Overview

Graph Database Fundamentals Course Overview

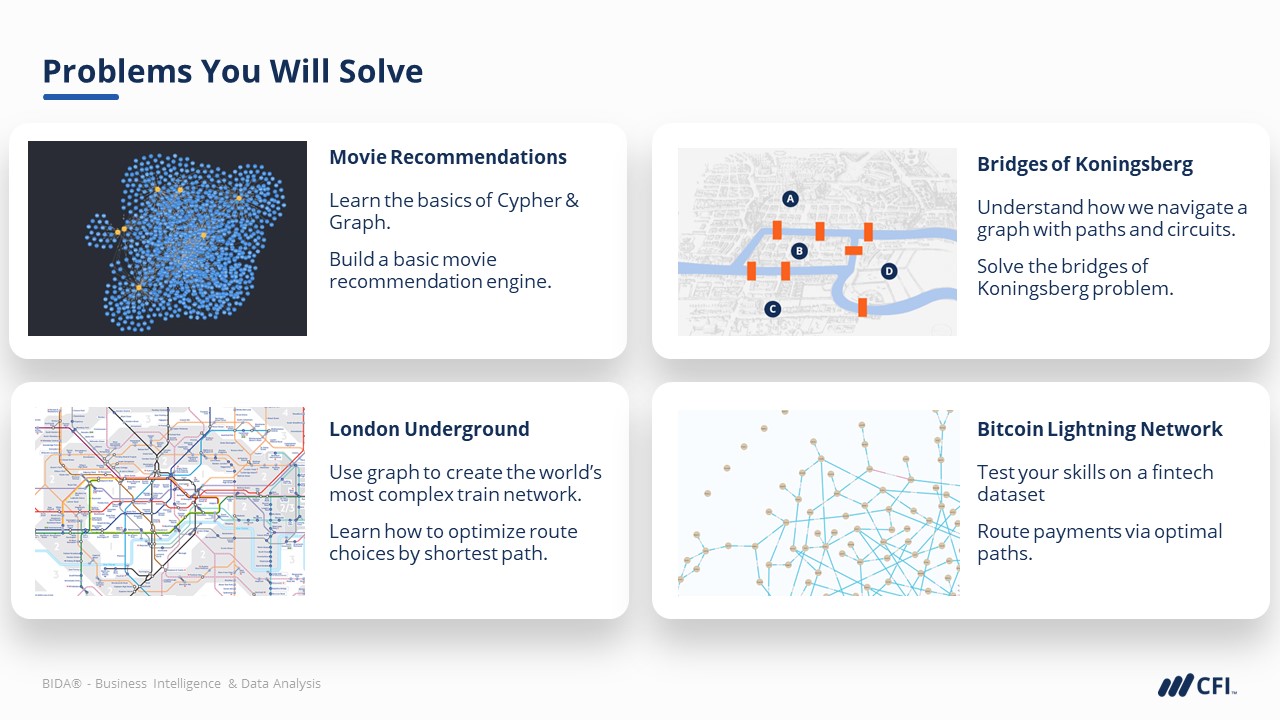

You’ll start this course by exploring the basic building blocks of a graph database and how it differs from a relational database. You’ll learn the basics of Cypher queries, which you’ll use to query a Graph and answer scenario-based questions. By doing this, you’ll begin to understand the types of data and questions that Graph analysis is best suited to. In addition, you’ll learn how to create a basic graph database from scratch and how advanced Cypher queries can help simplify otherwise complex problems in SQL. Graph databases represent a different way of solving data questions and can help us problem-solve differently.

