Overview

Alternative Investments for Wealth Advisors Course Overview

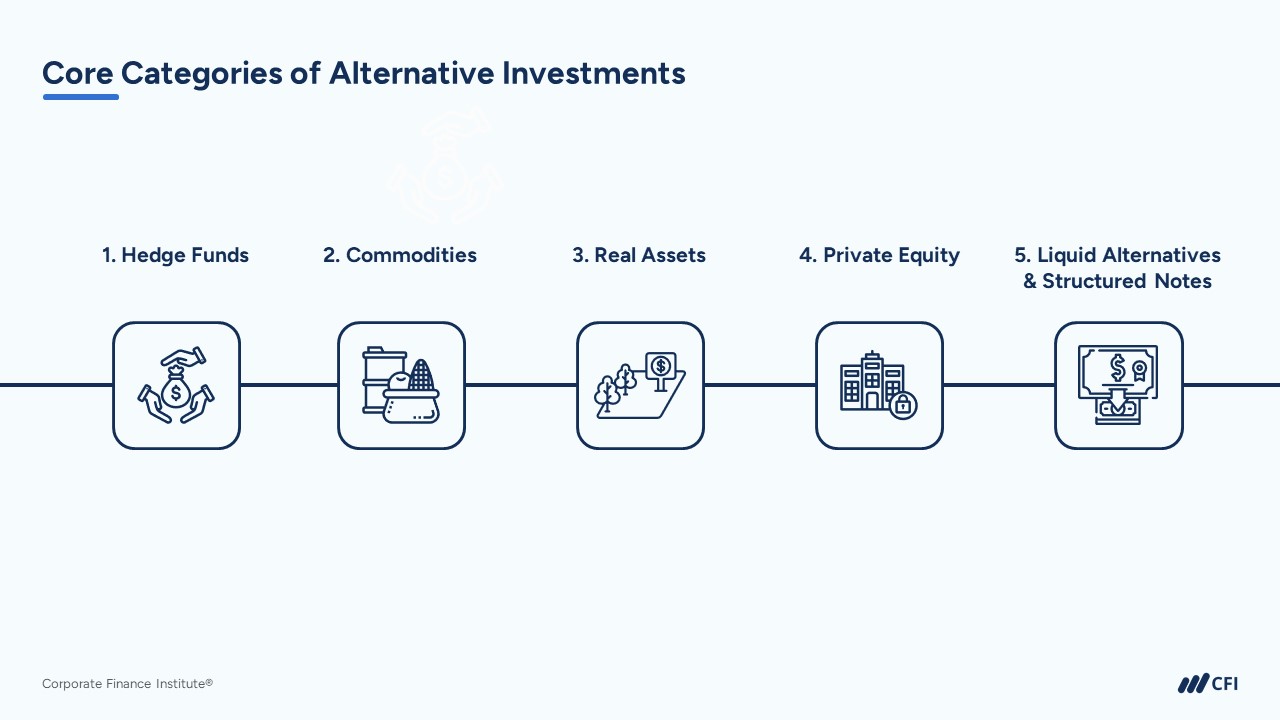

Alternative Investments are one of the fastest-growing categories of investment products in the Wealth Management industry. From Hedge Funds to Commodities and Venture Capital, investors are looking to Alternatives now more than ever to protect their portfolios and provide them with performance enhancement.

This course is full of information about Alternative Investments and differentiates them from conventional asset classes. Learn why Alternatives are in-demand, how to deploy these strategies in a Wealth Management portfolio, and what the advantages and disadvantages of Alternative Investments are.

Learners will test their knowledge with interactive exercises throughout this course to ensure they have a comprehensive understanding of how Alternative Investments can be deployed within a Full-Service Brokerage environment.

Alternative Investments for Wealth Advisors Learning Objectives

Upon completing this course, you will be able to:

