- What is a Business Combination?

- Types of Equity Investments in Business Combinations

- Consolidation of Subsidiary Equity Investments

- Equity Method of Accounting for Associate Equity Investments

- What is the Meaning of the Phrase "Goodwill" When Accounting for Business Combinations?

- What are Mergers and Acquisitions in Terms of Business Combinations?

- Mergers and Acquisitions Valuation Methods

- 1. Net Assets

- 2. Enterprise Value/EBITDA (EV/EBITDA) Ratio

- 3. Price/Earnings (P/E) Ratio

- 4. Revenue Multiple

- 5. Precedent Transaction Analysis

- 6. DCF (Discounted Cash Flow) Analysis

- 7. Dividend Yield

- 8. “Football Field” Chart

- FASB Rules for Evaluating Whether Integrated Sets of Assets and Activities are a Business or Group of Assets

- What is an Asset Acquisition?

- Business Combinations vs. Asset Purchase

- Learn More About Business Combinations and Equity Investments with CFI

What is a Business Combination? Definition and Factors

In business, a primary goal is to grow your company’s size and reach to the point where it is the most profitable in its niche market. To accomplish this goal, you may need to allow another larger organization in your field to acquire your company in a business combination. But what is a business combination, exactly?

What is a Business Combination?

A business combination is a transaction in which an acquirer company obtains control of one or more businesses. To identify whether or not a corporate transaction is a business combination, you should figure out whether IFRS 3 (International Financing Reporting Standards 3) defines the organizations doing the transaction as a business, as only IFRS 3-defined businesses can conduct a business combination.

When you look under IFRS 3, a business is defined as an integrated set of activities and assets that’s capable of being conducted and managed for the purpose of providing goods and services to customers, generating investment income (such as dividends or interests), or generating other income from ordinary activities.

If all companies involved in a corporate transaction meet the requirements for being defined as a business according to IFRS 3, then you are halfway to knowing whether the transaction is a business combination. The second element that you need to consider when trying to identify a business combination is whether control of other businesses is being obtained in the transaction.

Typically, when a business combination occurs, an entity purchases the equity interests of the business or businesses it’s acquiring and, in exchange, offers the acquiree cash, possible equity interest in the acquiring company, or some other consideration. This purchase ultimately leads the acquiring company to gain voting power and control of the acquired businesses. This means that the controlling acquirer has the power to make important business decisions on behalf of the companies that it acquired. Most companies include information on their business combinations in their balance sheets.

Types of Equity Investments in Business Combinations

Equity investment is money invested into a company through the purchasing of shares of that company in the stock market. Typically, these shares are traded on the stock exchange. Some of the different types of equity investments in business combinations are detailed below.

Subsidiary

A subsidiary equity investment occurs when a company owns at least 50% of the voting power and control over another company. People often refer to the company that controls another business as the parent company and the acquired, or controlled, business as the subsidiary.

Thus, the term subsidiary alone refers to a business that is controlled by a parent company. Because a parent company in a subsidiary equity investment has voting power and control over the acquired business, the parent company has the final say regarding all important business decisions.

Associate

An associate equity investment occurs when an investing company has enough influence over its investee organization to have a say in its financial and operating policy decisions but has either joint control or less than 50% voting power and control. The equity method of accounting is used when dealing with an associate equity investment.

Fair Value

Fair value refers to the actual value of an asset that’s agreed upon by the seller and buyer, whether that asset is a product, stock, security, etc. In other words, fair value is the unbiased market price estimate of a good, service, or asset.

Part of what makes fair value an unbiased estimate price is the fact that it’s fair to the buyer without putting the seller on the losing end. Thus, both the buyer and seller benefit from selling a product, service, or asset at fair value.

The fair value price is the price that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date. Equity investments of less than 20% are usually recorded under the fair value method.

Consolidation of Subsidiary Equity Investments

Consolidation in accounting refers to the process of combining the financial statements of a parent company and its subsidiary companies. Therefore, when there is a parent company that obtains controlling equity investment of a subsidiary company, that parent company must combine its own assets, liabilities, and other accounts with those of its subsidiary and present all of that financial information in a single set of financial statements.

It’s common for larger companies with controlling equity over numerous other organizations to consolidate financial statements with their subsidiaries and then use those consolidated financial statements to present the combined operating results of their entire business.

Equity Method of Accounting for Associate Equity Investments

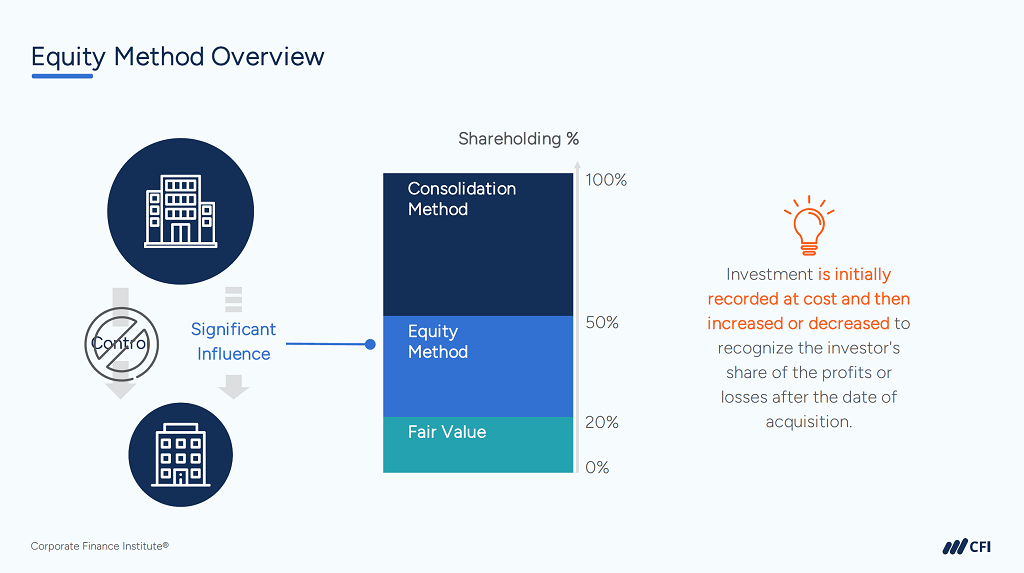

In the equity method of accounting, the investment is initially recorded at cost, and then later, its carrying amount is increased or decreased to recognize the investor’s share of the investee’s profits or losses after the date of acquisition. The equity method of accounting is used by companies with an associate equity investment. Typically, when a company contains an associate-level equity investment in another company, it holds between 20% and 50% of the investee’s voting power.

Image from CFI’s Accounting for Business Combinations & Other Equity Investments Course

What is the Meaning of the Phrase “Goodwill” When Accounting for Business Combinations?

In accounting, goodwill is when a company that is looking to acquire another company pays a price for the company that’s at a premium over the fair market value of the company’s net assets. The reason why parent companies are willing to pay for some businesses that they want to acquire in goodwill is because those businesses have valuable intangible assets.

According to the International Financial Reporting Standards (IFRS), intangible assets are non-monetary assets without physical substance. Thus, when an acquirer pays a premium for a target, it usually results in the recognition of goodwill and other intangible assets.

In other words, the acquirer is paying for the value of that company beyond its physical assets. Examples of high-value company intangible assets include the company’s positive brand and reputation, customer relationships, client base, talented workforce, and proprietary technology.

What are Mergers and Acquisitions in Terms of Business Combinations?

Together, the terms mergers and acquisitions refer to the consolidation of companies or their major business assets through financial transactions between organizations. While the terms mergers and acquisitions are often presented together, they mean two different things.

Two similarly sized companies merge whenever they come together to form one completely new company. Statutory consolidation, or amalgamation, also occurs when businesses combine to form a new entity so that the original companies cease to exist. Statutory consolidation is typically done through a merger.

A statutory merger is slightly different from a regular merger model or statutory consolidation in that it occurs when one company absorbs another company. Thus, the company that was absorbed ceases to exist as a legal entity, while the company that did the absorption continues to exist. A capital stock acquisition must occur for there to be a statutory merger.

Regarding a business combination, an acquisition is when one company purchases another company and takes over as the new owner due to having all or a controlling interest in the acquired company. An acquisition differs from a merger, statutory merger, or even consolidation in that all companies involved continue to exist going forward.

One of the companies in an acquisition simply becomes the parent company and owner of the other.

Mergers and Acquisitions Valuation Methods

There are various ways to determine the value of the target company in mergers and acquisitions, some of which are detailed below.