Graph Database Fundamentals Learning Objectives

Upon completing this course, you will be able to:- Summarize the differences between a graph database and a relational database

- Identify dataset features that lend themselves well to graph data structures

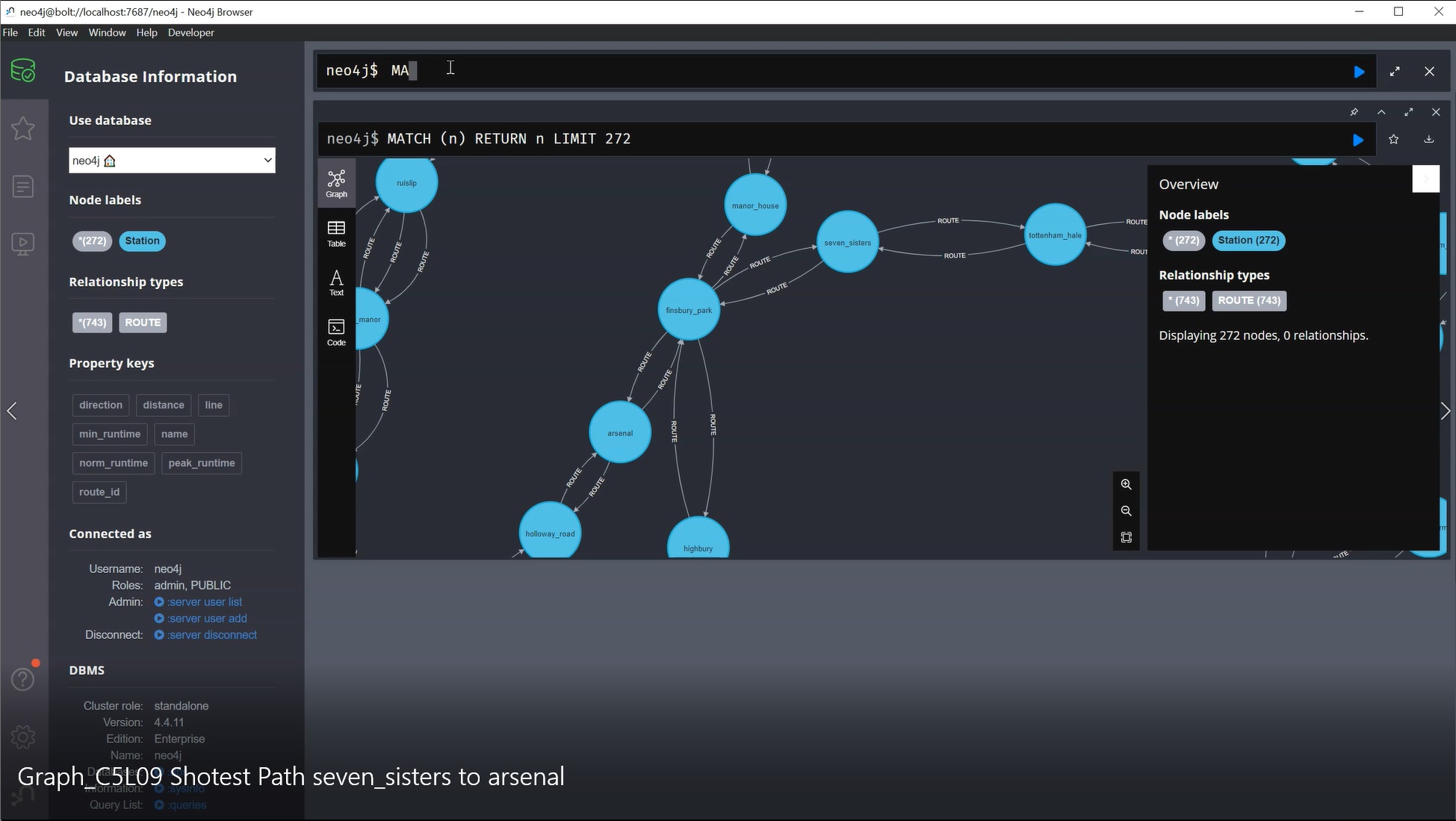

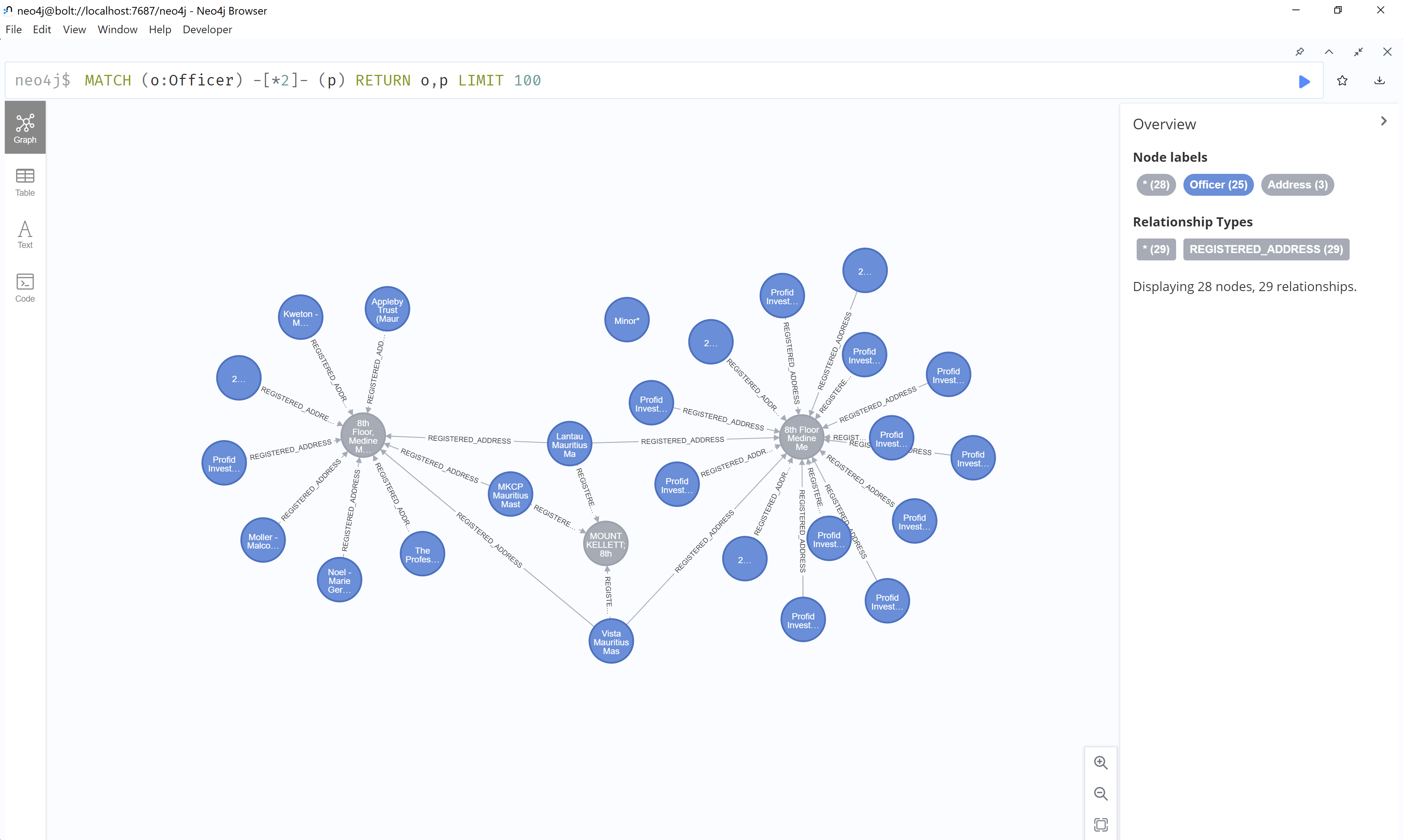

- Extract data from a graph database using basic Cypher queries such as MATCH, WHERE and RETURN

- Write Cypher queries to answer specific scenario-based questions

- Create a basic graph database from scratch

- Use Cypher to solve otherwise complex tasks in SQL

Who Should Take This Course?

This course on graph databases is perfect for those with zero prior experience with SQL or graph databases or those who want a refresher on the fundamentals and best practices. As with any database format, graph databases can be daunting to learn, which is why this course starts with super simple examples and works slowly up to more complex theories. Every concept and step is explained clearly and with as non-technical language as possible.Prerequisite Courses

Recommended courses to complete before taking this course.

Graph Database Fundamentals

Level 4

2h 28min

100% online and self-paced

Field of Study: Specialized Knowledge

Start Learning