a part of a series of FP&A courses.

Prerequisite Courses

Recommended courses to complete before taking this course.

FP&A Professional Headcount Forecasting & Analysis

Level 3

1h 7min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

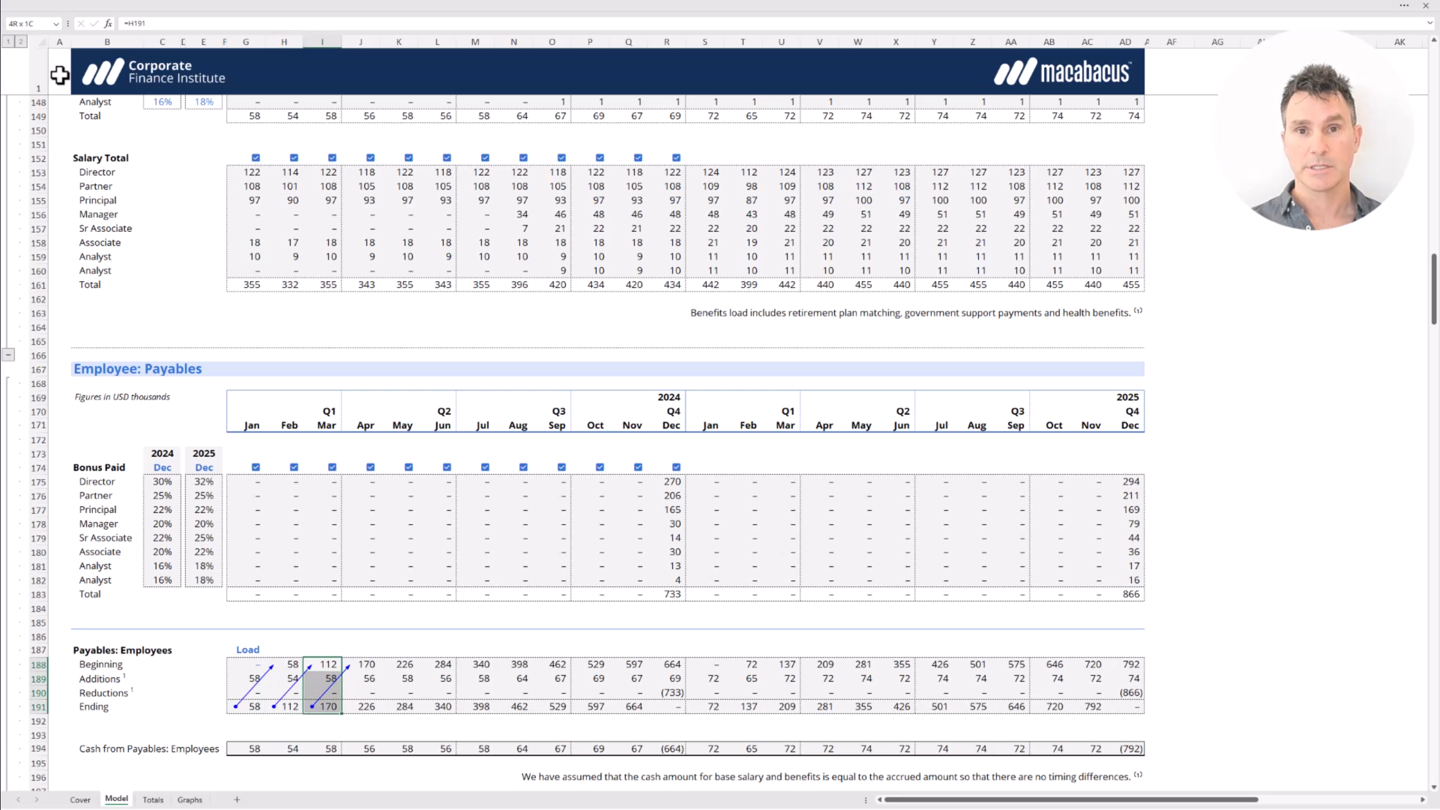

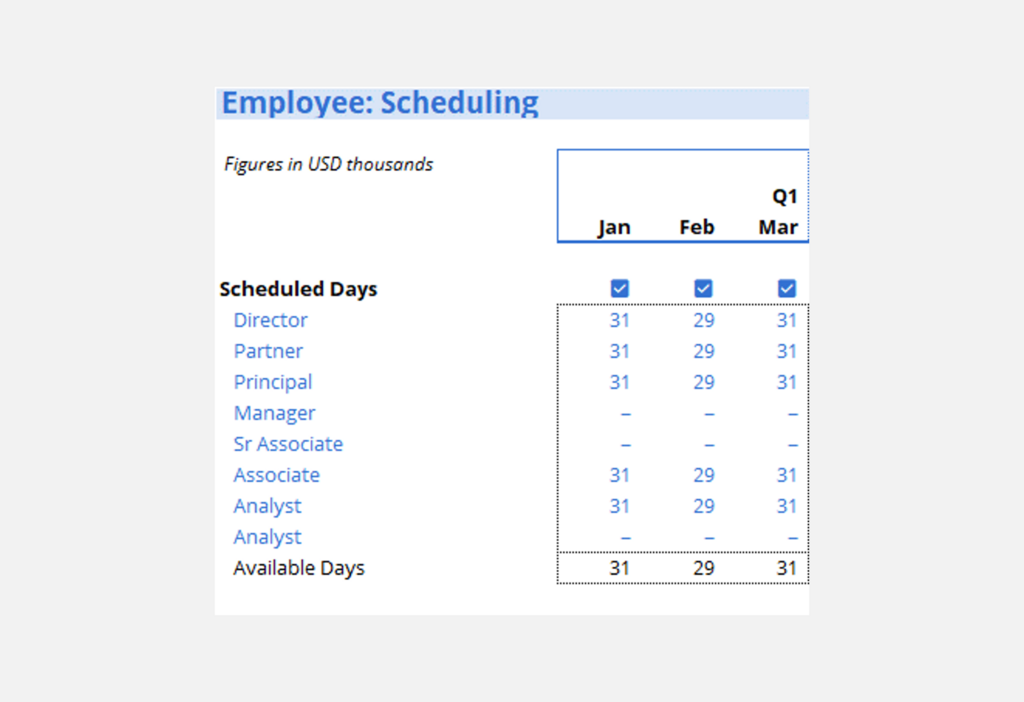

