Overview

FP&A Professional Model Build & Configuration Overview

CFI’s “FP&A Professional Model Build & Configuration” course will help you understand the best design for an FP&A model to review monthly data in a quantitative and qualitative manner.

FP&A Professional Model Build & Configuration Learning Objectives

Upon completing this course, you will be able to:- Review the optimal layout for FP&A models designed to review and analyze monthly data.

- Compare FP&A model design to other financial models to understand the differences and the unique requirements of FP&A models.

- Learn the best and most common Excel formulas and functions used in FP&A models.

Who Should Take This Course?

This course is perfect for FP&A professionals at a beginner, intermediate, or even advanced level. This course is a part of a series of FP&A courses.

Prerequisite Courses

Recommended courses to complete before taking this course.

FP&A Professional Model Build & Configuration

Level 3

1h 13min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

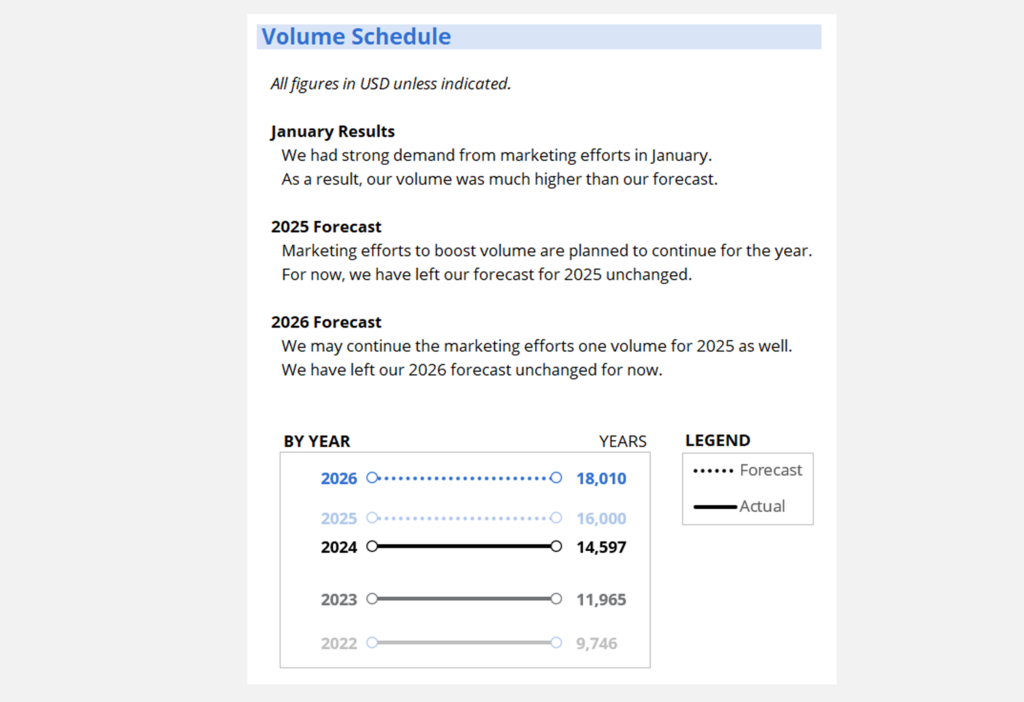

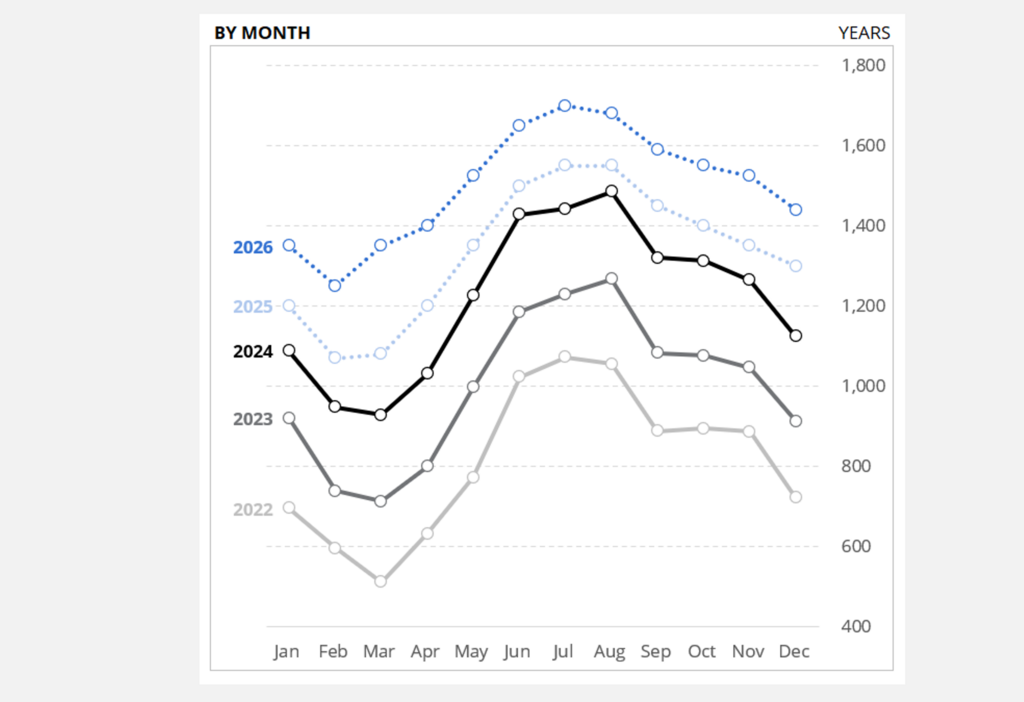

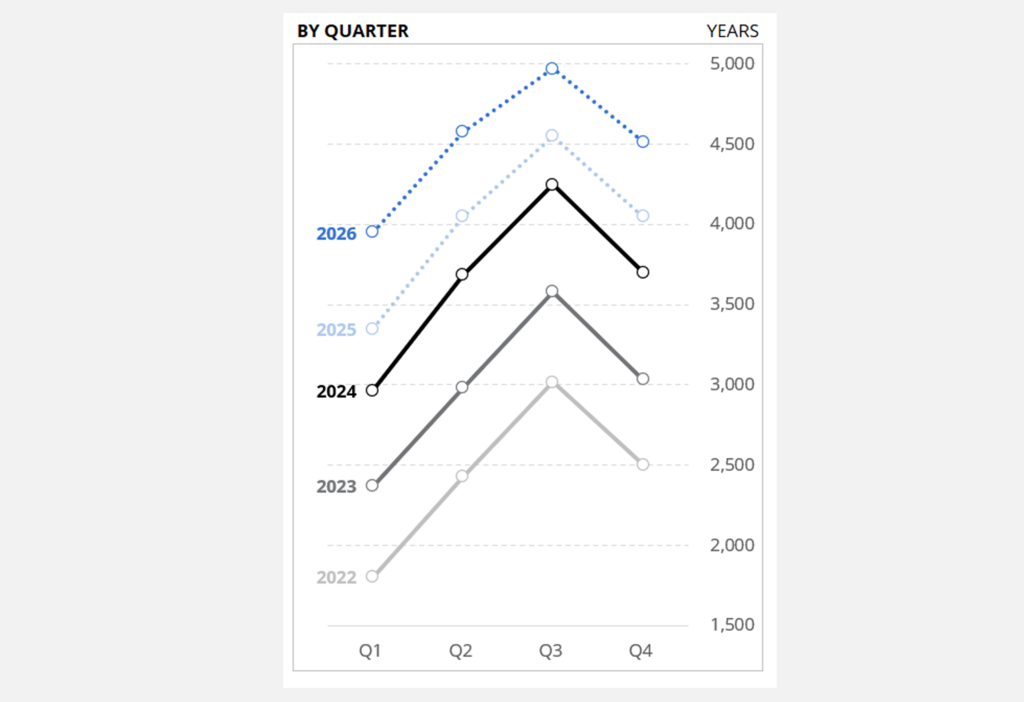

Other Schedules

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Analysis (FP&A) Specialization

- Skills Learned Accounting, Finance, Excel, Data Analysis, Financial Statement Analysis, Financial Modeling, Budgeting, Forecasting, Power Query, Power BI, and more.

- Career Prep Financial Analyst, Project Evaluator, FP&A Manager and more