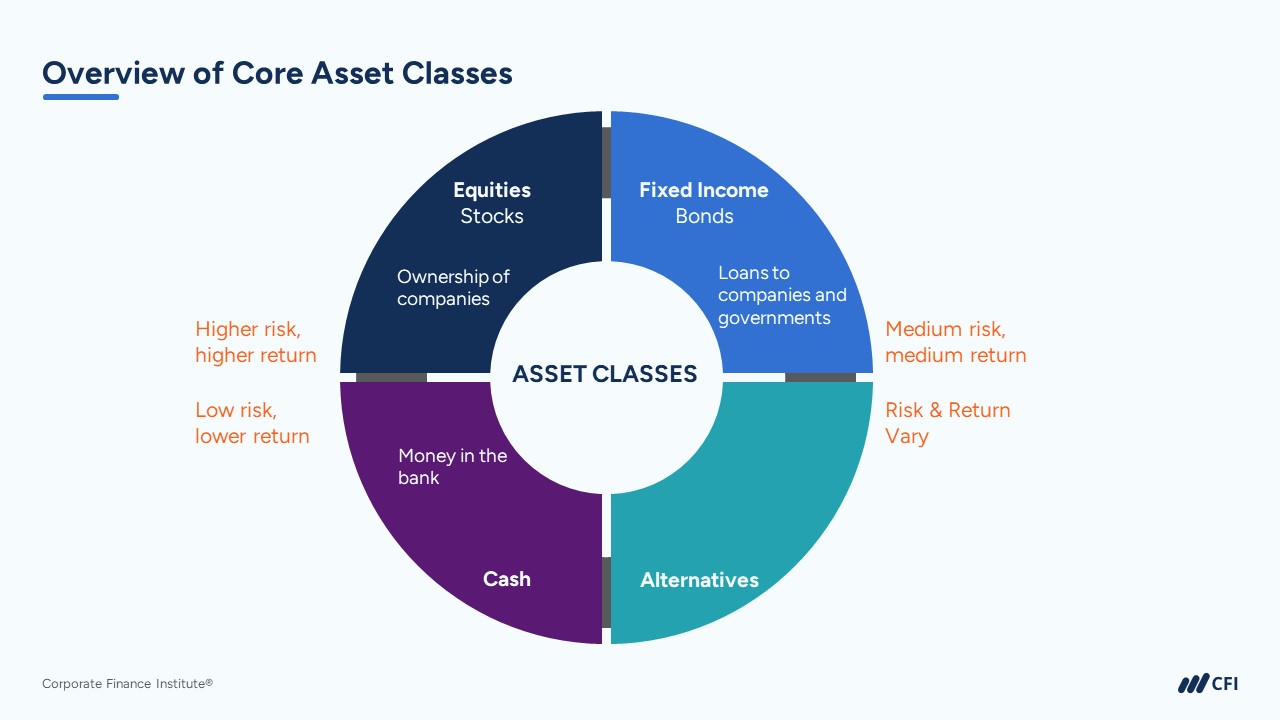

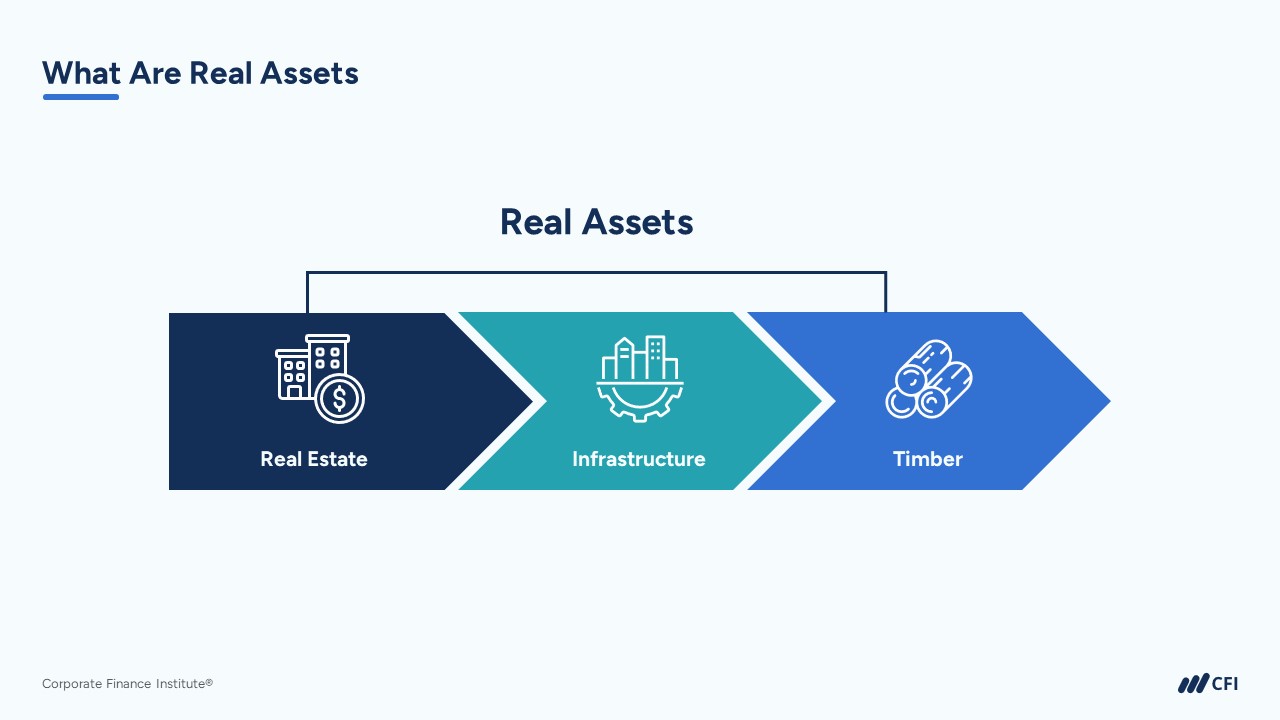

- Learn about a New Asset Class – understand the difference between Alternative and Traditional investment assets. Learn about the types of Alternative Investment and what benefits they can bring to an Investment Portfolio

- Build an Understanding of Best Practices for Alternative Investments within the Wealth Management context and how they can be deployed in a client account

- Write Investment Policy Statements that fully take into account a client’s financial needs and investment profile and integrate Alternative Investments into your existing book of business

Who Should Take This Course?

This course is relevant for anyone looking to improve their financial acumen and portfolio management skills in Retail Wealth Management. It does not matter whether you’re considering a career in Wealth Management or you’re a tenured Advisor that’s looking to take your practice to the next level; this course applies to anyone that wants to stay up-to-date on the latest industry knowledge, trends, and techniques.

Prerequisite Courses

Recommended courses to complete before taking this course.

Alternative Investments for Wealth Advisors

Level 2

1h 8min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

What Are Alternative Investments

Liquid Alternatives and Structured Notes

Primary Goals of Alternative Investments

Adding Alternative Investments to an IPS

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager