Overview

Advanced Prompting for Financial Statement Analysis Overview

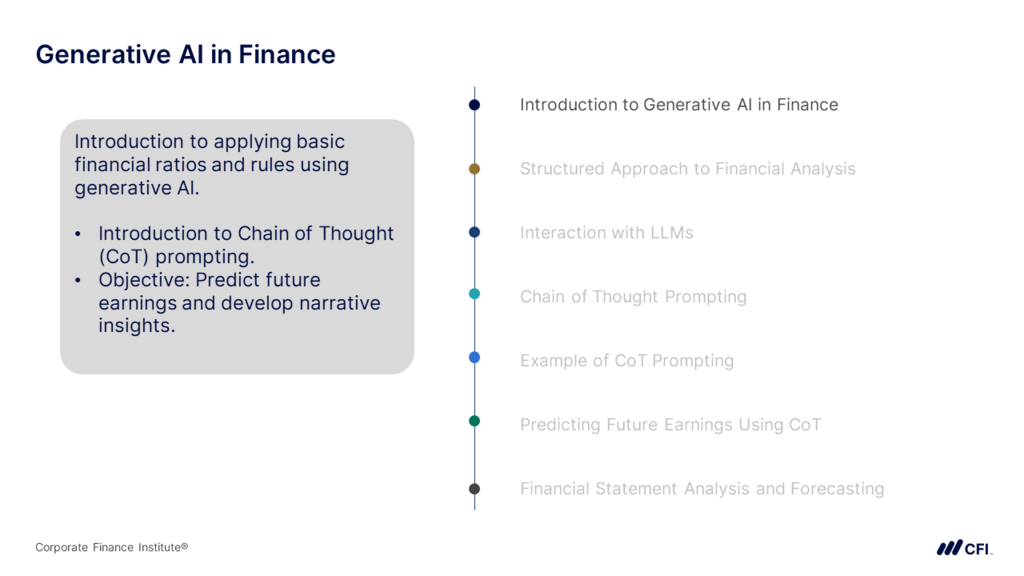

This cutting-edge course explores the transformative potential of AI in finance, focusing on leveraging large language models (LLMs) for enhanced financial statement analysis. Students will learn to harness the power of Chain-of-Thought (CoT) prompting techniques to conduct in-depth financial analyses, predict future earnings, and generate actionable insights. The course covers data preparation, key analysis tasks, financial ratio calculations, and the creation of custom GPTs for specialized financial analysis. By combining traditional financial expertise with advanced AI capabilities, students will gain a competitive edge in financial forecasting and decision-making.Advanced Prompting for Financial Statement Analysis Learning Objectives

- Master the process of collecting, formatting, and preparing financial data for AI-driven analysis.

- Learn to break down complex financial statement analysis into specific tasks using Chain-of-Thought prompting.

- Develop proficiency in calculating and interpreting key financial ratios using AI tools

- Gain skills in using CoT prompting to predict future earnings and develop narrative insights from financial data.

- Conduct comprehensive financial analysis using GPT models and interpret results for actionable insights

- Create and configure custom GPT instances for specialized financial analysis tasks.

- Understand common challenges in AI-driven financial analysis and apply best practices for effective analysis and validation.

Who should take this course?

This course is ideal for financial analysts, investment professionals, and finance students who want to enhance their financial analysis capabilities using cutting-edge AI technologies. It’s particularly suited for those looking to combine traditional financial expertise with advanced AI-driven analytical techniques to gain a competitive edge in financial forecasting and decision-making.Prerequisite

AI-Enhanced Financial AnalysisPrerequisite Courses

Recommended courses to complete before taking this course.

Advanced Prompting for Financial Statement Analysis

Level 3

1h 34min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat you'll learn

Financial Ratios

Chain-of-Thought Prompting

Case Study - Rivian

Financial Analyzer

Challenges and Best Practices

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

AI for Finance Specialization

- Skills You’ll Gain AI-Driven Financial Analysis, Excel Automation, and Applied AI Skills

- Great For Financial Analyst, FP&A Analyst, Business Intelligence Analyst, Investment Bankers, Equity Research and more