1. Net Assets

A net asset valuation is when you add up all of a company’s assets and then subtract its liabilities. A net asset valuation is most applicable to stable, asset-rich companies in fields of work such as property or manufacturing. However, keep in mind that a company’s balance sheet is usually based on historical cost accounting, so the fair value of the net assets may differ from the balance sheet value.

2. Enterprise Value/EBITDA (EV/EBITDA) Ratio

The EV/EBITDA multiple is one of the most commonly used valuation metrics in mergers and acquisitions. EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) is a commonly used measure of a company’s financial performance. EBITDA is considered a capital-structure-neutral metric since interest expense is not yet deducted as an expense.

Similarly, enterprise value is the value of the entire company, regardless of the value of debt or equity. To derive a company’s equity value using the EV/EBITDA multiple, you take the average or median EV/EBITDA multiple from a comps set and apply that number to the target company’s EBITDA. This gets you the target company’s enterprise value. To calculate equity value, take the enterprise value, subtract the value of debt, and add cash.

3. Price/Earnings (P/E) Ratio

The price/earnings ratio is the company’s value divided by its tax after profits. To determine a company’s value according to price/earnings, you use either the average or median multiple from similar companies and apply that multiple to the target company’s net income.

4. Revenue Multiple

A revenue multiple is a helpful metric for comparing companies with different profit levels but similar products, markets, and competition. A revenue multiple valuation is the most common way to determine the value of a young or early-stage company.

5. Precedent Transaction Analysis

As its name suggests, precedent transaction analysis comes from analyzing comparable transactions in the industry. Like comparable company analysis, precedent transaction analysis involves the calculation of multiples and applying those multiples to the target company’s financial statements. These multiples may include EV/EBITDA, P/E, revenue multiples, or even other industry-specific multiples.

6. DCF (Discounted Cash Flow) Analysis

Discounted cash flow analysis is a widely used valuation method for mergers and acquisitions. A DCF analysis calculates the present value of expected cash flows to determine the intrinsic value of a company. One important detail about a DCF analysis is that it considers the time value of money by discounting future cash flows to their present value using an appropriate discount rate. Ultimately, a DCF analysis allows for a comprehensive evaluation of a potential target company.

7. Dividend Yield

The dividend yield valuation model suggests that a company’s market value is supported by the current value of its dividends. The concept behind the dividend yield valuation method is similar to that of the DCF valuation method in that this valuation method is based on a company’s cash flows.

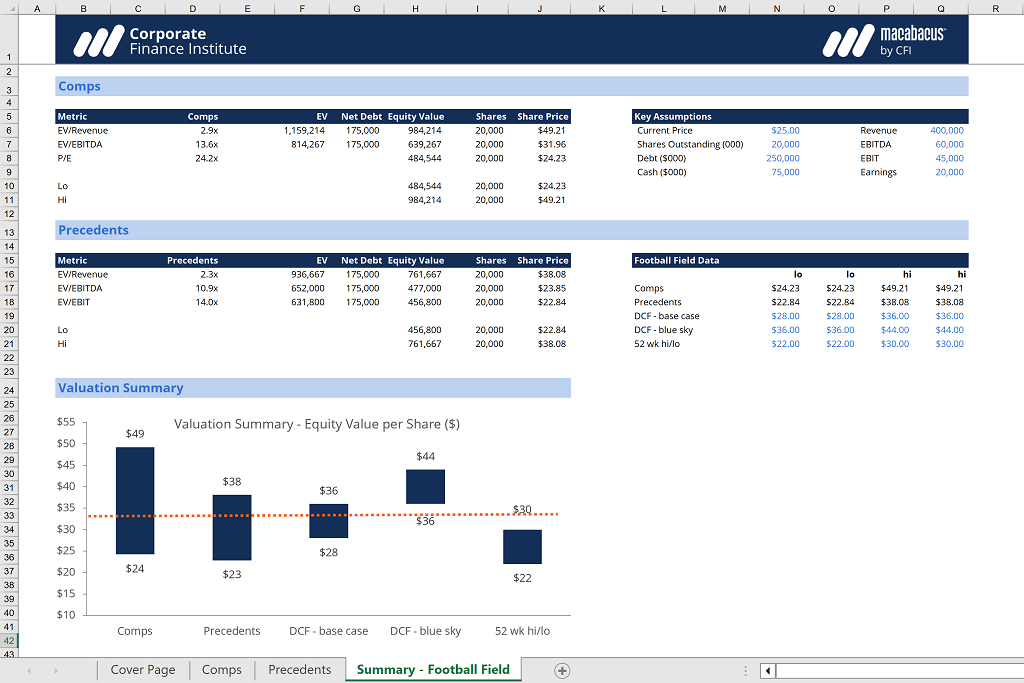

8. “Football Field” Chart

Valuation results are commonly presented using what’s known as a football field chart. When using this chart, you can quickly see a company’s valuation across different methodologies, such as various multiples, precedent transaction analysis, and DCF. Therefore, the football field chart helps communicate the potential value of a target company.