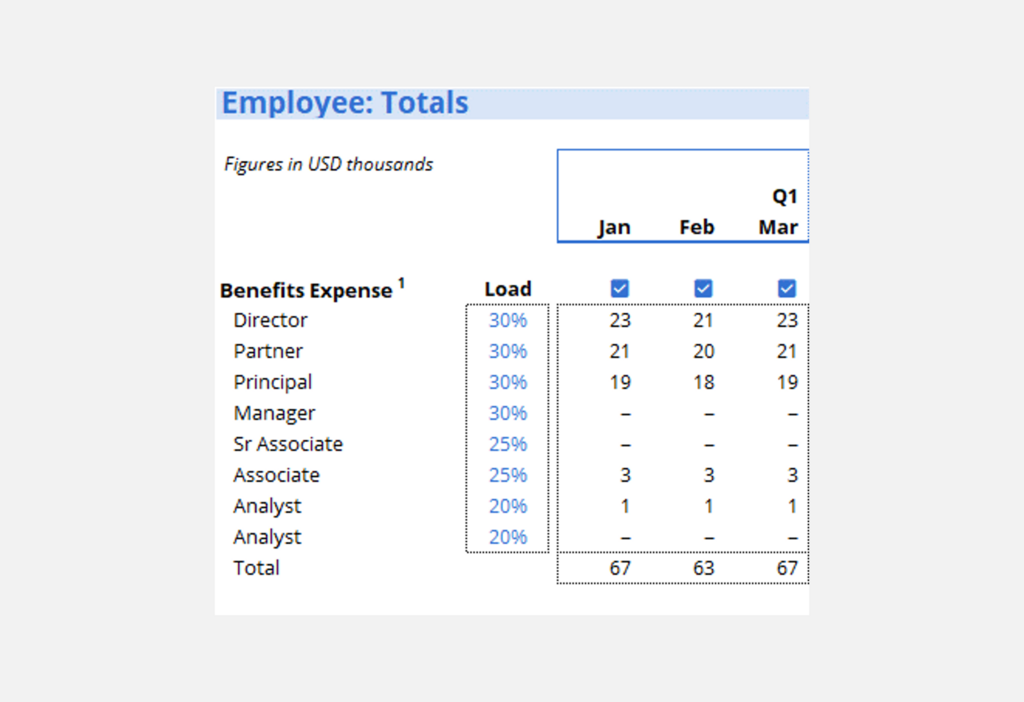

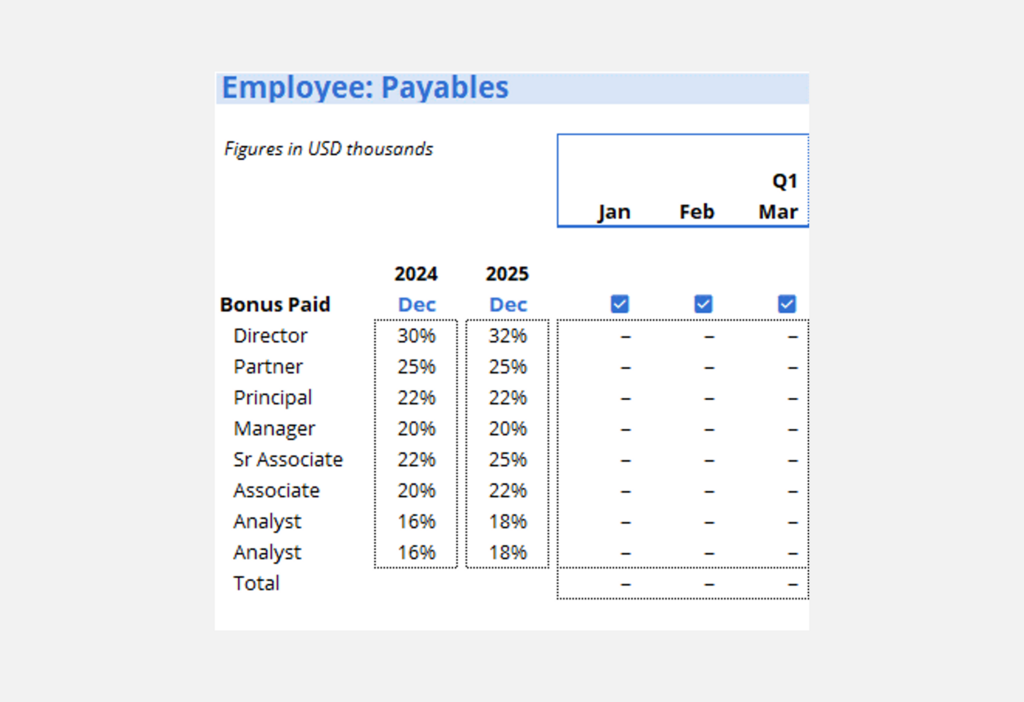

Employee Totals & Payables

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Analysis (FP&A) Specialization

- Skills Learned Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, and more.

- Career Prep Financial Analyst, Project Evaluator, FP&A Manager and more