Image from CFI’s Valuation Model Comps Precedents Football Field Template

FASB Rules for Evaluating Whether Integrated Sets of Assets and Activities are a Business or Group of Assets

The Financial Accounting Standards Board (FASB) governs accounting rules for mergers and acquisitions for companies that use US Generally Accepted Accounting Practices (GAAP). Regardless of whether a company reports its financial statements using US GAAP or IFRS, whenever a business acquires or merges with one or more other businesses, it’s necessary to perform a purchase price allocation (PPA) for financial reporting purposes.

Purchase price allocation for mergers and acquisitions helps give investors more transparency into transactions and their implications for company value. Accounting rules for business combinations help entities evaluate whether an integrated set of assets or activities should be accounted for as an acquisition of a business or a group of assets.

What is an Asset Acquisition?

An asset acquisition is when a company purchases another company by buying either a portion or all of its assets instead of the target company’s stock. One benefit of an asset acquisition as opposed to a standard business combination is that asset acquisitions provide buyers with more flexibility. This is because asset acquisition buyers pick and choose specific assets and liabilities to purchase.

Having the choice of assets and liabilities also lessens the risk that the buyer assumes unknown or undisclosed liabilities. While having options provides asset acquisitions with more flexibility and potentially less wasted money, it also adds a layer of complexity to their purchases, as buyers of asset acquisitions have to identify all the assets and liabilities that they want to acquire and assume.

Furthermore, in an asset acquisition, the acquirer and target company must agree on the allocation of the purchase price among the assets in the deal. The United States Internal Revenue Code dictates that the purchase price be allocated using the residual method. The residual method allocates purchase price among assets equal to their fair market value with any remaining balance going to goodwill.

Business Combinations vs. Asset Purchase

It’s important to know that there is a difference between business combinations and asset acquisitions, as the accounting for an asset purchase differs from business combination accounting in a number of key ways. For example, when recognizing identifiable assets and liabilities in a business combination, they’re measured at fair value, while in an asset purchase, the total cost is allocated to individual items based on their relative fair values.

Also, goodwill is recognized as an asset in a business combination but there may or may not be any goodwill in asset acquisitions. Similarly, deferred tax on any initial temporary differences is recognized in a business combination but not recognized in an asset purchase.

Another key difference between a business combination and an asset acquisition is that when accounting for a business combination, transaction costs are expensed when incurred. On the other hand, when accounting for an asset purchase, transaction costs are typically capitalized. Transaction costs are fees paid to investment bankers, lawyers, and accounting firms to help complete the transaction.

When it comes to the topic of contingent consideration, there are also differences between the way accounting is done for a business combination versus for an asset purchase. For example, contingent consideration is recognized at fair value at the acquisition date when accounting for a business combination.

Subsequent changes to the value of contingent consideration are based on whether the contingent consideration is classified as an asset, liability, or equity. If equity, then the consideration is not remeasured in subsequent accounting periods. Contingent consideration classified as either an asset or a liability is remeasured to fair value at the end of each reporting period, and the change in fair value is reflected as income or expense on the income statement.

When accounting for an asset purchase, contingent consideration is often not recognized since the acquirer is only purchasing assets and not an entire business. If there is contingent consideration, the acquirer will recognize this consideration if it is probable and estimable.

Learn More About Business Combinations and Equity Investments with CFI

With all the information you must learn to manage business combinations and equity investments properly, it’s wise to take advantage of any educational opportunities. That’s where CFI steps in.

With the help of CFI, you can access educational resources or take advantage of courses or certification programs to help you become more proficient in business combinations. To further build on your business combination and equity investment knowledge and skills, take our CFI course on Accounting for Business Combinations and Other Equity Investments.

Additional Resources

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

Become a Certified Financial Modeling & Valuation Analyst (FMVA)®

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Master financial modeling and improve your proficiency across the entire accounting and finance universe

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in